Let me explain how it works, @pom-nametagfilms. I’ll share with you some details on handling your contractors.

I can help you get this issue sorted out to ensure that the tracking of your 1099 transactions are accurate.

According to the US tax law, you need to file a form 1099 for anyone whom you paid $600 or more in the prior year. It includes the withheld federal income tax under the backup withholding regulations. This is for contractors, freelancers, vendors, and other non-employee.

Since some of your contractors won’t register their W9 in QuickBooks Online, I suggest setting them up as your regular vendors. This way, you will have an option to include and track their 1099s. With regards to receiving them, they won’t be able to obtain them unless they’re setup in QBO Track payments for 1099.

Here’s how to add a vendor:

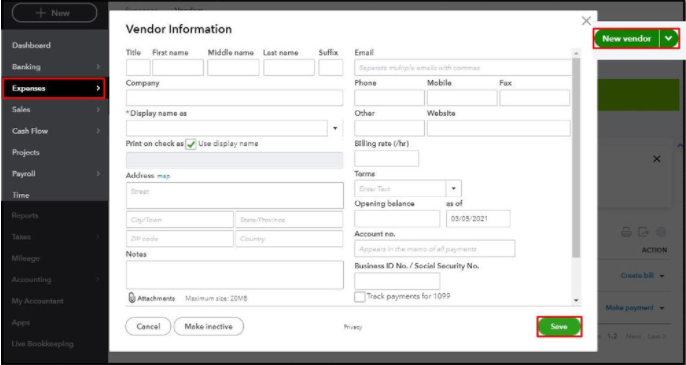

- On the left pane, go to Expenses.

- Select Vendor and click New Vendor.

- Complete the fields in the Vendor Information window.

- Tap Save.

If you want to track their payments for 1099, you can tick the box under the Business ID No. / Social Security No.

You can also seek self-help articles on our QuickBooks help articles page, to help you get your QuickBooks task done in no time.

For your reference, I'm also adding these resources to give you more details about the 1099s:

Also, QBO offers several payroll reports that you can pull up to access your business and employee information. To get started, see our Payroll reports page.

Visit us here again if you need further assistance processing 1099s in QuickBooks. The Community is always ready to help you.