Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood day, Naomi.

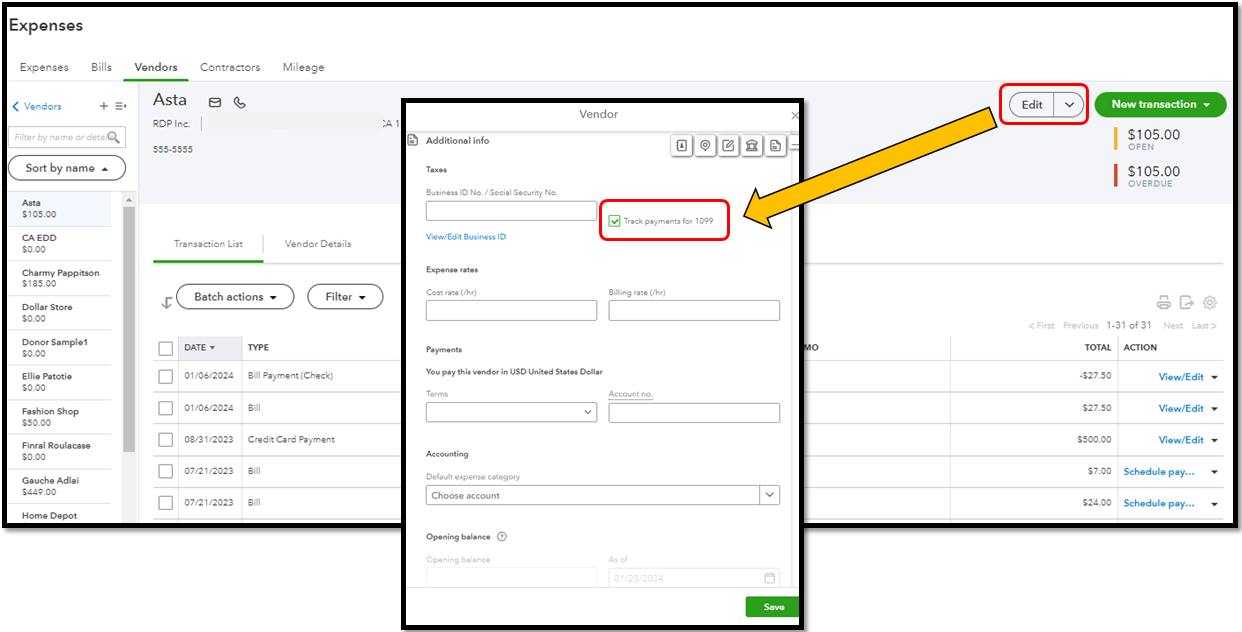

The option to change vendors to contractors is unavailable in QuickBooks Online (QBO). If you want to track your vendor for 1099s, we can simply open their profile and check the Track payments for 1099 box. Let me show you how:

Moreover, you can run 1099s reports in QuickBooks to show who needs 1099s, payment totals, and more.

If you have any additional questions, feel free to add them to this thread, and I'll be more than happy to assist you. Wishing you a wonderful day ahead.

Thank you for your response !

When I have checked the vendors, I do not see any edit or additional info buttons. Where do I find this? To track payments?

This is what my screen looks like. Where do I find edit?

I found it! Inside each vendor profile.

Does turning this on, then use payments from the last year so I can file their 1099's? Or is it just now active with payments going forward?

Hello there, Naomi. It's great to know that you have found the edit option for your vendor's profile. Let me share some additional information about tracking 1099 in QuickBooks Online (QBO).

You're on the right page that after navigating to the Vendors menu, all you have to do is select the appropriate vendor to see the Edit button.

Regarding your additional concern, once you select the Track payments for 1099 option, all of the payments made to your vendors will be automatically reported to 1099 as long as you paid them above the annual $600 cash threshold, excluding payments made via credit card, debit card, or third-party system, such as PayPal. You'll also have to ensure you've paid your vendors to the correct expense account.

Here's how you can review the vendor's payment transactions to see what accounts they're associated with:

Additionally, here are a few helpful articles with more information about preparing 1099s in QBO:

I'm only a post away if you need more help with creating and filing your 1099s in QBO. It's always my pleasure to help you out again. Have a great day!

Thank you, Kevin_C, this information is helpful. This is my first time handling 1099s for our church. The ones we have identified as contractors are showing up, but I'm trying to determine why payment to a vendor isn't showing up in the Review Recipients step, neither in the Tracked for 1099 or Not Tracked for 1099, completely missing. It is a payment via our bank bill-pay service, as most of our vendor payments are, approximately $5k for services dated December 2023. The vendor until reading this post was not flagged for 1099 tracking. The expense account used for the payment is selected in the step, Select accounts. The vendor has the tax ID entered, address, etc. Ideas why the 1099 process would skip this vendor?

Oh, never mind, I figured it out.

I followed the instructions to check the 1099 box for a vender who is actually a contractor. Contractors do not show up anywhere.

Let's perform troubleshooting steps by clearing your browser's cache to refresh the system and display those contractors in QuickBooks Online (QBO), @GuardiansMT. I've provided the detailed process below.

Excessive historical data in your browser can create discrepancies that hinder the display and performance of your QBO. As a result, you're unable to see your contractors after checking the options to Track payments for 1099.

For this reason, I recommend clearing your cache to update any website preferences interfering with the program's functionality or using another supported, up-to-date browser to narrow down the issue.

Alternatively, feel free to use these keyboard shortcuts to open an incognito window to access the most recent version of a webpage without stored data that causes display issues:

Furthermore, I'll add this article that'll help you learn how your contractors can add their own 1099 tax info: Invite a contractor to add their own tax info in QuickBooks Online.

Moreover, we have QuickBooks Live Expert Assisted that are always available to help you with best practices in setting up and making the most out of QuickBooks Online.

If you have any further questions or need additional assistance with your vendors or contractors, please don't hesitate to ask. We are dedicated to helping your roofing company operate seamlessly. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here