Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAh Tori you know that contacting support is a half-day long path of doom! Especially for this kind of request. Any guidance you might have that would help me get to L2 domestic support or perhaps pre-sales engineering would be most helpful and appreciated!

Welcome @Azucenanvrrt .

Thanks for dropping in! I'm happy to help you with customizing sales forms like estimates and invoices in your QuickBooks.

I'm assuming you are using QuickBooks Online, if you're using QuickBooks Desktop, let me know.

There are a few variables depending on which version of QBO you are using. Take a look at how to customize invoices, estimates, and sales receipts in QuickBooks Online.

Something to keep in mind, any customizations or edits you make will affect all current and future forms.

question about Multicurrency feature. How can I change the cost of an inventory item to Euros, so its properly reflected on the Purchase Order.

Thanks for following up with the Community, FullFillery.

Your I sell this product/service to my customers option can be found when creating the item.

Here's how the process works:

Now that you've created a product/service item for the contributions, your next step is to issue a credit memo for the value of your donation.

Something else to be aware of is if the amount you're writing off as a contribution will significantly affect your gross sales amount, you'll want to work with an accounting professional prior to making the entry. If you're in need of one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

I'll be here to help if there's any additional questions. Have a lovely day!

Hi. We're looking to wipe the transactions and start fresh at 1/1/2022. Is there a way to download all of the data at once, in case it's needed, or do we need to download separately - i.e., each bank account, credit card.

I started a new company in QuickBooks pro 2007. I can login to old company but not new one

Hi -

We're receiving deposits from QuickBooks payments. How do we set them up so the fees are charged to the sender/payer, rather than us?

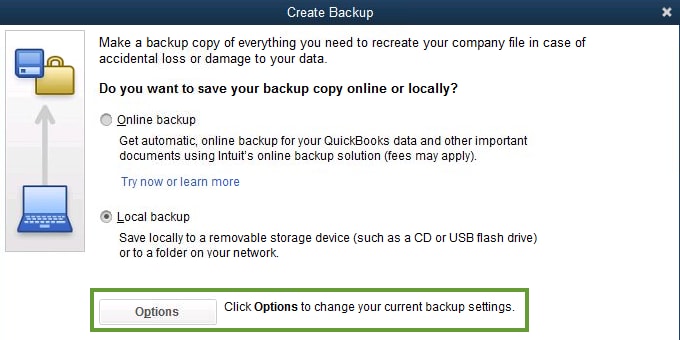

I back up my QB Desktop Pro 2021 to a thumb drive. Whenever I do this I end up with a duplicate(?) backup on my desktop. Can I delete these? How do I stop it?

In Payroll I am doing a bonus payment but when I go to put in the amount I get a pop up screen. It is for new bonus payment detail.

What information is supposed to go here?

I am paying a bonus of 1340.42 and it has all other information but the federal income tax and it will not let me add it manually.

I have a few questions:

I just started an LLC late last year. I have been categorizing my salary payments as Owner's Pay but I see when I print one of my reports that this is considered non-payroll money taken out of the business. How do I categorize this as payroll? I am not using the Quickbooks payroll software.

Also - I have one banking transaction that shows up from a linked account that was auto categorized as amounts temporarily being held from deposited checks. This does not appear on my bank statement.

Great question. Currently, there isn't an option to do a bulk download. You need to export each list individually.

Are you wanting to start completely fresh as of 01/01/2022? Have you considered starting a new QBO company? You could move the list over and cancel the old company. You'd have read-only access to the old company for a year.

Here is a reference guide to take a look at: Delete your data and start over in QuickBooks Online

Thanks for getting back to me, @jscco.

I understand it can be quite a process to get in touch, especially this time of year. I want to make sure you get help as soon as possible.

I can't connect you directly to our Tier 2 team, but we can make sure to stay in touch here to ensure you get the help you need. If you speak with support and do not get the resolution you need, let me know, and I'll continue to help in any way that I can!

I am new to QuickBooks and signed up for the small business account. I know how to create an invoice now but want to show that the invoice has a deposit. For instance if the invoice is for $500 and a 50% deposit is due, how so I show that? The remaining would be invoiced again but I want to document the process with the total amount, 50% due (invoice 1) and then the remaining with the 50% deposit highlighted with the total due (invoice 2)

Thanks - we'll take a look!

Good afternoon @James vail , thanks for joining us in the drop-in session! To be sure I understand correctly, do you mean that you created a new company file, but it doesn't appear in the list when you go to open it?

If that's the case, this article has a great list of troubleshooting options that may help to resolve the issue: What to do if you can't open your company file in QuickBooks Desktop

If none of these work, or I've misunderstood in any way, please let me know! We can continue to work through it together.

Hey @Leah2020

I don't like a lot of clutter on my desktop, so I can appreciate your wanting to stop those duplicate backups. You can delete the duplicate backups on your desktop, no problem as long as you have the thumb drive backups.

To stop the desktop backups, you'll want to adjust the backup options:

That should do it!

Thanks for bringing your questions forward here in today's drop-in, wineguyatl!

To make sure I'm on the same page, are you currently using QuickBooks Online? The option to change the currency for inventory cost isn't currently available. I'd like to invite you to submit this suggestion so it can be potentially added in the future. Here's how:

1. Click the Gear icon in the top right corner.

2. Select Feedback and enter your suggestion.

3. Choose Next when you're ready.

I recommend checking out the following linked articles in the meantime for even more info on using multicurrency:

Feel free to reach back out if you have any other questions!

I thought I replied to this question, but it's appearing in the wrong place. Anyway, I'm using Quickbooks Online.

how do I categorize payments that were made to a credit card prior to starting our business? Before we started our business we used a capital one master card. When we started our business, we started strictly using it for our small business. We paid the card off using personal cash before we started using it for the business. I had to link the card back further for reconciliation purposes so that the beginning balance was accurate. For the charges, I categorized them as owners draw, and for the payment mothod, my only options are checking accoutn or cash on hand, so I put cash on hand but now it states that I have a negative cash on hand balance. How can I change that?

Hey there, jswartout. I'd be glad to lend a hand with your QuickBooks questions.

Rather than Owner's Pay, I recommend using an Owner's Draw equity account to pay yourself. The following linked article provides even more info about setting up and paying an owner's draw.

Additionally, there's a great post on the QuickBooks Blog that compares salary to owner's draw.

It's always a good idea to speak with your accountant about which option is best for you and your business. I'll be here if you have any other questions!

Thanks for swinging by our drop-in event, @JFAllen93.

Congrats on the new QuickBooks, and welcome to the family!

There are a couple of different ways we can handle this one. The first way would be to create a credit memo and apply it to the invoice. The other way would be to apply the deposit as a partial payment, leaving the invoice status as Partial instead of Paid. I've included some steps for both scenarios below.

To create a credit memo:

To apply the credit memo to the invoice:

Check out Create and apply credit memos in QuickBooks Online for additional details about this process.

If you wish to add a partial payment, here's how you can do that:

That's all there is to it. The invoice status will automatically change to Partial after following the steps above. To get more in-depth information about invoice payments, check out Record customer payment in QuickBooks Online.

Please keep in mind it's always best to discuss these matters with your accountant before making any changes to your account. If you don't have an accountant, you can find one here in our Resource Center.

Don't hesitate to let me know if you have any follow-up questions or concerns!

Welcome to the Community, Ash_80.

Your New Bonus Payment Detail window is asking you to review the estimate of your employee's total earnings this year. QuickBooks utilizes this information to calculate income tax on bonuses. The estimate should include all of their earnings, except this current bonus or any previous ones, and should be based on their gross amounts.

When you're finished entering your estimate, you can add a bonus item to their paycheck.

Here's how:

I've also included a detailed resource about working with bonus paychecks which may come in handy moving forward: Create Bonus Paychecks

Please don't hesitate to send a reply if there's any questions. Have a wonderful day!

You could charge your customer the credit card processing fee by adding it to their invoice. Currently, there isn't a feature available in QuickBooks to do that automatically.

You would set up a service item for the fee. Here's how:

Then you would add the service item to the invoice.

Here is some additional information about credit card processing.

HI again @jscco !

I was able to speak with one of our engineers and they provided some additional guidance I'd love to share.

There is no way to run a test migration, per se, but you can create a backup in 2019, save the backup in a safe location, then initiate the migration to 2022 to see how it goes.

If anything goes poorly, you can restore the backup and continue to use 2019 until you're able to reach support for assistance.

You can find more information on creating and restoring backups here: Back up your QuickBooks Desktop company file

I hope this helps!

Thank you to everyone who joined us for today's drop-in session! We are now closed to new replies, but the QuickBooks Community is always open to your questions, 24/7! Post a new thread any time. Most questions are answered in less than 4 hours.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here