Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I have to file a quarterly 940 because this quarter will be over $500. I didn't realize I had to do this last year and I got penalized. like 2020 wasn't hard enough. Well I have researched and it doesn't seem as though you can do a quarterly 940 in QB. Has anyone have this issue and if so what is your work around? Thanks Sally

Look no further, @sally412.

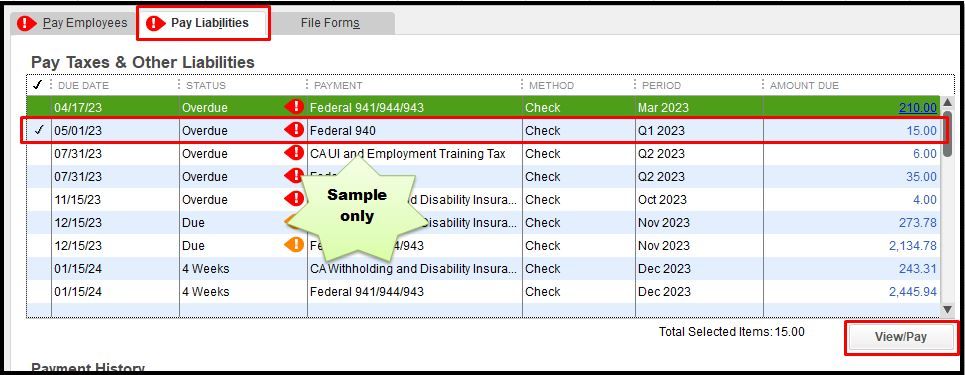

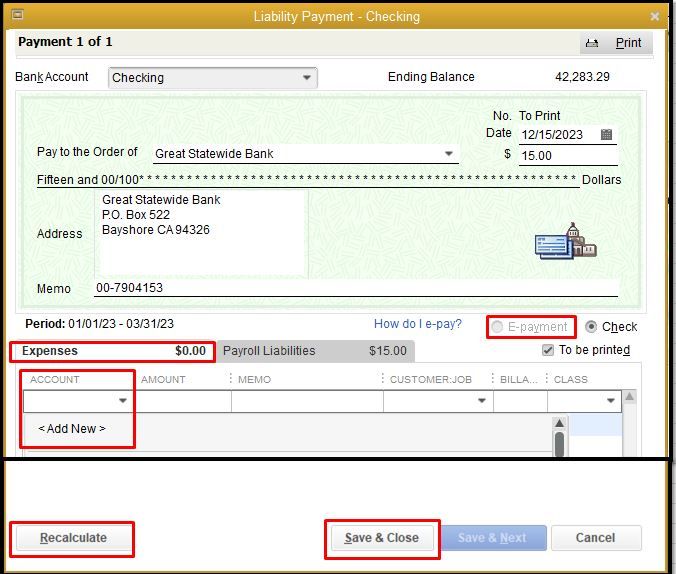

Here are the steps you can perform to pay penalties in QuickBooks Desktop. When you have liabilities under the Pay Liabilities tab, you can add the amount of the penalty under the Expenses column. Then make sure to change the Payroll Tax forms and Payment schedule in your Payroll Wizard so the period/date of the schedule will be changed in QuickBooks.

Let me show you how:

For your reference, please see this article: Set up and pay scheduled or custom (unscheduled) liabilities. You can also see the EFTPS website to give you other options in paying penalties.

QuickBooks also has several Excel-based payroll reports you can generate to view your business and employee information. To get started, head to the Excel-based payroll reports page at this link.

If you need further assistance about paying penalties in QuickBooks, please leave a reply below. I'm always here to help. Have a good one.

Thank you for your reply about paying the penalty. My original question is how to pay quarterly 940 FUTA when it is only an annual report when the quarter is over $500.

I appreciate the clarification that you gave, @sally412.

I'd be happy to share some insights regarding the FUTA tax limits and guide you in paying your taxes on QuickBooks Desktop.

Once your FUTA tax is $500 or less in a quarter, carry it over to the next quarter. Continue carrying your tax liability over until your cumulative tax is more than $500. At that point, you must deposit your tax for the quarter. Deposit your FUTA tax by the last day of the month after the end of the quarter.

If your tax for the next quarter is $500 or less, you are not required to deposit your tax again until the cumulative amount is more than $500.

On the other hand, you can pay the liability electronically in the system, if you have activated the electronic for your tax forms and payments in QuickBooks Desktop.

To do that, just follow the steps shared by my peer above, just make sure to select the correct payroll liability before hitting the Submit button. If you don't have the E-Pay option you can pay the 940 taxes automatically on your state agency's website.

For more details about managing deduction limits in QuickBooks Desktop, feel free to read through this reference: Understand the Federal Unemployment Tax Act (FUTA) deduction limit.

If there's anything else that I can assist you with, please let me know in the comment section down below. I'll be always around ready to help.

You can't file the 940 form quarterly because it's an annual form.

However, you may need to pay the tax more often. Do that like you pay your other payroll taxes - in the payroll center.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here