Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've got you covered, elizabeth6.

We have just the report that'll show your Total Gross Sales. Let me walk you through the steps to pull up this report:

For additional insight about this, you can visit this article: Sales tax in QuickBooks Online

That should get you going in the right direction. Please don't hesitate to reach out to me again if there's anything else I can help you with. Thanks for reaching out, wishing you and your business all the best!

Why doesn't gross sales include the sales taxes paid by clients? When I run the P/L report, the total sales is incorrect when I compare to the 1099-Misc forms reported to the IRS by clients.

Hi almoterp,

You can adjust the date range of your P&L report or change the Accounting Method used to see if you get the same result.

On the other hand, your P&L report is based on the transactions you entered in QuickBooks while the 1099-Misc forms are based on your clients' records. If tax amounts are still not matching, I'd suggest doing a cross-reference check with them to know why you got a different amount.

Please don't hesitate to go back to this thread if you need more help.

Hello there, @5470.

Let me provide additional insights on how you can pull up a Sales Tax Liability report that consists the Gross Sales in QuickBooks Online.

Pulling up the sales tax liability report in QuickBooks Online will only provide the taxable sales of your transactions. However, you have the option to pull up the Taxable Sales Detail report to see the gross sales amount.

To do that:

You can refer to these resources below to know more about the available reports in QuickBooks Online as well as on how to customize it.

I've also included some links and tutorials that can help you with running QuickBooks:

Lastly, QuickBooks is constantly finding new ways to make sure that your product meets your needs, based on your feedback. I'd encourage you to visit our QuickBooks Blog to be updated with our latest news and updates including product improvements.

Please let e know if you have any other questions with this concern. I'd be happy to help you out. Have a great day!

Further to add to this discussion, wouldn't it make simple sense for QBO to add a Gross Sales index/tax/filter so users could run truer reports that accurately reflect Gross vs. Net Sales??

True accounting systems, I believe, do that sort of filtering and reporting.

Thanks for trying some tests and providing some feedback, @almoterp.

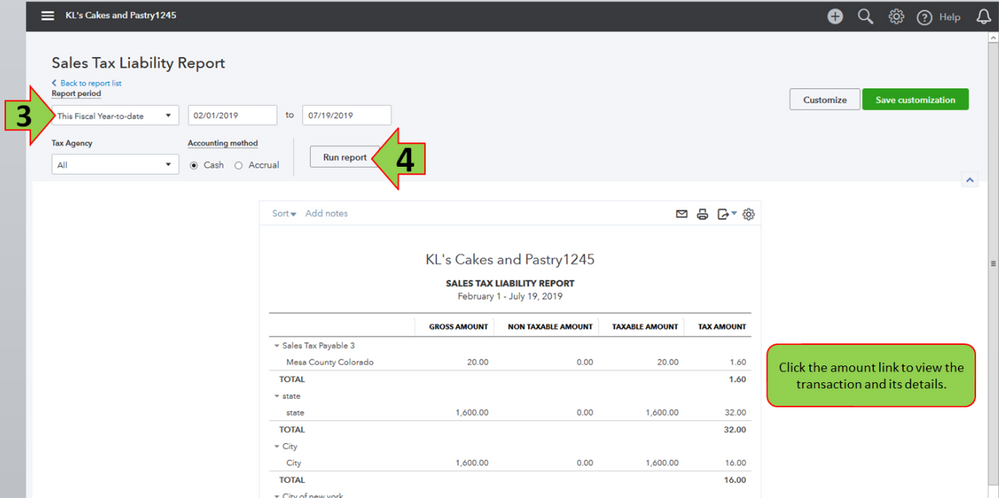

Aside from the recommendation given by my colleague, you can also run the Sales Tax Liability report. It provides the taxable and non-taxable amounts. The report is grouped by tax agencies and you can click the Amount link to get the details of the transactions.

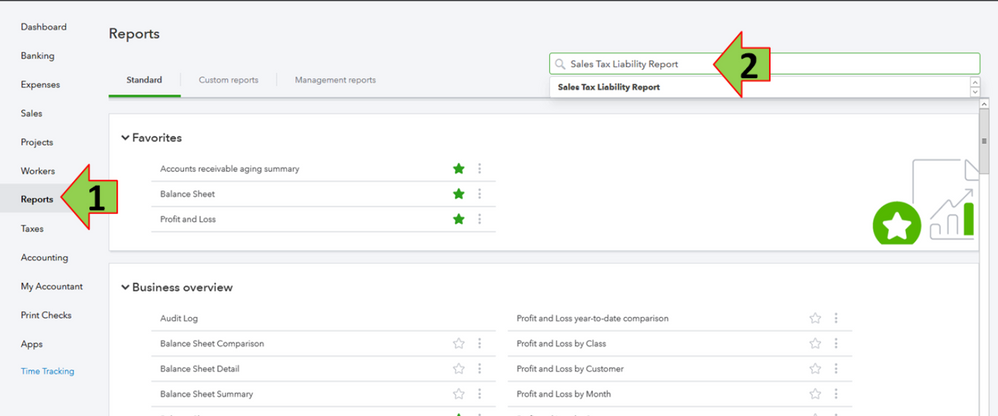

Here are the steps on how to pull up the report:

To learn more about customizing reports you can refer to the link. You also have the option to memorize it by clicking the Save Customization button.

For more reference about the Sales Tax feature, check out the articles below:

Keep me posted on the results or if you have follow-up questions. I'm still here to help you further. Wishing you all the best!

Hello there, Dollface.

I appreciate you for sharing your workaround with us. So far, my colleagues have already mentioned all the possible workarounds available that would show the Total Gross Sales.

Your idea of having an additional column for Gross Sales to the Sales Tax Liability Reports sounds convenient and I would love to share this suggestion to the product developers. For now, I encourage you to visit our QuickBooks Blog to be updated about the said feature, and we'll be sure to inform you through this thread.

Should you need with something else, don't hesitate to reach back to me. I'll be right here to help you.

Glad to see you again in the Community space, @5470.

As mentioned by my colleagues, feedback has been sent regarding your request about the Gross Sales column to show on the report.

Since the workarounds didn’t provide the information you need, let me pass another suggestion to our Development Team for consideration in the near future. An idea like this helps us determine what enhancements and improvements are needed to make our product more effective and convenient to use.

I’ll let you know if there are any changes by updating this thread. For now, I recommend visiting the QuickBooks Online Blog to get recent news, and details of the latest features. Check out the link given by my colleague or click this for more information: https://quickbooks.intuit.com/blog/.

Post in the Community again if you need anything else. Wishing you and your business continued success!

I am using the sales tax liability report but I don't have any non taxable sales showing up. I don't have any choices in the customize.

I need non-taxable wages by state to file sales tax returns

Hello Lowchee,

It's possible that you have the old sales tax interface. This is why the non-taxable column is unavailable in the Sales Tax Liability report.

You'll want to run a different report called Taxable Sales Detail. Then, customize the report by following these steps:

You can also export the report to Excel and manually edit the information.

If you're using the automated sales tax, I'd recommend contacting our Customer Care Team. We will check your sales tax settings and investigate this further.

Here’s how you can reach out to us:

For other questions or concerns, you can always visit us here. Thanks.

I am having the same problem. The gross amount does not display on the Sales Tax Liability report but does display on the Taxes Tab on the left. It shows the Gross amount but would be helpful to see it in the report.

There is a gross amount on the report but it wrong and does not include everything.

Thanks

-Dimitry

Quickbooks online has been aware of the gross and expempt sales column missing from the sales tax liability report for well over a year now with no attempt to fix it. What in the world is going on?!?!? This is extremely important for businesses who need to file sales tax monthly. The "solution" mentioned in the comments does not help whatsover with multiple sales. Something that used to take 10 mins I have now spent a full day on. I will be switching to a new accounting software that listens to customer feedback on such an important issue. ADD GROSS SALES, EXPEMPT SALES COLUMNS TO YOUR SALES TAX LIABILITY REPORTS!

Wanted to second this and believe it would add significant value since the primary use for Quickbooks is tax liability tracking. I am willing to pay more for Online with its limitations instead of Desktop if it continues to cut book keeping hours and increase workflow. This does not.

I'm able to print by doing a right-click on the screen and then print frame or print window.

I even save it to a PDF to file electronically. Sorry for the delayed response, just now reading through all the threads of unhappy clients who need a simple fix not a bandaid for including GROSS Sales column.

I am having the same issues and just posted a similarly worded question. I was using an old version of QB desktop and it would show my Total Sales, Non-Taxable Sales, Taxable Sales and Amount of Tax Due when I ran the sales tax liability report. I NEED all of these columns as I do have quite a few clients (non-profits and others tax exempt) who do not pay sales tax. But, I need to show all sales when I pay my monthly sales tax to the state. This report is actually the primary reason I decided to stay with QB, but if this online version won't do this for me, I will have to switch back to the desktop version. This seems like a very simple and common item to include in a report. I'm curious how many users who may be new are not aware that they are not seeing all of their sales when they file their sales tax reports and will have a nightmare to deal with at the end of the year when it's tax time and their numbers don't match. Yikes.

Hi there, photomomma17.

Thanks for stopping by the Community, I see your original post and a fellow agent has commented on it.

If you have any other questions or concerns, feel free to post on it, night or day. Thank you for your time and have a lovely afternoon.

I am trying to do my sales tax return. I pulled the sales tax liabililty report and the gross sales doesn't have all of my invoices in it. When I ran a sales by product/service detail report the amount is much higher. I just noticed it because I was looking for an invoice that was tax exempt and it wasn't in the sales tax report and then when I did the detail report I realized there was about several invoices that weren't showing up in the sales tax report. How can I get them all to show up in the sales tax liability report, I have to start my return with my gross sales.

Hi there, @Lmendez10. I'm here to share with you some information about the sales reports in QuickBooks Online (QBO) and help you get the gross sales amount for a certain period.

The Sales Tax Liability Report displays a summary of your taxable and non-taxable sales, plus the total sales tax you've collected from your clients. Adding the gross sales on this report is not an option for now. Thus, you can run the Profit and Loss Detail report, then group the Distribution Account to All Income Accounts.

Here's how:

You may export your reports to Excel and customize the information from there. I'm adding this link as your guide: Export your reports to Excel from QuickBooks Online.

For more hints about checking and filing your sales tax returns, you can also check out the topics from this article: Check how much sales tax you owe in QuickBooks Online.

If you have any other follow-up questions about your reports and sales taxes, please notify me by adding a comment below. I'm more than happy to provide additional assistance. Keep safe!

Why does the total on the "Taxable Sales Detail" report differ from the Sales Tax Center quarterly "Taxable Sales"? I keep ending up with "over collected taxes" even though I'm using the correct sales tax rates. Any suggestions? I'm using the numbers from the Sales Tax Center, should I not be?

Hello there, @FionaB.

I've got some information why the amounts on those reports don't match.

The Taxable Sales Details contain the original price of the transaction on the taxable Profit & Loss report. It includes the date, transaction type, customer, quantity, rate, amount, and balance. The date and the accounting method are some of the reasons for the difference. To resolve this, I suggest making sure the date range and accounting method is correct.

Let me guide you on how to do it:

For more information about managing reports and calculating sales tax, feel free to check out these helpful resources:

Let us know if you're able to run the sales reports seamlessly. If you have further questions about QuickBooks and reports, I'll assist you right away.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here