I understand that you want to view the tax withheld and current balance in QuickBooks Online (QBO), Diego. Let me guide you through the process below.

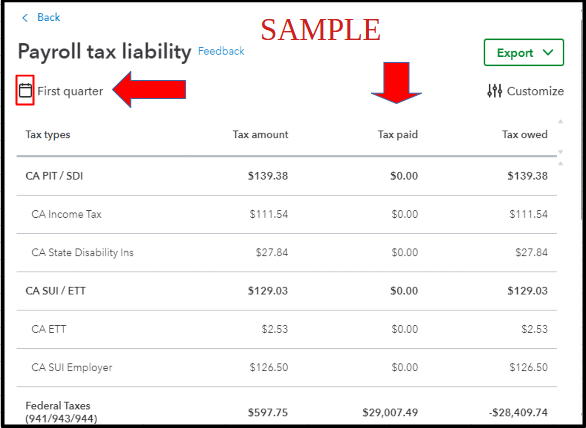

In QBO, you can see the amount withdrawn from your bank account for taxes withheld by running a Payroll Tax Liability report and looking at the Tax paid column. Here's how:

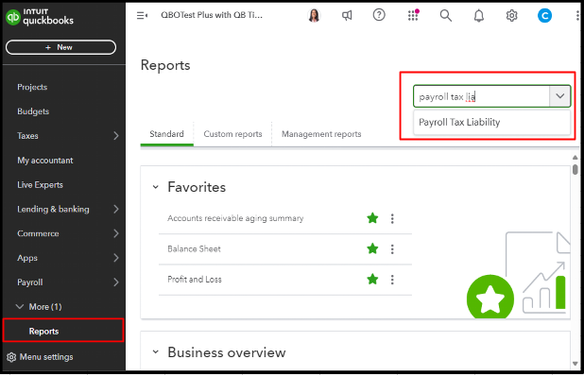

- Go to Reports.

- Type Payroll Tax Liability in the Find report by name search box.

- You may adjust the report period by clicking the calendar icon.

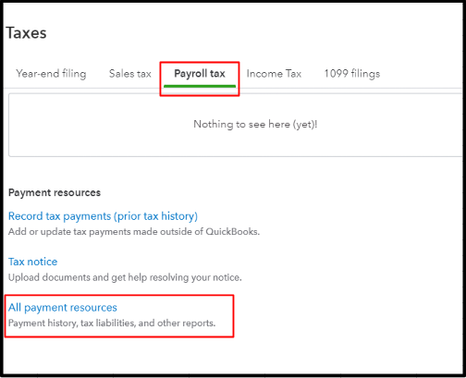

Additionally, you can check your list of tax payments to view the current balance or amount that has not yet been remitted or withdrawn. Please note that these updates are not real-time, and it may take some time after the payment has been submitted or accepted by the agency, usually until the due date or a few days afterward. Refer to the steps below:

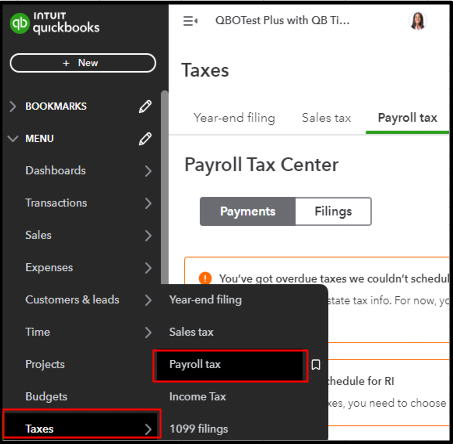

- Click Taxes, then Payroll tax.

- Select the Payments tab.

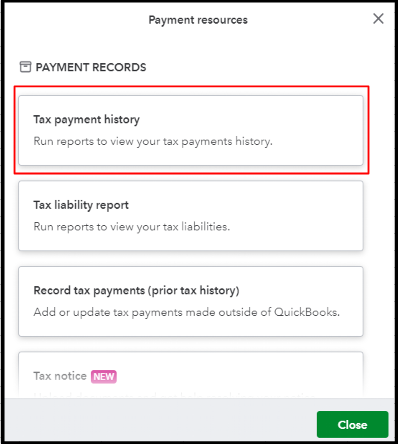

- Scroll down to the bottom section and click All payment resources.

- Select Tax payment history. You may also customize the period range of the report by clicking the calendar icon.

Moreover, it's best to contact our Payroll Support Team for the most updated balance information.

Finally, I'll share this guide to help you handle overpaid taxes in QBO Payroll: Resolve a payroll tax overpayment.

If you have other questions about handling taxes in QBO, please respond below. We'll be here to assist you.