Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am working with a client who operates a retail business in three different locations. Each location has a different sales tax rate. The locations have all been set up with their correct addresses. When he creates an invoice and selects a Location from the Location drop-down box, the Location of sale field just below the Location field does not update. The Location of sale field always has the main business address in it and has to be changed manually. This also means that the sales tax is computed based on the main business address and not the actual location of the sale.

For example, in the attached screenshot, the Location field shows Mt. Vernon, but the Location of sale field shows the company's Mansfield address.

Is this a known issue with QBO, or is the sales tax calculation feature supposed to work this way, or am I missing some kind of setting somewhere that will make this work the way I think it should?

(I know I can work around this by manually creating different tax rates for each location. That's where I'm going next if the automatic calculation doesn't work.)

Thanks!

Hello there, apmessner.

I can see how relevant and beneficial to update the Location of sale field when selecting a new location within the invoice. Yes, you're correct that the sales tax is computed based on the address showing on the transaction, where you sell and where you ship.

For now, you can manually create different tax rates for each location in the program. To learn more about recent improvements, news, and product enhancement, you can visit our blog website.

Also, you may want to check these articles for additional information about the automated sales tax in QBO:

Let me know if you have other concerns with QuickBooks. Keep safe always.

Thanks for your response.

You said,

Yes, you're correct that the sales tax is computed based on the address showing on the transaction.

This isn't true, though. Sales tax is only computed based on the company's address as specified in company settings. This is a completely useless feature - if you're going to roll out an automated sales tax feature, it should compute sales tax based on the location of the sale, not the address in the company profile.

It's also misleading to roll out automated sales tax and only use California - which has dozens of tax agencies already set up and ready to go - in your training and promotional materials, when not all of the other states are ready to go. This feels like a beta test of a new feature rather than something that is fully formed. I've come to expect better from Intuit, but you guys kinda whiffed on this one.

It's also super frustrating that now that I've turned on automated sales tax, I can't turn it off.

Explore this AST Filing & Reporting app as a workaround.

https:// taxjar.grsm.io/mytax

Otherwise you may open a new blank QBO account and migrate data from the old one

https:// quickbooks.grsm.io/US

https:// quickbooks.grsm.io/us- promo

Having the same problem here in Arizona, its changing every invoice to based on our location instead of the customer location which is where the tax rate is based for contracting tax. It was working and then there was some change and all of December and January taxes are wrong and every invoice for each city is wrong.

I have manual tax rates for each location and quickbooks online is overriding my tax rates and defaulting to based on the location of the business not the customer location. I have called and emailed and quickbooks has remoted in and there is no fix because quickbooks has zero understanding of the problem.

Hi awsarizona!

Thanks for joining us here. I know how important the accuracy of the tax is. Allow me to help you in fixing this.

QuickBooks Online allows us to create custom tax rates. If you selected a custom rate but it still defaults to the location of sale, you'll want to check if this is due to a browser error.

You'll want to use an incognito window. From there, create a sales transaction or review the existing ones. Incognito won't save your browsing history which can result in an error. These are some of the shortcut keys:

Also, you'll want to clear the cache and make sure you're using a supported and up-to-date browser. This can fix any browser-related issues.

I added this link if you need a report that shows much sales tax you owe: Check how much sales tax you owe in QuickBooks Online.

Comment again here if you need more help from me. I'll be here!

Tried incognito & clearing the cache.

"Sales Tax based on location" still seems not to work, as it only pulls the sales tax rates based on our business office location (programmed in our account settings). Will not switch to other locations we have programmed in under "locations" that are in different towns, counties or states where we operate at a retail level.

Beginning to think it's just not possible and leaves me looking for other book keeping options.

Justin

[email address removed]

[phone number removed]

I know that this hasn't been easy for you and your business, @auroraaviationmo.

I'm here to share some information about how the Location Tracking feature works. Total sales tax rates are the sum of state and local rates. This means QuickBooks determines the entire tax rate for each sale based on where you sell and where you ship.

Additionally, some states require you to collect tax based on your business location even if you sell or ship to a different location in your jurisdiction. To learn more, you’ll want to consider checking out these special tax scenarios to see if your situation belongs to them:

Please read through this link for more information about how QuickBooks Online calculates sales tax. This way, we can keep track of your state's tax regulations so that sales tax and returns are calculated correctly.

I'm adding these resources to guide you with taxes:

If I can be of any additional assistance, please let me know by leaving a comment below. I'll always have your back whenever you have more queries with taxes in QBO. Take care always.

We know how sales taxes work. I am beginning to think that Intuit doesn't, though. It's really frustrating. Overall, QBO is a very good product, but you rolled out this sales tax feature when it was still half-baked. That was more than a year ago, and you still haven't fixed it. Intuit needs to provide users an option to manage sales tax manually, because the way they have attempted to automate it DOES NOT WORK.

You have a complete lack of understanding the underlying problem.

The problem isn't that it doesn't track sales tax, it does.

It just collects the wrong sales tax in the "based on location" feature because the rate will not change with the change of location.

It always charges sales tax based on my main business office address in account settings. We have 2 other locations that sell retail at those locations in other cities & states, no shipping, but when those locations are selected in the invoice the sales tax rate does not change to the correct for that location.

Frustrated in Aurora

- Have called tech support 3 times and spent hours on the phone and no one seems to comprehend the problem or can even tell me if the program is supposed to be able to do this as the "Sales Tax Based On Location" option suggests.

Justin

I am having the same problem too. Location of Sale doesn't change or there is no way to change or remove it every time you create an invoice from a different location. Something that Quickbooks needs to fix and give attention to.

If you have a process to fix these issues please let me know.

My problem is just the opposite. I want the sales tax to always calculate based on my business location but on occasion it charges the customer address rate.

How can I fix it to be ALWAYS my business location?

Hello there, @Asc1982. I know it's been a while, but let me address your concern about removing the Location of Sales field when creating invoices in QuickBooks Online (QBO).

I recognize the convenience of having a way to remove the Location of Sales field when creating invoices in QBO. I also understand that you want to make some changes and improvements to QBO to meet your business needs.

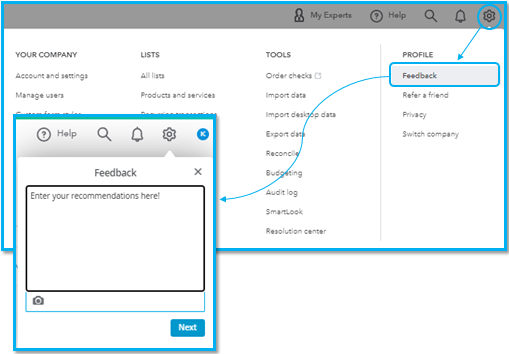

While this option is unavailable, I suggest sending feedback or feature requests to our developers. You can submit them directly from your QBO account. Here's how:

Furthermore, you'll want to visit our Customer Feedback page to stay updated on the latest news about QBO.

In addition, I'm attaching this link that can efficiently guide you in supervising your account: Learn about QuickBooks Online with how-to videos.

Please know that you're always welcome to post a reply in this thread if you have any other questions about your QBO account. I'll be here ready to assist you. Keep safe!

It's a pleasure to have you here in the Community space, @dsab. I'm here to lead you in the correct direction for a complete solution.

My colleague, RoseJillB, has already answered a similar question you've posted. You can view her answer through this link: https://quickbooks.intuit.com/learn-support/en-us/taxes/re-wrong-sales-tax-all-work-is-[…]done-in-my....

You can also look for self-help articles on our QuickBooks help articles page to help you complete your QuickBooks tasks quickly.

Post a reply if you have other questions about the refund process in QuickBooks Online. I'll get back to you as soon as I can. Have a good one!

I moved from Dallas to Mckinney address and the base on location is only asking for the 6.25 so for a whole month i was collecting the wrong amount and had to pay the difference . QB not helping they dont understand that it has to do with the Mckinney address ... i can pick dallas, frisco and it works.. they tell me 24-48 hrs then they say 10 day... now they want a tax paper showing that its suppose to be 8.25 from the tax office . we are in Texas ! just wanted to see if you found a work around lol

Hi there, @Kimberle7e.

Let me share details on how sales tax works in QuickBooks Online. Then, to ensure your taxes track accurately.

The sum of state and local rates is the total sales tax rate. This implies that QuickBooks uses the locations of the sale and the shipping to determine the total tax rate for each transaction.

Furthermore, there's a special tax scenario with various calculations. Like, in California's state, county, and city tax rates are focused on where you run your business. These rates stay the same even when you sell or ship to somewhere else in the state. Yet, the district rate you have to collect changes depending on where you sell or ship in the state. That's the reason why your sales tax is calculated using the city rate.

I also suggest to consult your tax advisor expert to get further assistance with this matter.

For more details about sales tax calculation, check out this article: Learn how QuickBooks Online calculates sales tax.

Lastly, you may refer to this article to view steps on how you can run a specific report to see how much sales tax you owe: Check how much sales tax you owe in QuickBooks Online.

Please let me know if you have other questions about managing your sales tax. I'm always here to help. Take care always and have a good one.

I couldn't agree with you more!

QBO Sales tax is becoming an absolute mess. Now it is adding numbers into the sum for the month that are not even there. I am not sure what QBO engineers are doing to the software but all these format changes are having a big impact on people that have systems in place. When doing this for nearly a decade you would think that QBO would have it figured out. It added over $4,500 in sales tax from some ambiguous place. When I went to the reports it showed the correct amount. When I went to pay, it showed the incorrect amount, but with no detail as to where it came from.

Time to review options.

Hello there, @muenstermann. I want to ensure this will be taken care of.

I know how difficult it is to see incorrect sales tax amount when processing a payment. Thanks for sharing detailed info of your concern. To determine the details of the taxable or non-taxable sales in your account, you can pull up the Sales Tax Liability report. Refer to the steps below:

For reference, check this article: Check how much sales tax you owe in QuickBooks Online.

If you still can't see the details of the taxes showing when you're making a payment, I recommend reaching out to our Customer Care team to further investigate the root cause of the issue. They can pull up your account in a secure place and provide additional instructions on how to resolve this. Here's how:

If you have any other concerns about paying sales tax in QBO, please don't hesitate to post again here. I'm just around the corner to help. Have a good day ahead and stay safe.

For a short time QB worked "Based on location", as a result I manually changed 900 plus accounts to based on location which doesn't currently work. A total waste of hours!

Seems to me it the Shipping From that's the problem, theres not a way to turn that off.

NOT HELPFULL, NEED A PERMANENT FIX

Hi, did you managed to solve this?

Hi, did you managed to solve it?

Hi there, @Shay11. I want to route you to the right support to help you fix the sales by location tax in QuickBooks Online (QBO).

In QBO, the sales tax is automatically calculated based on your customer's tax-exempt status, where you sell or ship, and what you sell. For more information, check out this article: Learn how QuickBooks Online calculates sales tax.

Since you still experience incorrect calculations when choosing another location under the Location of Sale field, I recommend reaching out to our Phone support team. Once connected, you can request a screen share session so they can further review your setup and determine the root cause of the issue. They can also create an investigation if necessary.

Also in QBO, running a report to view how much sales tax you owe is a breeze. For detailed instructions, please read this article: Run the Sales Tax Liability Report.

I'll be right here to provide additional assistance if you have other QuickBooks concerns. Have a good one and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here