Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello I need help figuring out how to update the Tax Item in Manage Sales Tax. I know how to add new tax items and groups through lists however when I go to Manage Sales tax - Pay Sales Tax the correct tax items do not show up. What is currently in my system is old so every month when I enter the payment it is deducting from the wrong account making that account go negative, meanwhile the correct accounts continue to grow since they are never recording the sales tax payment.

I appreciate your effort and providing details, Arke.

First, have you already tried to adjust the date on the Pay Sales Tax window? The window defaults to a limited date range, which can make it appear as though no tax is owed. If you haven't yet, follow these steps:

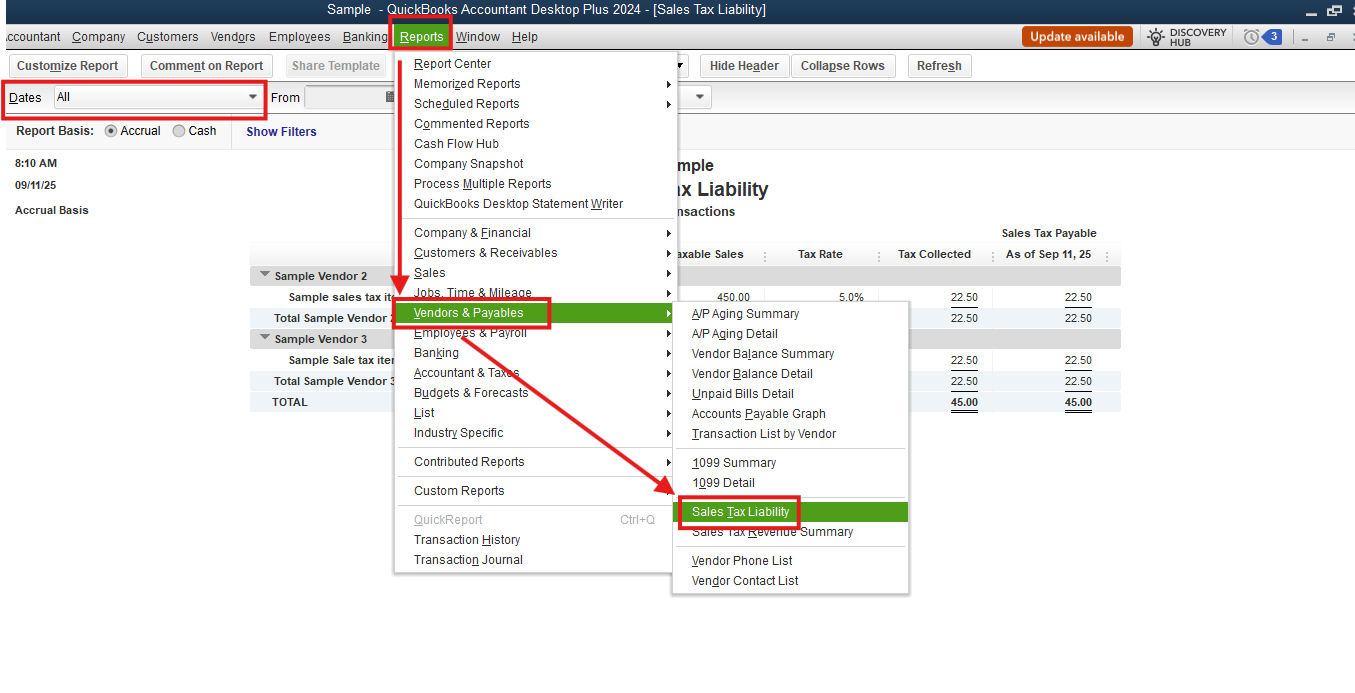

If the correct tax items still don't show up after adjusting the date, it's possible the tax accounts were entered incorrectly on previous transactions. The Sales Tax Liability Report is the best tool to verify this:

Please don't hesitate to let us know if you need further assistance in managing your sales tax. The Community space is available 24/7.

Thank you! I ran the report for sales tax liability and it is not showing all the subaccounts I have under Sales Tax on the balance sheet. On the balance sheet I have Tax and then subaccounts listed (for example Chandler, Maricopa County, California ....) all tax amounts are getting assigned to the subaccounts however when we go to make the sales tax payment (in manage sales tax) all payments are showing under Tax Other so that subaccount is showing negative. I do not know how to change this.

Welcome back to the Community, Arke. Let’s work on resolving why your sales tax isn’t displaying correctly in QuickBooks Desktop (QBDT).

First, can you clarify how the subaccounts under the Sales Tax Liability account were created? Were they manually added in the Chart of Accounts, or were they set up as separate Sales Tax Items with specific rates and tax agencies in the Sales Tax Center? Knowing this will help us pinpoint the issue.

In QBDT, all sales tax collected from invoices and sales receipts is automatically recorded in the default Sales Tax Liability account. This process is automated, and you cannot manually assign sales tax amounts to specific subaccounts.

When you use Manage Sales Tax to make payments, QuickBooks pulls from the default Sales Tax Liability account and applies the payments to the correct jurisdictions. If you’re seeing a negative balance in your subaccounts, this could be due to an overpayment when settling your sales tax liability.

To fix this, you can use the Adjust button in the Pay Sales Tax window to make a Sales Tax Adjustment to correct the payment.

Additionally, when you mention that all payments appear under Tax Other, could you please provide screenshots of your setup and reports? This will give us a clearer picture of the issue and guide you through the exact solution.

Don’t hesitate to reply here if you have further questions. We’re here to help!

The original 22800 account was used with an old POS and the new POS does a breakdown which you will see are subcategories to 22800. Daily we import info from POS to QB using a journal entry and that is how the accounts are credited, the challenge is the correct accounts are never debited since we cannot change Manage Sales Tax. It will not allow me to attach an image or a link but here is what the balance sheet looks like:

22800 Tax

22820 Chandler Retail 017 11583.37

22830 Maricopa County 48,496.27

22860 Washington State -1473.11

22800 Tax - Other -50,383.07

Tax 22800 Tax 8223.46

What other info would be helpful?

The original 22800 account was used with an old POS and the new POS does a breakdown which you will see are subcategories to 22800. Daily we import info from POS to QB using a journal entry and that is how the accounts are credited, the challenge is the correct accounts are never debited since we cannot change Manage Sales Tax. Attached is what the balance sheet looks like:

What other info would be helpful?

Hi, @arke.

Thank you for sharing the details and providing the screenshots to help us better understand the issue with sales tax categories appearing on the balance sheet, as well as how these accounts are debited. Please note that the system uses a default account for any sales tax items, and this account cannot be changed to your preferred sales tax subaccounts (e.g., county, state, or retail). This is why the payments are showing as negative amounts and are being categorized under Tax Other.

In QuickBooks Desktop, sales taxes, whether county, state, city, or retail, are managed as items or names that default into a specific Sales Tax Payable account. These names function as subaccounts linked to the parent account. For example, if you have sales tax items titled "State," "County," and "Retail," they’ll be segregated when you run Sales Tax Liability reports to show the different rates and amounts collected for each.

Additionally, the reason your preferred subaccounts don’t appear in the Sales Tax Liability report is that the report doesn’t use the accounts themselves. Instead, it relies on the sales tax item names for categorization.

As you’ve observed, while the system allows you to edit the sales tax item's rates, tax names, and vendor tax agencies, it doesn’t allow you to edit the default account used for these items. The negative amounts appearing on the subaccounts imported from POS to QuickBooks Desktop are caused by your preferred account category mapping for debits and credits, which doesn’t affect the default account used by sales tax items. If you would like to correct this issue and use your preferred sales tax subaccounts in QuickBooks Desktop, I suggest adding a journal entry. To ensure everything is recorded accurately, it’s best to seek assistance from your accountant.

Before making any changes to your company file, I recommend creating a backup copy. This ensures you have the original version of your company file that you can restore at any time in case of errors during the debiting or crediting process.

Please let us know if you need more assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here