Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have one employee that did not have any Federal withholding ever since we entered her new W4 information. I have checked and re-checked and it is set up correctly. We pay to have this stuff calculated for us, WHY DID THIS HAPPEN?

Thanks for taking the time to scour our Community space for potential solutions. If you haven't encountered this yet, this solution will prove useful in resolving the federal tax calculation issues, MVVR.

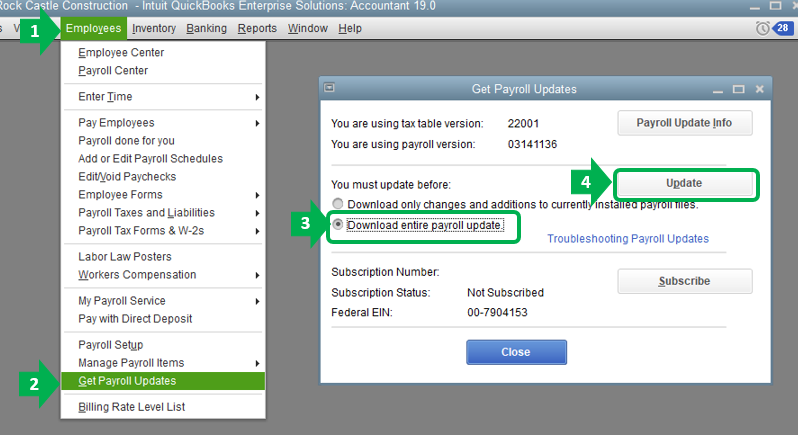

I appreciate you for reviewing the employee's information entered in the new W4 information. This helps us better isolate the issue. If you haven't updated your payroll to the latest release, I'd suggest doing so. This is often used to fix payroll issues and downloads the most current tax rates and calculations in your account. Here's how:

Federal Taxes will not calculate if your employee’s pay is too low or has many dependents. Another reason is when you're creating another payroll even if he has a pending and unsaved paycheck. Let's increase the gross pay by entering a larger rate or worked hours. If the same thing happens, check if the employee has a pending paycheck and revert for the taxes to calculate. Let me show you how:

More troubleshooting steps can be found here: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly. Here's an article you can refer to for more details about how QuickBooks calculates payroll taxes.

Need to see your employees' year-to-date data and other payroll details? You can run a payroll liability report to get started. This article can provide more details about the report and how to run it: Run payroll liability balances report.

Do you have more questions about your employees? Ask away and I'll help you out. If you have questions about running payroll reports in QuickBooks, add them to your reply.

Are you sure that the employee should have any federal tax withheld? Employees, especially ones with dependents that don't have a significant salary, often owe no federal income tax and, therefore, have no withholding. You can confirm this by looking at IRS Publication 15-T, specifically page 12.

This is happening as well with my employees not sure what's happening.

This has happened to me as well! My withholding is zero and a total of $3.00 Federal Tax was taken out in 2023! Please help!

Hello, @ChiroLifeCenter.

Welcome to the Community! I’d be delighted to share some information why the federal taxes are deducted incorrectly on the last payroll you run for last year.

Here are the possible reasons QuickBooks aren’t calculating federal taxes properly:

When the federal withholding is not deducting correctly, you’ll have to revisit your employees’ profiles if they are set up correctly. QuickBooks calculates the federal withholding based on these factors:

To review your employees’ payroll information, here’s how:

On the other hand, if you add the deduction to your employee’s first payroll of the year, the liabilities will be added to the current year instead of last year. What you can do is to create an adjustment check dated the same with the last payroll. By doing so, you’ll not have problems with your 2018 tax forms like 941 and W2.

If the employee is overpaid on the last payroll, you can create a deduction item with a tax tracking of “None” and use it on their first payroll of the year.

If you require further assistance with the steps mentioned above, we recommend contacting our Payroll Support Team. A payroll specialist can provide additional help through a secure remote access session.

Here’s how to contact us:

You can comment below if you have further questions about calculating federal withholding in your employee’s paycheck. I’m always here to lend a hand.

Hello, @ChiroLifeCenter.

Welcome to the Community! I’d be delighted to share some information why the federal taxes are deducted incorrectly on the last payroll you run for last year.

Here are the possible reasons QuickBooks aren’t calculating federal taxes properly:

When the federal withholding is not deducting correctly, you’ll have to revisit your employees’ profiles if they are set up correctly. QuickBooks calculates the federal withholding based on these factors:

To review your employees’ payroll information, here’s how:

On the other hand, if you add the deduction to your employee’s first payroll of the year, the liabilities will be added to the current year instead of last year. What you can do is to create an adjustment check dated the same with the last payroll. By doing so, you’ll not have problems with your 2018 tax forms like 941 and W2.

If the employee is overpaid on the last payroll, you can create a deduction item with a tax tracking of “None” and use it on their first payroll of the year.

If you require further assistance with the steps mentioned above, we recommend contacting our Payroll Support Team. A payroll specialist can provide additional help through a secure remote access session.

Here’s how to contact us:

You can comment below if you have further questions about calculating federal withholding in your employee’s paycheck. I’m always here to lend a hand.

Without knowing salary/wage and all of the details on your W-4 (step 2 checked?, Step 3 amount, any entries in Step 4) there's no way to determine whether $3 is right or wrong. You can post that here or look at IRS Publication 15-T, page 12.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here