Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I use AvaTax to calculate my sales tax via QuickBooks Online. While I do have the QBO Automated Sale Tax activated, I do not use it as I have AvaTax send all tax amounts to a Sales Tax Payable liability account.

I do have a question regarding the Out Of Scope Agency Payable account. After creating invoices, sales tax is calculated through AvaTax and added to the Sales Tax Payable liability account. At the same time every invoice sends a $0.00 to the Out Of Scope Agency Payable liability account. Does anyone know what this account is? Can I delete it? Or would that affect my already created invoices.

Thank you!

Hi there, @R_Crane.

I'd be pleased to help share information about the Out of Scope Agency Payable account.

The Out of Scope Agency Payable account is one of the default accounts created by QuickBooks Online (QBO) and use for sales tax recording. Any transaction which is selected as taxable, but has $0.00 tax amount it will be posted to the Out of Scope Agency Payable Liability account.

Since you're using AvaTax to calculate sales tax via QBO, the amount of taxes calculated is added to the Sales Tax Payable Liability account. QBO calculate $0.00 amount that is posted to the Out of Scope Agency Payable Liability account.

In addition, the account can't be deleted since it's a default account in QuickBooks.

To learn more about sales tax in QBO, you may check this article: Sales tax in QuickBooks Online.

Don't hesitate to add a post/comment below if you have any other sales tax concerns. I'll be always here to help you!

Thank you so much for the information. It's very helpful.

I do have another somewhat related question. Since the Out Of Scope cannot be deactivated, would you know if there is a way to turn off the QBO sales tax amount from appearing on printed invoices? My invoices currently show the correct AvaTax sales tax amount as a line item, then at the bottom show $0.00 for QBO sales tax. This is a duplication and is somewhat confusing to customers.

Thank you again.

Russ

I can help you with this, R_Crane.

You can customize the invoice template and uncheck the Tax column in the Activity table section. This allows you to print an invoice without the sales tax amount and taxes will only show in the Tax Summary section. I've provided some screenshots below for your reference.

For more details on how to customize your invoice template, please follow the steps below:

I found a helpful article more details about customizing invoice: How to customize invoices, estimates, and sales receipts.

Just reply to this thread if you have additional questions.I'd be glad to help.

I just found this account while reviewing my Chart of Accounts for 2019 and there are values within this account. They're all from old invoices (2017 and 2018), but there is a positive value in Out of Scope Agency Payable.

My CPA never mentioned anything, so it's probably nothing worth losing sleep over, but what does it mean if there are values in this account?

Hello there, @georgiajackson19.

Let me provide additional information about the Out of Scope Agency Payable account in your Chart of Accounts.

The amount value in your Out of Scope Agency Payable account only means that there are transactions created on the specific Tax Agency. If you want to zero out the value of this account, you can consider removing the tax code. Here's how:

Here's an article you can read for more details: Remove sales tax rate.

You might also want to watch this YouTube video to know more about the accounts in your Chart of Accounts: Understanding the Chart of Accounts.

If you need any additional assistance while managing your Chart of Accounts, you can leave a comment below. I'll be sure to get back to you. Have a good one.

Your screenshots are from the previous Sales Tax programming, and your link is from 2018. I have the accrued sales tax stuff that QBO rolled out last year. I can edit Sales Tax Settings, but it literally only gives me the option to make inactive. I also only have Texas listed... no other agencies. QBO has pretty much disabled the ability to make any changes with sales tax calculations, accruals, etc.

Also, there has been no activity since 2018 in this Out of Scope Agency account, and I have billed those few customers since those last transactions. So something changed.... I have no idea what, but for whatever reason, this account isn't being used in the background of QBO anymore.

Thanks for sharing the screenshot of your Sales Tax Center, georgiajackson19.

You can proceed to making it inactive if you're not using it anymore, or keep it active if you want to run reports about the sales tax collected for this tax item. Follow these steps to check why there was an amount associated to this tax:

Also, the ability to edit sales tax rate and calculations are no longer available because everything is automated. Sales taxes are generated based on your location and the customer's addresses.

Check out these articles about the Automated Sales Tax feature to get more details:

The Community is always here if you need anything else. We're here to make sure that you're able to sort it out.

I'm not going to make my sales tax inactive - it's my sales tax. I was simply showing the screenshot notating that I don't have multiple agencies as the last commenter suggested.

There is physically NOTHING I can do within the sales tax edit section.

My original question was referring back to 2017 and 2018 transactions that have a value in the Out of Scope Agency report. I'm not looking to edit anything with my sales tax. I wanted to know why QBO posted taxable items in this account when the ORIGINAL reply said QBO only used 0.00 values for this account.

Thanks for getting back to us, @georgiajackson19.

You'll want to contact your tax agency to check if those said Tax codes have 0% or it has different.

If there's a difference, it could be the possible reason the amounts are reported. However, if there is no difference, I recommend contacting our support team.

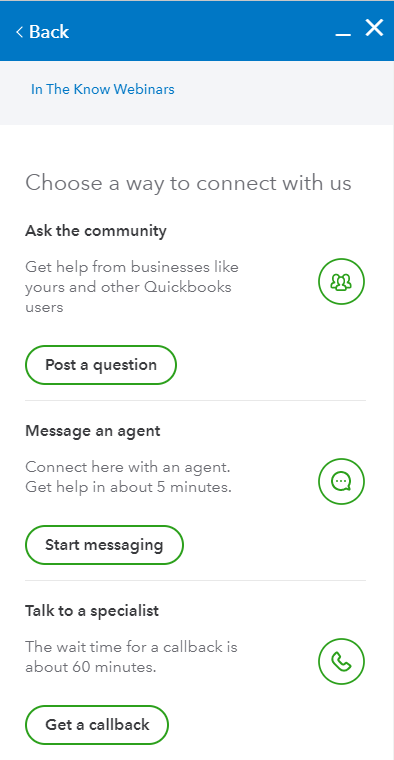

They have the tools to check your account securely and investigate why the amounts are reported. To reach them in your QuickBooks Online (QBO) account:

You might also want to check this article for reference to learn more about the sales tax in QBO: Sales tax in QuickBooks Online.

Don't hesitate to get back to us if you have other questions. We're always here to help you anytime. Have a great day and take care!

What if it won't let you deactivate it. I've never seen this before. My new client is showing FIVE (!!!) Sales Tax Payable liability accounts and this is one of them. It has never been used, therefore shows zero transactions/zero balance. I need to be able to deactivate it.

I've got your back, @sooverit2.

Before we start, did you receive any error message when trying to deactivate the Sales Tax Payable liability accounts? Any additional information would be greatly appreciated.

Zero balance accounts can be easily deactivated in QuickBooks Online (QBO). You can go to the Chart of Accounts and deactivate the unused Sales Tax Payable account from there. Here's how:

I'm adding this article for more guidance: Make an account inactive on your chart of accounts in QuickBooks Online.

Just in case you want to learn how to manage sales tax payments in QBO, you can check out this article for detailed information: Manage sales tax payments in QuickBooks Online.

If you have other concerns or follow-up questions about deactivating accounts, feel free to leave a comment below. The Community team and I are always here to help.

I know how to deactivate accounts. Like I said above, it will not let me deactivate it. This is a QB added useless thing. (I wish you guys would stop adding random things that have to be fixed later.)

I was able to deactivate the other random unused sales tax liability accounts. I need this gone.

@sooverit2, thank you for returning to the thread and providing me with a screenshot that will assist me in giving information about your issue. I'd be delighted to help you clear things out.

I understand how important it is to do any activities in QuickBooks efficiently and without challenges. However, you are unable to deactivate this particular account because it is set as default in QuickBooks Online (QBO).

You might be interested in learning how to handle default accounts in your chart of accounts by clicking on this link. They are created when you set up QuickBooks or initiate an event, such as turning on the sales tax option.

These articles are helpful resources when handling chart of accounts in QBO moving forward:

Please get back to us if you need further clarifications with managing your chart of accounts or any QuickBooks-related concerns. We're always here to help you. Take care!

We are having the same issue as items posting to this account. However, ours has amounts in them. Anyone have this issue? (We do use another software to create our invoices and sync them to QBO). Thank you!

I understand you're using third-party software to create invoices and sync them to your QuickBooks Online (QBO) account, Dawn.

To provide you with the best solution possible, I would like to ask for more details about the software you are using. Can you please let me know the name of the software and any other relevant information that might help us narrow down the issue?

It would also be helpful for you to contact the third-party software support team, as they can assist in resolving this issue.

On the other hand, one possible solution to consider is to check your register for "Out of Scope Agency Payable" from the Chart of Account. Once you find the transaction in question, edit it. The transaction only shows on this account if it's taxable but has a $0.00 tax amount.

In addition, you can check these articles to learn how to run basic reports in QuickBooks:

Please provide any additional details that you can so I can further assist you. I am here to help and will be on the lookout for your response.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here