Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We owe state and federal payroll taxes for 2019. How do I add the interest and penalties in Payroll?

We have been making monthly installment payments. How do I enter this?

Hi there, jmeck.

We can include the penalty when processing the liability payment in Quickbooks. Here are the steps:

You may also need to contact our Payroll Support Team. They have available tools to assist you in properly recording your penalties and interest in QuickBooks.

I'll be right here if you have any other concerns.

I meant that my L1 for 2019 did not get filed and I have been trying to get it corrected with little assistance. I have uploaded, emailed, and called to get it resolved with zero luck. I had to file my own L1 for Payroll taxes to the state at least to get it on file. That only to care for the filing portion but since it was not done by Quickbooks in the first place it was late and delinquent fees are now due. I received a final notice on April 6, 2020. Since I transition from Intuit Full Service to Quickbooks Online one just blames the other and nothing has gotten done.

Hi there, JJLFABRICATION1,

Thank you for the inputs. Let me clear things out for you. You'll want to manually record past due state and federal payroll taxes in QuickBooks Online (QBO). This is because the system won't allow you to pay them electronically.

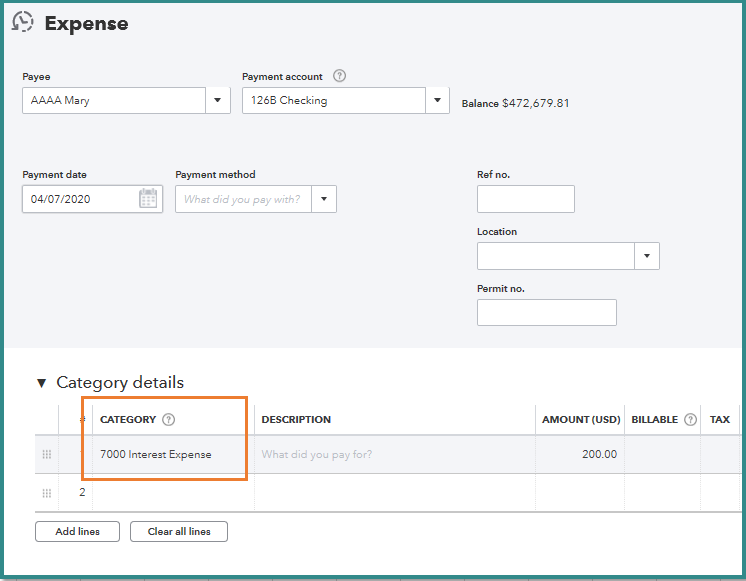

Then, you can create an expense record the interest and penalties. This will separately record those payments from your taxes.

Let me show you how:

On the other hand, we pay taxes and file your returns in Intuit Online Payroll Full Service. Now that you move over to QBO, we no longer have access to your account. You'll need to log in and file your taxes.

I've added this article for additional information: Paying late federal taxes. It provides options for submitting a late tax payment or penalty in QuickBooks.

Should you need anything else, please let me know. I'm always around to help you out.

Thanks, this worked fine for entering penalties and interest.

We entered into an installment agreement with the state EDD. I am not able to enter installment payments in on-line payroll when I choose the month the debt was incurred.

These are not listed in bills to pay, which is where the taxes and penalties are entered.

How do I enter an installment payment, i.e. total debt is $450 for Q1 2019 and payments are being made at the rate of $78 per month.

thanks again !

Good to hear that works for your business preference, jmeck.

We can create a liability account to use it when recording an expense posting both the liability and the interest and penalties. In the first line enter the payroll liability account and it's corresponding amount, this goes the same with the interest paid.

Let's ensure that we use the correct liability account so that it'll decrease our payroll tax liabilities being posted in our books. I also suggest reaching out to your accountant to further verify.

Feel free to get back to me if you need more help. Take care!

I'm using QB 2016 desktop for mac. i don't have a "payroll center" option under "employees" only "payroll" which takes me to sign onto the payroll center, and "employee list" and "time tracking."

there is no "pay liabilities" tab in on-line payroll. when I enter "pay taxes" under "taxes and forms" I am not able to change the amount paid while recording the payment date and check #. I can only enter the full amount, but this was paid in installments.

I wsa able to enter the penalties and interest as you instructed before, thank you.

in addition to my post a few minutes ago: I want to remove the pending 941, 940 and CA payment taxes showing as still due to pay in QB payroll for Mac. We have managed to pay all in full by now, but they still show as due.

Thank you for getting back in here, @jmeck.

I want to make sure you'll be able to manage your liability accordingly. I suggest reaching out to our representatives. This way, they can check your account and help track your liability payment.

Here's how:

Please also review our support hours to ensure your issue gets addressed right away.

You may also consider visiting our QuickBooks Help. This way, you'll be guided setting up payments, managing your income and expenses, running reports, etc.

Just click the Reply button if you have other concerns. I'm always here to help you. Have a good day.

I tried this - can not find Pay Liabilities tab - where is it located 2021

Hi there, Deb02.

Welcome back to the QuickBooks Community. I appreciate you for following the steps above to achieve what you want. I'll share troubleshooting steps to ensure that you're able to find the Pay Liabilities tab.

The Pay Liabilities tab is located under the Employees menu and Payroll Center. If you can't find the said option from there, I suggest running the Verify and Rebuild Data Utilities to get this sorted out. The Verify Data utility identifies any potential data damage issues that might've caused the missing option. While the Rebuild Data utility repairs damaged data in your company file. Before this, you'll have to secure a backup copy of your company file.

To Verify data:

To Rebuild Data:

For further details, you can open this article: Verify and Rebuild Data in QuickBooks Desktop. This also provides information on how to manually correct errors.

Lastly, you may refer to this article to view another solution on how you can fix minor data issues with your company file: Fix data damage on your QuickBooks Desktop company file.

Let me know if you have other questions or any related concerns about different options in QBDT. I'm always free to help you whenever you need my assistance. Take care and stay safe always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here