Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for the reply but you've missed the point entirely.

Firstly, these reports were all correct last month. This month they are not. I have not changed anything, QuickBooks has (new invoice form and sales tax calculations). Therefore, please do not suggest that I am suddenly doing something wrong after years of no issue. You have rolled out a horrible invoicing change - each invoice takes roughly double the number of clicks and time to prepare as previous. The sales tax calculation (i.e. the actual percentage used) doesn't show on the main invoice screen any more, and now I must click into a separate screen to see what is being charged, and to avoid having to manually enter a work location each time (which our customers don't need), I have to change to manual calculation and enter the tax rate on each invoice - for a state with different surtax rates in each county, that is onerous. Don't even get me started on the fact that your new screens don't accommodate dark theme.

Secondly, I do understand the concept of taxable and non-taxable, and NO, taxable is not selected on the invoice form.

Thirdly, products and services are never exclusively taxable or non-taxable in our line of business - they vary based on circumstances (labor for example (for us) is only taxable if the invoice includes taxable product, otherwise our services are tax exempt) and customer (some customers are always tax exempt, but most are only exempt if what we provide is for resale - therefore they must remain as a taxable customer for those cases). Please do not suggest that every customer and product needs to have a taxable and exempt record (thereby doubling the number of products and customers and increasing my workload). However, just to validate, I changed one of the product codes to be tax exempt (rather than potentially taxable) - no tax on the invoice, but still appears on the tax liability report as taxable income with no tax charged (this is wrong - it should not be on the report at all).

And finally, you haven't addressed why the sales reports are now suddenly also incorrect (correct gross sales, but taxable sales are now incorrect), nor why the numbers on the tax liability report do not match the actual sales. Yes, I know it is a line total. Why isn't there a report total (as there is for total tax) for gross or exempt sales?

I will have to manually calculate all of the values for my State sales tax filing. What scares me even more is that our reports are now incorrect - this is 3 1/2 weeks away from year end. If my reports are incorrect, what am I supposed to submit to the stakeholders? What am I supposed to give to the accountant for 2023 income tax filing? How can I trust any of the reports at all?

Thanks for elaborating on your concern, @dLearned I understand what you're going through under the sales tax liability report.

I can get you the right support that has the resources to check your account and sales tax setup in a secure environment. You'll want to reach out to our Customer Support Team. They'll surely sort things out with you and give you direct and detailed steps on how to fix the issue you're currently experiencing.

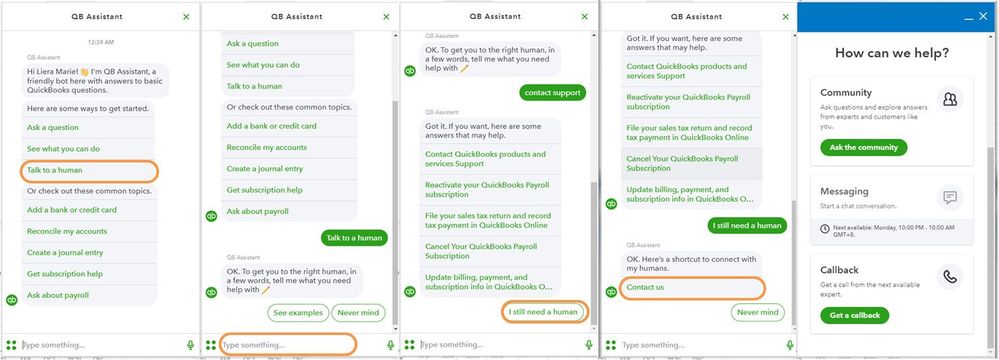

Here's how to contact us:

You can also check out this article that lists all our support hours and types.

I'll be attaching an article that will help you manage your sales tax setup while waiting to get connected with our Phone Support.

I appreciate your patience while we are looking for remedies for your sales taxes. Please know that we are here to support your growing industry.

I am also having issues with sales tax liability reports. Over the last year my total sales on the sales tax liability report is no longer correct.I did not realize this until recently. It only shows sales that are marked taxable somewhere in the invoice. It does not report the true total sales numbers. Why? What setting could have changed?

I completely understand how crucial it is to have accurate sales tax data, especially when it comes to reporting, Steelrose22.

Let me make it up to you by making sure you get a detailed explanation of why this issue occurs.

I recommend contacting our QuickBooks Support Team. They have full access to your account and can review the sales taxes added to your invoices. They can also determine its cause to ensure it won't happen again.

Here's how to contact our support:

I appreciate your patience as we work through this. If you have any other concerns or questions about managing your sales taxes and transactions, please don't hesitate to add a comment below. I'll be glad to help you out.

Can someone explain to me about the Multiple tax line? On the sales tax liab report, and it has a negative number. I think I understand it but I want an official meaning if I could. Thank you!

KT

Hello, Ktbarthedoor.

Let me explain what the Multiple tax line means and what causes the negative number on your sales tax liability report.

In QuickBooks Online, the term "Multiple tax line" refers to a feature that allows you to apply different tax rates to individual line items on a sales transaction. This feature is useful when you have products or services subject to different tax rates within the transaction.

For example, let's say you have an invoice with two line items: Item A and Item B. Item A is subject to a 5% tax rate, while Item B is subject to a 10% tax rate. By using the multiple tax line feature, you can assign the appropriate tax rate to each line item, and QuickBooks Online will calculate the tax amount accordingly and ensure that your sales transactions comply with the applicable tax laws and regulations.

Now, regarding the negative number on your sales tax liability report, there are a few possible causes:

It's important to review the details of your sales tax liability report to understand the specific transactions or adjustments that are causing the negative amount. If you're unsure about the particular entries, consult an accountant or bookkeeper who can review your QuickBooks Online data and provide guidance on addressing any discrepancies.

For additional tips while handling your sales taxes and liability reports, you can check out these articles:

On the other hand, you may review the topics from this link for more resources while working with your sales and other customer transactions in the future: Topics about your company's income and customers.

Just leave a comment below if you have other questions or concerns with QuickBooks and sales tax liabilities. I got your back! Stay safe always, and have a great day!

Thank you for the quick response but this is quickbooks desktop enterprise not sure if that matters. I have reviewed all of the invoices that are showing up in the negative line. The only thing I can determine is we are using QB Grouping which part of what QB offers for Sales Tax. Some of the items are taxed at one rate for city tax and then another rate for county tax. Do you think QB is deducting back out invoice amount of one of those lines since it does include both lines in the report?

Example:

Mayes County 4988 Taxable Sales 1000.00 Tax Rate $137.50

Pryor City 4909 Taxable Sales 1000.00 Tax Rate $400.00

Ok State Taxable Sales 1000.00 Tax Rate $450.00

Total Sales for the month is $1000.00

So is it putting in a negative in the multiple tax line so that your total is $1000.00 not $3000?

Thank you!

Katie

Hey there, @Ktbarthedoor.

Thanks for joining in on this thread.

The negative will show on the sales tax liability once you make an overpayment in QuickBooks. You can view all the transactions to check if you made an overpayment. If there is, you'll need to clear the negative amount in the sales tax payable by adjusting the sales tax liability.

If the set up is causing you to have negative items, you may need to double check that it's set up correctly and that you aren't somehow doing a double charge.

I hope this helps. If you have any further questions, just let me know. I'm only a post away!

So are you referring to the setup of the sales tax group below? There is not an overpayment so I don't think that is the issue. I just can't find anywhere in QB Desktop that explains the report itself. When you are invoicing you would pick the Group Name: Pryor, Mayes, OK-GRP. Then on the report it will have them listed separate. That is what is nice about the report in QBD it gives you the totals as compared to QBO. But if your total is $1000 in net sales and as per my example above and you have $1000 in each line does QBD just know that the total is $1000 in total sales or does it have $1000 on each line then a Negative $2000 on the multiple tax line (subtracting the duplicate taxable amounts) which gives you your actual total of $1000.00 for the month....

Hi there, Ktbarthedoor.

I'd be happy to provide clarification about the negative multiple tax line on the Sales Tax Liability report.

Yes, you're right. QuickBooks deducts the amount in the multiple tax line to offset and correct the total sales amount. It puts a negative in the multiple tax line, so the total amounts to $1000 and not $3000.

If you need additional information on reviewing sales tax reports, please refer to this article: Review sales tax reports.

You might find this article handy when paying sales tax: Pay sales tax.

Please let me know in the comments below if you have additional questions about sales tax or anything related to QuickBooks. I'm just around to help you.

Our QB online report seems to be grouping nontaxable sales with tax exempt sales. Is there a way to separate them? Colorado requires them to be reported on separate lines in the sales tax report. Putting them all under nontaxable sales when that normally only accounts for approx 1% of these sales. How can I get QB to report these items separately? QB desktop had that capability.

| Total Sales | Non-Taxable Sales | Taxable Sales | Tax Rate | Tax Collected | Sales Tax Payable As of Nov 30, 23 | |

| City of Colorado Springs | ||||||

| Colorado Springs 04-0017 | 0.00 | 0.00 | 0.00 | 3.07% | 0.00 | 0.00 |

| City of Colorado Springs - Other | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Total City of Colorado Springs | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Colorado Department of Revenue | ||||||

| El Paso County | 0.00 | 0.00 | 0.00 | 1.23% | 0.00 | 0.00 |

| PPRTA | 0.00 | 0.00 | 0.00 | 1.0% | 0.00 | 0.00 |

| State of Colorado | 0.00 | 0.00 | 0.00 | 2.9% | 0.00 | 0.00 |

| Colorado Department of Revenue - Other | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Multiple taxes for Colorado Department of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Total Colorado Department of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| No tax vendor | ||||||

| 0 - Exempt | 0.00 | 0.00 | 0.00 | 0.0% | 0.00 | 0.00 |

| Other | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Total (no tax vendor) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Multiple taxes from different vendors | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| TOTAL | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Thank you for joining this thread, dbmom.

The option to separate the nontaxable and tax-exempt is not available in QuickBooks Online. What we can do is export the nontaxable report to an Excel file to add columns for your item. Let me help you on how to do it.

First, let's run a report for Nontaxable, here's how:

6. Select Run report.

Next, we can now export the report.

If you have additional concerns regarding your nontaxable sales in QuickBooks Online, please don't hesitate to post them here in the Community space.

This is a major problem. It is beyond naive to assume that tax exempt sales, which are very closely monitored by the taxing authorities, are the same as no tax sales. Expecting you users to dive down into the bowels of a report because Intuit made a very bad decision is beyond insulting. You need to fix this before you lose more customers than I suspect you already have.

I would NOT place sales tax in the hands of Intuit. What is wrong with using Avatax?

Hi Coast2 - Did you find a resolution to this? I just switched to online last month and sales tax is due TODAY!

Agree 100%. Never an issue with QB desktop, QBO - no way to get an accurate sales tax report. Does seem to have gotten worse after an update. Tried 3 times to talk with support, absolutely no clue. Have any of the developers ever done a sales tax report? And you want to raise prices?

Hello @Coast2 , I am an accounting professional who is a Certified QBO ProAdvisor and is based in CA with clients in CA and other states. I came across your problem in the QBO community when I was searching to see if anyone else was having issues with the built-in sales tax system miscalculating the total tax for items for the 6% state rate for Florida where my client is located (similar to CA, Florida has county surtax rates that QBO also tracks and calculates which show as sub-lines on the Sales Tax Liability report proper filing of the return and payment on Florida's DOR website). Your issue came up because a commenter mentioned Florida.

What I am writing to you about has nothing to do with your missing column problem ... I happened to notice on your screenshot of your sales tax liability report you provided to the QBO employee, that it is a Cash Basis report. CDTFA regulation is that sales tax liability in CA is required to be remitted on a accrual basis, regardless if your business is cash-based for income tax purposes. (https://www.cdtfa.ca.gov/lawguides/vol2/suta/130-0005.html)

Based on direct experience with my clients in CA, I strongly recommend you start filing your tax returns using an accrual basis sales tax liability report from QBO, because CA routinely audits businesses who have Sales & Use Tax accounts, and the aftermath of an audit on your account is a time-sucking headache for the business owners (I have a CA client who made online purchases for her business but some retailers were not charging tax on the sales--CDTFA caught this and assessed a ridiculous amount owed with penalties and fees based a blind estimate of total purchases she made in a calendar year (multi years) - she had to produce all the receipts for her online purchases to prove she was charged sales taxes on most of her online purchases).

Hope this helps! Just wanted to offer some sage advice from one business own to another! Have a nice day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here