Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for bringing this inquiry here in the Community, @sara95. Allow me to share an insight about sales tax calculations.

QuickBooks calculates your sales taxes for various reasons. It calculates based on the customer's status. However, tax-exempt rules are different everywhere. The calculation also takes into account where the product or service is sold and shipped, as well as its tax category. Sales tax rates differ in each state, and in some cases, sellers are required to charge taxes based on their business location and the shipping destination. Also, if you set your product or service as taxable, the program will calculate the sales tax automatically regardless of whether your customer is tax-exempted.

However, if you want to apply the tax exemption to these customers, you have the option to do so. Here's how:

Furthermore, you can set up your sales tax category for your product and services to accurately calculate how much to tax your customers.

Additionally, check out this article to customize and generate a report about non-taxable sales: Non-taxable sales report in QuickBooks Online.

Feel free to visit the Community page if you need further assistance with sales tax calculations or other QuickBooks-related concerns. Our team is always available to support and assist you. Have a great day ahead!

This makes absolutely no sense - If a customer is marked tax-exempt it should not calculate tax for that customer. 501c3 and government entities do not pay sales tax and it doesn't matter what the product is. On another note - I know we can turn sales tax off on the items on that invoice but that solves no problems if the person creating the invoice doesn't know that the customer is tax exempt - again that's why we turn off sales tax in their customer record. I have been going rounds with Quickbooks support on this issue for weeks. Last time I was told it is a known issue that other people have reported and they are working on it. From your response, I would assume that is not the case?

I wish you didn't have to go through all these hurdles when working with QuickBooks, @sara95. Let me provide some details regarding this sales tax issue and help you point in the right direction for support.

Upon checking our database, I've confirmed that there is an ongoing investigation into the sales taxes that are still being calculated for tax-exempt customers. We understand the frustration of not having this function as expected and the importance of resolving this as quickly as possible. Rest assured, our Engineering Team is aware of this and is working diligently to resolve it.

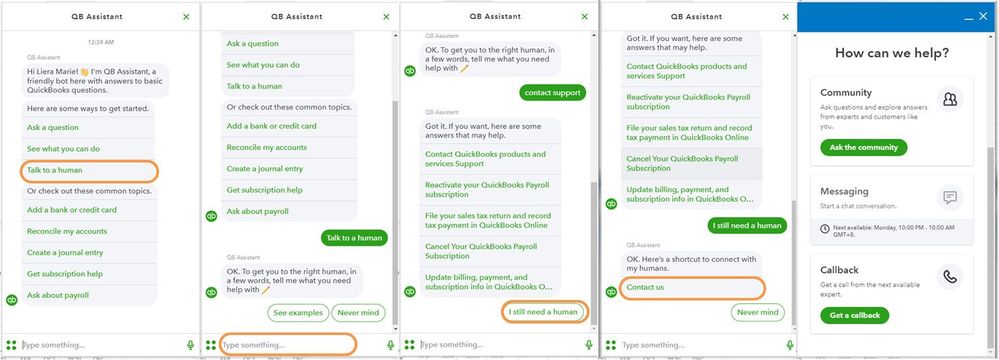

While we're unable to provide exact dates for when this issue will be fixed, I encourage you to contact our Customer Care Team again for instant updates about this issue. They'll add you to the list of affected users and notify you via email of the resolution updates. You can also present this investigation number (INV-92060) to our representative as your reference. Here’s how to get in touch with them:

Please check out our support hours to ensure that we can address your concerns on time.

In case you need to check how much sales tax you owe, we can run the sales tax liability report to help make sure that everything is accurate before you file your return to your tax agency.

I appreciate your patience while we’re working to fix this. Please know I'm only a post away if you have any other QuickBooks-related questions. Stay safe!

AAAAAGGGGGGGGGGGGGHHHHHHHHHHH- How can that be your answer? There are so many of us in sales tax hell right now because of how this works. When is it all getting fixed?????????????

I completely understand how crucial it is to have accurate sales tax calculations, especially when it comes to reporting, lmoCDS. I recognize the frustration that arises when tax-exempt customers are incorrectly shown as taxable.

As of now, the investigation is still ongoing. We don't have a specific timeframe for when this issue will be resolved. Rest assured that our engineering team is actively working to fix the problem and ensure accurate calculations moving forward.

I recommend contacting our QuickBooks Support Team so that you'll be added to the list of affected users. This way, you'll receive email updates on the investigation's status and be notified once it's been resolved. I've included the steps to contact support below.

In the meantime, you'll want to consider unchecking the taxable field on each invoice.

I appreciate your patience as we work through this. If you have any other concerns or questions about managing your sales transactions, please don't hesitate to add a comment below. I'll be glad to help you out.

Do we really need to call to add a client to the list that are affected by this issue? Calling customer service is such a time suck.

We appreciate you joining us here in the thread, @IAWTFC. We'll provide details about the update on sales tax calculating on tax-exempt customers inside QuickBooks Online (QBO).

Yes, you're right. You'll want to contact our Customer Care Team so they can add you to the list of affected customers. As we check here on our end, the investigation is still ongoing, and our engineers are still trying to come up with a solution to fix this.

In case you're using Plus, Essentials, or Simple Start. You can reach out to our support from Monday to Friday from 6 AM to 6 PM PT, and on Saturday, you can reach out to our support from 6 AM to 3 PM PT. For QuickBooks Online Advance users, they can contact our support team anytime. See this page for more details: QuickBooks Online Support.

In addition, you can check this page to help you ensure your data stays accurate inside QBO: Run reports in QuickBooks Online.

You can visit us anytime here in the Community space if you have any additional concerns, @IAWTFC. We'll make sure to be around to help you out again. Keep safe.

OH MY GOD! ARE YOU FREEKING KIDDING!!!!!!!!!!!!

A MULTI BILLION DOLLAR COMPANY AND YOU CREATE A GITCH LIKE THIS, WHAT THE F..K!

GET YOUR COLLECTIVE HEADS OUT OF YOUR A...S AND FIX IT!

A HIGH SCHOOL KID COULD MAKE THIS RIGHT.

Funny! I just called to have two of my clients added to this investigation and was told it was closed but not resolved. Supposedly they are pushing a patch. They are working on it.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here