Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIs there a way I can see how quickbooks came up with each box on W-2? I understand what goes in each box, and I found some random numbers I can't wrap my head around.

2 main errors:

1. Our overtime is exempted from state wages (box 16). Some employee have correct Box 16 (Box 1 - Box 14) and some just have Box 1 amount.

2) Our Local Wage (Box 18) should equal to Box 1, but some have different amount. Their Local Tax (Box 19) is correct though.

I called payroll support, but all they could do was to see if my company file have any error, and told me to check with the accountant as they are not licensed to give suggestions? We pay about $3000 per year for this service and I think it's just not fair.

Back to my question, is there any way I can see how quickbooks came up with their number?

@jzk0050 My memory is rather shaky, but I seem to recall @BigRedConsulting mentioning just such a report before, that would show the sources for the different boxes.

They may or may not see the ping I just made, but either way, good luck.

Your employee's W-2 includes sections detailing their total payroll information in QuickBooks Desktop (QBDT). Generating a specific report can provide deeper insights into these components. Let me assist you in obtaining this report, Jzk0050.

You can generate the Payroll Summary report, which outlines and displays your employees' total payroll wages, taxes, deductions, and contributions. This is particularly useful when creating W-2 forms. To do so, follow the steps below:

After generating the report, you'll receive detailed employee payroll information. Moreover, I recommend visiting the QuickBooks blog for more insights into understanding the W2 forms.

Additionally, this article with guidelines for printing your W-2 forms may help when you need to send a copy to your employee or accountant: Print your W-2 and W-3 forms.

Feel free to mention my name in the comments below whenever you have questions about QBDT W-2 forms. I'm here to assist you anytime. Stay safe!

We are having this same problem. Our state exempts overtime wages from the taxable income. All of the other boxes on the W2s are correct, but box 16 isn't calculating the correct state taxable wages on 1/3 of our W2s. It should be the total gross income minus the exempt overtime amount. The differences between the correct amount and the amount QB has put in that box are random, make no logical sense, and don't show up on any version of the many reports I've pulled to try and track down these strange amounts (ranges from $47.25 to $300 off in that box). The Review/Edit screen doesn't let me edit anything that's already populated; it only allows things to be added in empty boxes. I can't knowingly e-file incorrect forms, especially when it should be easy to correct. QB should give us the ability to correct the forms in the W2 worksheet screen if QB programmers can't figure out how to make the software do the math correctly.

@FrustratedCustomer3 Try going to Reports>Employees & Payroll>More Payroll Reports In Excel>Tax Forms Worksheet.

This report will allow you to select from a number of payroll tax reports including W-2s and see exactly which payroll items are contributing to which box on each employee's W-2.

@FrustratedCustomer3 Er, not that that will solve your core issue; just that it can help you track down some of the random numbers you mentioned.

Try right clicking the box and hit override. This should let you edit. When I generated 2025 W-2 just to check and the calculations were fine, so I think it's just this year that's mapped weirdly. I ended up manually editing them. Don't waste your time calling the customer service, they will either tell you to go ask your accountant or manually edit them yourself. I even have a ticket I opened up regarding this issue. Don't think I'll hear back from them.

Hi there Customer3,

I appreciate the details regarding the amounts shown in box 16 and your effort to verify them on the report. I recognize the importance of submitting the correct one to avoid any inconvenience in the future. Let me clarify the components of the calculations and share a few reasons that affect the value to ensure correct state-taxable wages on the form.

The data on the W-2 form is based on the payroll information you've set up in the program. With this, I'd like to know if you change the tax mapping manually. Additionally, if you have fringe benefits, it only increases the wages in boxes 1, 3, and 5, or include the total in box 14 (labeled Other) or on a separate sheet. In this case, Override the amount on the State income tax to reflect the correct value.

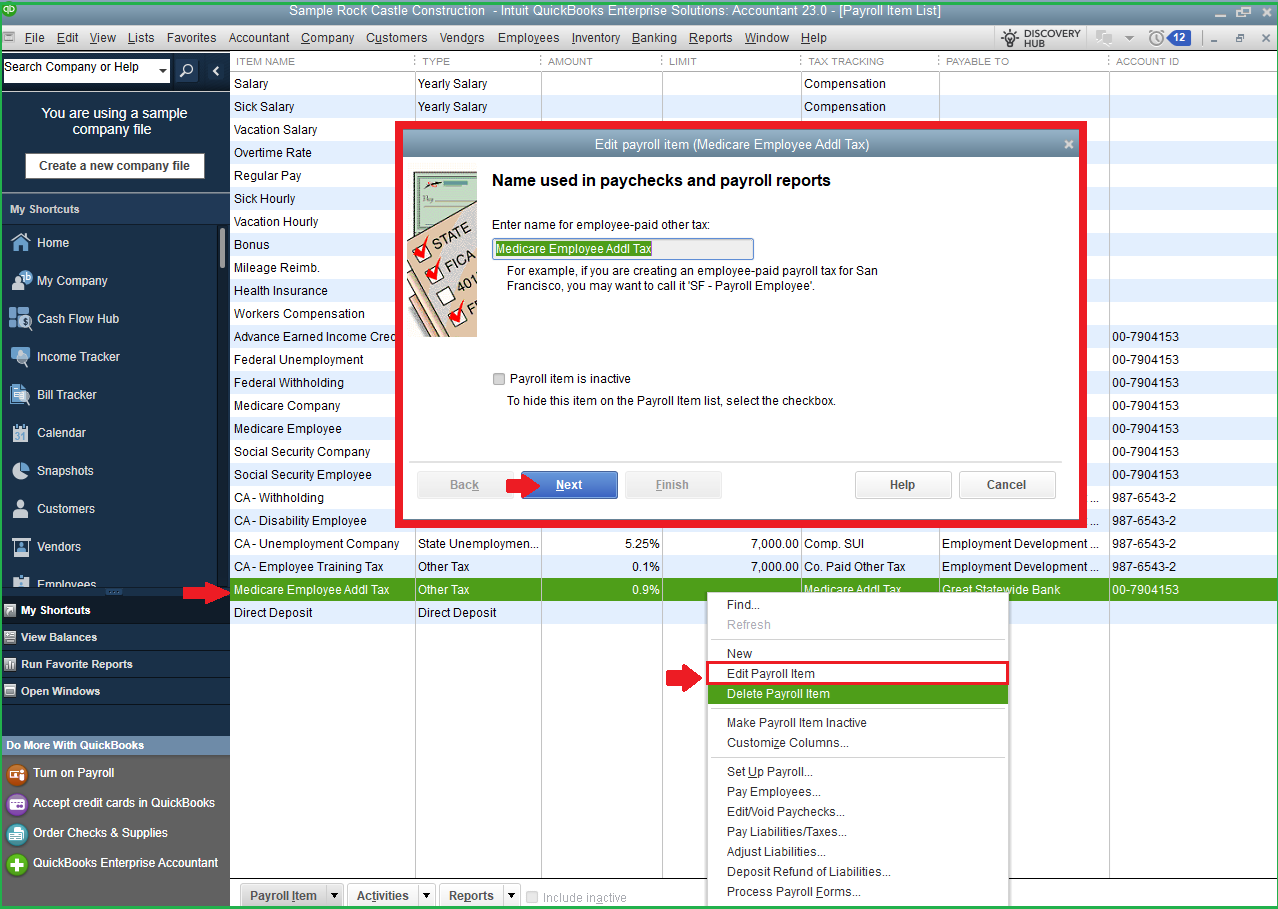

Moreover, we can review the payroll items involved since random figures are displayed. If it's currently classified as a federal tax tracking type, it will not impact the state-taxable wages on your W-2 forms. That said, modify the tax tracking type to show it in box 16.

Here's how to do that:

To use the old and new payroll items on a paycheck or inactivate one, refer to this article: Fix a payroll item with incorrect tax tracking type in QuickBooks Desktop Payroll.

Additionally, I recommend consulting your accountant or tax advisor if uncertain about which tax tracking type to utilize for each deduction item. They can provide other ways to help you correct the amounts.

Moreover, you can create a payroll summary report to view payroll totals, including employee taxes and contributions. Follow the instructions provided under the QuickBooks Desktop dropdown.

Furthermore, save this reference to send paper copies to your employees or for your own: Print your W-2 and W-3 forms.

Count on me if you need a hand in rectifying payroll taxes or tailoring financial reports. We'll be right here to assist you promptly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here