We're thrilled to see you here on our Community forum, Emily. We're eager to lend a hand with the 1099 form in QuickBooks Self-Employed (QBSE). We'll make every effort to assist you in resolving your issue.

Your client/employer may be still unable to file your 1099 through the IRS. I recommend contacting them to confirm, and you may request a hard copy. Once your employer has filed your form, you will receive an email invitation and can open the invite using a free QBSE account. Then, you can view your 1099 form on the Clients menu.

Here's how:

- Head to the QuickBooks Self Employed log-in page.

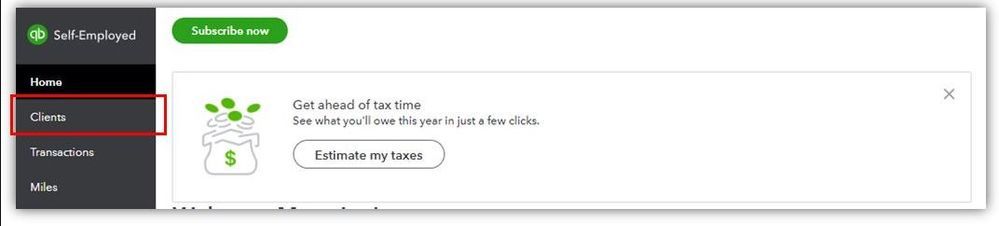

- Once signed in, go to the Clients tab.

- From the Forms section, look for your 1099 form.

Please review the screenshot attached below.

If you're still unable to find the 1099 forms, I suggest contacting our technical support team. They can use specific tools to locate the forms in your account.

Here's how:

- Click on Help (?) and hit Contact Us.

- Note: If you’re using the QuickBooks Self-Employed app, tap the + button and pick Ask QB Assistant.

- Enter Talk to a Human, then tick Continue.

- Choose which way you want to connect with us.

- Have us call you - Get a call from a support expert.

- Chat with us - Start a conversation with a support expert.

See this article for more details: Contact QuickBooks Self-Employed Support. Ensure to review their support hours to know when agents are available.

For more details about managing 1099s in QBSE, check out this article: Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

Moreover, you can also refer to this article for further guidance in filing taxes through QBSE: QuickBooks Self-Employed Annual Tax Guide.

Feel free to leave a comment below if you need further assistance with accessing your 1099 forms or have inquiries about managing your QBSE account. It's my pleasure to assist you. Have a great day ahead!