Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- Re: vehicle purchase

- :

- Reply to message

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Hi there, Jennalyn G. Let me share some information about tracking asset depreciation in QuickBooks Online.

Your QuickBooks Online account doesn't necessarily need an upgrade. We also haven't made any enhancements or changes to this feature, so you should be able to track an asset's depreciation.

For the option to show, we simply need to switch from Accountant view to Business view before creating an asset account.

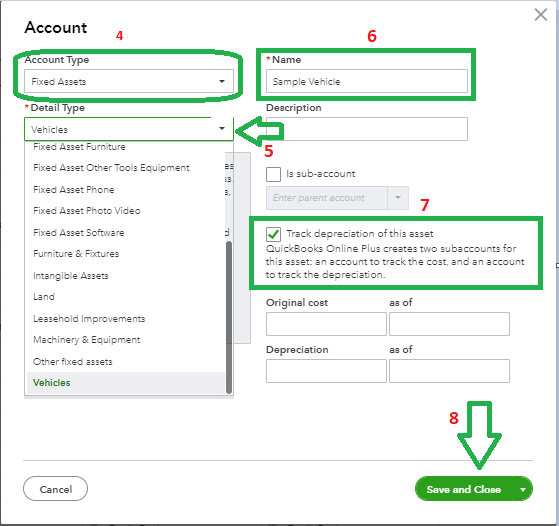

After switching to Business view, you can delete and recreate the vehicle's account be sure the Account Type you select is Fixed Asset, and choose the appropriate Detail Type. I'll show you how:

- Go to the Gear icon at the upper right.

- Under Your Company, choose Chart of Accounts.

- At the top right, hit New.

- In the Account Type, select Fixed Asset.

- Choose the Detail Type that best describes the asset.

- Name the account.

- Mark the Track depreciation of this asset box, then the system will automatically create a Depreciation sub-account for the item.

- Fill in the original cost fields.

- Once done, hit Save and Close.

I've added this article for more information: Set up an asset account in QuickBooks Online.

To understand more about the chart of accounts in QuickBooks Online, use this link as a reference: Learn about the chart of accounts in QuickBooks Online.

Feel free to get back to this thread if you still need help with anything or have other concerns about managing your accounts. I'll be here to assist. Have a wonderful day!