Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhere would in place the purchase of a piece of equipment ($750) in QuickBoo?

Solved! Go to Solution.

Hi there, @Iniuan22.

I'd like to Welcome you to the Community family. Allow me to share some information on where you can place the purchase of a piece of equipment in QuickBooks Online.

Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased.

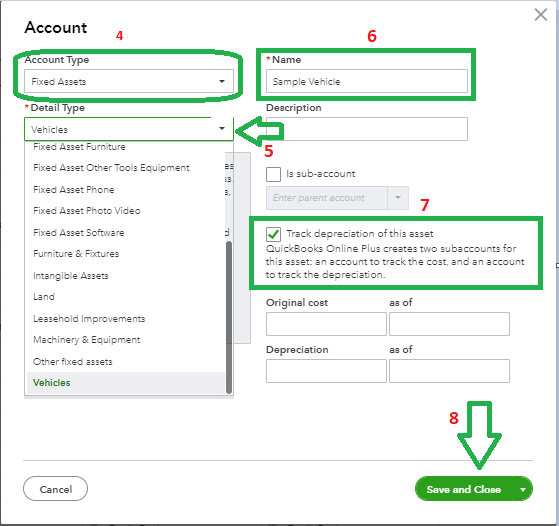

To set up an asset, please follow these steps:

For more information about this process, please refer to this article: How do I set up an asset?

However, if you are unsure on which option to choose, I'd suggest consulting your accountant for assistance. This is to ensure that your books are accurate.

| You can also get one-on-one help for your business: Check out QuickBooks Live. |

This should keep you moving today, @Iniuan22. Please don't hesitate to post any questions that you may have. Cheers to a productive and prosperous day.

Hi there, @Iniuan22.

I'd like to Welcome you to the Community family. Allow me to share some information on where you can place the purchase of a piece of equipment in QuickBooks Online.

Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased.

To set up an asset, please follow these steps:

For more information about this process, please refer to this article: How do I set up an asset?

However, if you are unsure on which option to choose, I'd suggest consulting your accountant for assistance. This is to ensure that your books are accurate.

| You can also get one-on-one help for your business: Check out QuickBooks Live. |

This should keep you moving today, @Iniuan22. Please don't hesitate to post any questions that you may have. Cheers to a productive and prosperous day.

The IRS has a $2,500 rule. If it's less than that you can expense it, to something like "Small Equipment Expenses". But you may want to record it as a fixed asset in your books for control purposes, and then include it in the book to tax profit reconciliation

its 6. Name the account where it gets confusing. Do we have to name that 'machinery' or can it be Apple Mac computer - I did this and now I have two accounts one for the computer then another machinery. Asked before but answers tend to be confusing for the newbie.

its number 6. 'name the amount' which gets confusing. name it Apple Mac computer or just 'machinery; I did this and then I get 2 lines in the accounts list one for the computer and one for machinery. Is this right? I have asked before but answers tend to be confusing for a newbie. 'Name it' isn't specific. Then how do I itemise this asset purchase in QB?

Hello there, @garry clarkson.

I can get it sorted out by providing some additional insights. When creating accounts in QuickBooks Online, you can choose the preferred name showing for your purchases in the Chart of Accounts.

To itemize your asset purchases into greater detail, I suggest breaking them down through sub-accounts. That way, they'll be organized accordingly in the system and will be more detailed on the financial reports.

The steps below will guide you on how to edit and add a sub-account to the existing parent:

Check out this additional screenshot for your visual reference of the result:

Also, here are some helpful references that you can check out about using QuickBooks Online:

Drop me a comment below if you have any other questions. I'll be more than happy to help. Wishing you a good one.

Cheers! I think its just the terminology and the idea that its flexible - too much flexibility can confuse :) I guess could be 'equipment' instead of machinery as we don't manufacture anything. Its a service industry producing videos and images. This kind of itemisation is what I was looking for. Could I then put the computer and the hard drive and scanners etc in separate names all in the sub account of computers?

I'm so happy to hear that my colleague resolved your concern, @garry clarkson.

Terminologies may be different in QuickBooks Online yet imply the same function. Yes, you can put the computer, hard drive, scanners, keyboard, etc. in separate names all in the sub-account of computers.

That way, the items can be categorized specifically to the right account.

I'll add this article as your guide in reconciling your account, so they match your bank and credit card statements: Reconcile an account in QuickBooks Online.

Please feel free to leave a message to this post if you need further assistance. The Community is always here to help. Take care, as always!

I have heavy equipment that I want to keep track of maintenance expenses for, but not quite sure where I should put this in QB. Basically if I have a loader that needs repairs or parts I want to be able to have a running total of these expenses and be able to scan the invoices in and have it all in one location. Am I able to do that?

Hi there, rosmith0669.

Thanks for stopping by this afternoon, while I'm not able to tell you exactly how to categorize your items and expenses I can show you how to add, edit and delete them. as well as provide you with an article you can use to help differentiate between bills, checks and expense.

Create an expense

Before you Save and close, you have some options to consider that could help track the expense:

You can find these steps as well as a tutorial video at the following link: Enter, Edit or Delete expenses.

For assistance on figuring out how to categorize items, refer to this article: What is the difference between bills, checks, and expenses?

If there's anything else I can help with, feel free to post down below, thank you for your time and have a nice afternoon.

Hello, i am trying to add the fixed assets account, but unfortunately, there is not that option on my chart of accounts, what can i do?

I can walk you through creating an account, andresrpo2.

I'd like to verify which QuickBooks subscription you have so I can provide the correct steps in creating an account. We can only create accounts in QuickBooks Online and Desktop versions.

Create an asset account in QuickBooks Online

QuickBooks Desktop

For more details on handling your Chart of accounts, you can use this link: Learn about the chart of accounts in QuickBooks.

Let me know if you have other questions. Take care and have a great day!

BettyJane,

After entering a piece of equipment as a fixed asset, how do we include charging, or rather accounting, for its use to the customer. E.g., we have a chainsaw, and we charge $100/day for it, but don't want that as a line item in estimates or invoices.

Additionally, when we pay to have it services, how do we list that cost in our expenses?

Thank you,

Donna

I have a same question. Can anyone help on this matter?

I have same question. Can anyone help on this matter?

Thanks for joining us on this thread, Dee09.

If you don't want to add the charge to the estimates or invoices, you can directly enter the amount into the account type you've recorded the equipment.

Here's how:

I'd also recommend consulting an accountant to guide you with the process. If you don't have one, you can use our Find-an-Accountant tool to look for an expert near you.

In case you need to calculate your asset's depreciation, I'd suggest checking out to learn more about the process:

Please let me know if you have other questions about managing your assets. I’m determined to answer them for you. Have a great day!

I had a quick question. I have a created a power, plant and equipment account for for my client. This is his second year. Do I need to cero out the first year power, plant and equipment amount? or do I leave it like that so it it accumulates over the years?

We purchased a vehicle for $18000. I added a new account with the vehicle name but I do not have the option Track depreciation of this asset box. This would be very helpful to have. Is this an upgrade to QBO?

Hi there, Jennalyn G. Let me share some information about tracking asset depreciation in QuickBooks Online.

Your QuickBooks Online account doesn't necessarily need an upgrade. We also haven't made any enhancements or changes to this feature, so you should be able to track an asset's depreciation.

For the option to show, we simply need to switch from Accountant view to Business view before creating an asset account.

After switching to Business view, you can delete and recreate the vehicle's account be sure the Account Type you select is Fixed Asset, and choose the appropriate Detail Type. I'll show you how:

I've added this article for more information: Set up an asset account in QuickBooks Online.

To understand more about the chart of accounts in QuickBooks Online, use this link as a reference: Learn about the chart of accounts in QuickBooks Online.

Feel free to get back to this thread if you still need help with anything or have other concerns about managing your accounts. I'll be here to assist. Have a wonderful day!

How can we fix the problem if we forgot to mark Track depreciation of this asset box?

Hi there, Khhh. QuickBooks Online (QBO) has a new layout for creating or editing accounts. Let me share some insights on how to fix this problem.

If you can still see the old interface, you can mark the Create a category to keep track of depreciation box. If not, you’ll need to inactivate the account and recreate a new one. To track depreciation, select Accumulated Depreciation from the Detail type drop-down list.

Before making the account inactive, the account should have a zero balance, it's not one of the default accounts used in the Chart of accounts, and it's not being used in an automated workflow.

Here's how to make the account inactive:

After deactivating, you can recreate the account and mark the Create a category to keep track of depreciation box. For the new interface, select Accumulated Depreciation from the Detail type drop-down list.

Furthermore, if you want to keep your accounts organized and easily accessible, refer to this article for more guidance: Use account numbers in your chart of accounts in QuickBooks Online.

Finally, if you need help managing your accounts, our QuickBooks Live Expert Assisted service is available to provide guidance. They can share knowledge on how to maximize the potential of your accounts.

Please feel free to return to this thread if you need more help about managing your accounts. I'm always here to assist you.

I purchased a generator and I'm not sure where to put it under. We use it for our sewing machine back up and for equipment outside and camera installs when know electric offered.

You can set it up as fixed assets and put it under Machinery & Equipment as the detail type, @bus PARTS. Below, I'll explain why and guide you through it.

To start, the generator can be recorded as fixed assets specific to machinery/equipment because these items can't be immediately classified as expenses upon purchase. It's also important to checkmark the category to monitor depreciation, allowing you to keep track of the expenses and the equipment's original cost. For more precise guidance, consider consulting your accountant for more accurate information.

Here's how to set it up:

For more detailed information, you can check this article: Add an account to your chart of accounts in QBO.

After setting up your assets, you can review this article to learn how to record their depreciation, as QuickBooks Online doesn't automatically depreciate fixed assets: Depreciate assets in QBO.

Moreover, you can refer to this article for a financial snapshot of your company as of a specific date, which includes information on your business's worth, liabilities, and assets. Run a Balance Sheet report in QBO.

Furthermore, have you had the opportunity to learn about our QuickBooks Live Expert Assisted team? They specialize in streamlining transaction sorting and financial management. I highly recommend looking into their services, as they could significantly enhance your accounting process!

Please know you can rely on the Community team for assistance in setting up your purchased generator in QuickBooks. We're here to support you and are eager to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here