Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- Re: Working with Gift Cards and Sales Receipts

- :

- Reply to message

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

Yes, you can, @Prespares.

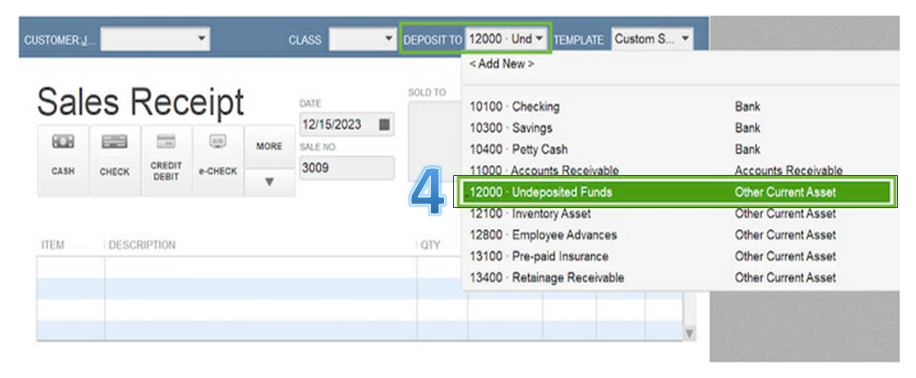

You'll have to put the sales receipt into the Undeposited Funds account. This account holds the transaction before you record a deposit. It will automatically appear in the Bank Deposit window. This helps you match the operating expenses back to the income on the transaction. Let me guide you how.

- Go to Customers from the top menu.

- Select the customer's name.

- Find the sales receipt you just created.

- From the Deposit to drop-down, select Undeposited Funds.

- Enter any necessary changes.

- Click Save & Close.

The screenshot below shows you the fourth step.

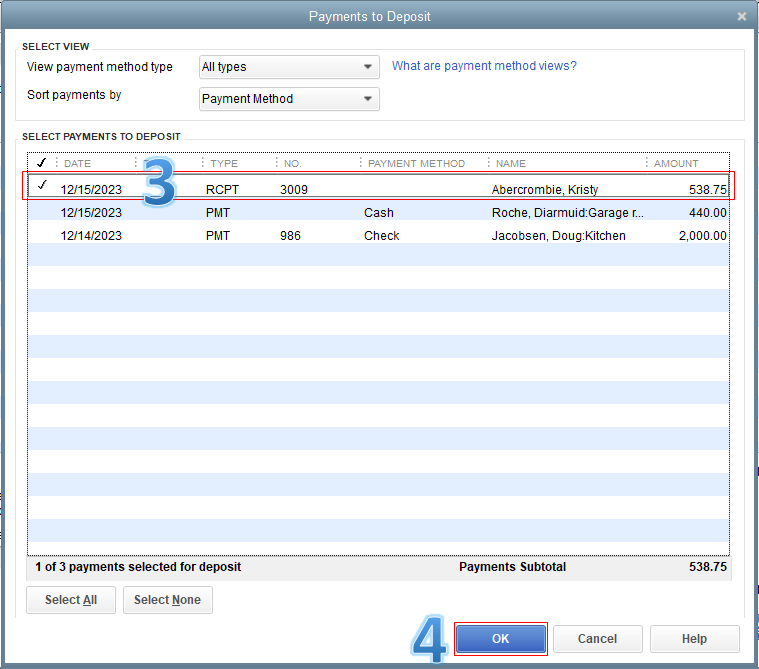

To create a bank deposit:

- Go to Banking from the top menu.

- Select Make Deposits.

- In the Payments to Deposit window, choose the sales receipt.

- Click OK.

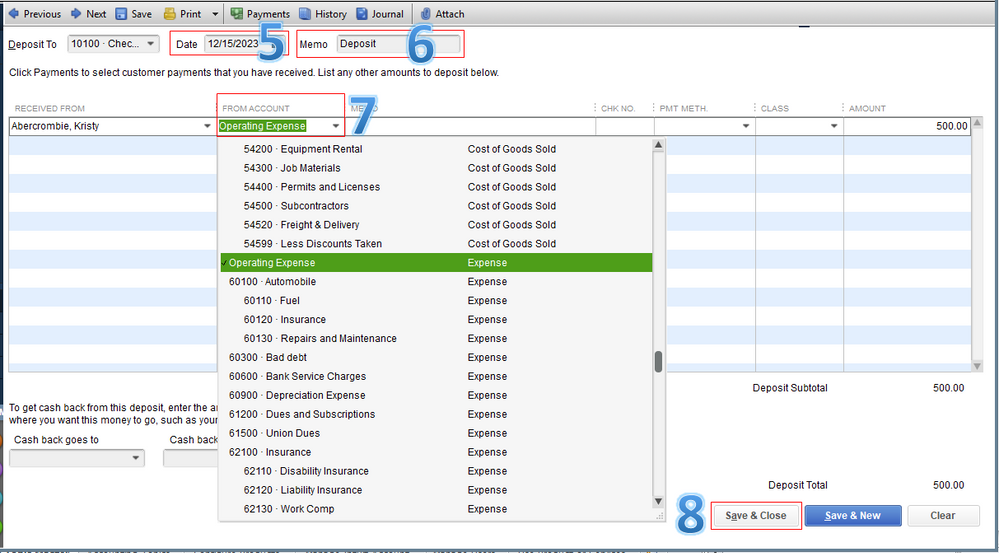

- Enter the date for the deposit.

- Add a memo as needed.

- In the From Account drop-down menu, select the Operating Expenses account.

- Click Save & Close.

The screenshot below shows you the last six steps.

You can visit this article: Deposit Payments. It covers all the steps from putting the transactions into the Undeposited Funds account, making a deposit, and running the QuickReport: Undeposited Funds.

If you're on a cash basis when running your financial reports, a sales receipt is one of the most important money in transactions. However, if you're on an accrual accounting method, you can use Accounts Receivable (A/R) workflow in the program. To learn more about its different workflows, see this article: Manage A/R transactions.

I'm here anytime you have other concerns. Have a great day, @Prespares.