Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

Reply to message

Replying to:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reply to message

It's nice to have you in the Community, @Sonny G.

That's a good question! I can absolutely help create a commission check with fees deducted on it.

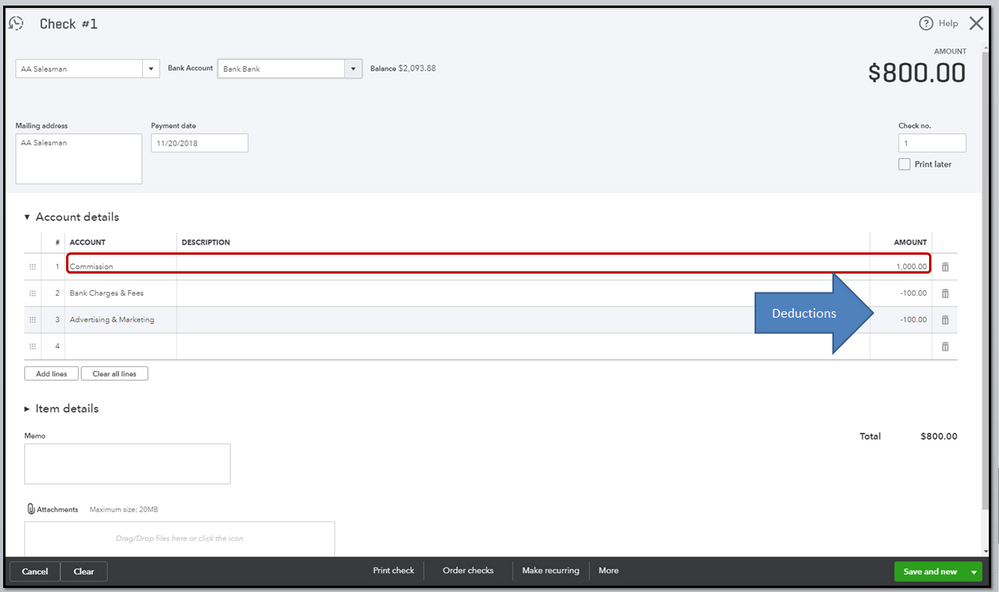

First, I would like to know how these Real Estate agents are entered in QuickBooks Online? If you recorded them as vendors, you can write a check for the commission amounts, then enter those fees in negative. Make sure to set up a commission expense account in QuickBooks Online prior to creating the checks.

To create a Commission Expense account:

- Go to the Gear icon, then choose Chart of Accounts.

- Click New. From the Account Type field select Expenses.

- Pick the appropriate Detail Type.

- Enter a relevant name, such as Commission.

- Click Save and Close.

To create a check:

- Go to the Create button (Plus icon), then pick Checks.

- Enter the real estate agent's details.

- In the Account column, choose Commission and enter the appropriate amount.

- From the second line item, select the fee you need to deduct, then enter the amount as a negative sign.

- Click Save and Close (see screenshot 1).

However, if you've tracked them as an employee in QuickBooks Online, you can create a deduction item for the fees to deduct. Then, run a Commission Only paycheck.

To create a deduction item:

- Go to Workers in the left panel, then choose Employees.

- Choose the Real Estate Agent you want to edit, then click the Pay pencil icon.

- Scroll down to number 4, then click the Add a new deduction link.

- Choose New Deduction from the Deduction/contribution drop-down.

- Select Other deductions in the Deduction/contribution type.

- Choose an appropriate type.

- Enter an amount or percentage per pay period.

- Click Ok.

To create a Commission Only paycheck:

- Go to Workers in the left panel, then choose Employees.

- Click the Run payroll drop-down arrow, and select Commission only.

- Select the checkbox next to the real estate agent to include in this payroll.

- Enter the commission amount for each.

- Write in the Pay date.

- Choose the pencil icon next to Payroll options, select the one you want and click Apply.

- Pick Preview payroll, and then click Submit payroll.

Here are articles to give you the detailed steps:

I'd also recommend consulting with your accountant before you do the process.

You should now be able to give those commission checks to your real estate agents with the appropriate amount.

If you need more help with this or if you're referring to something different, please let me know by leaving a reply below.