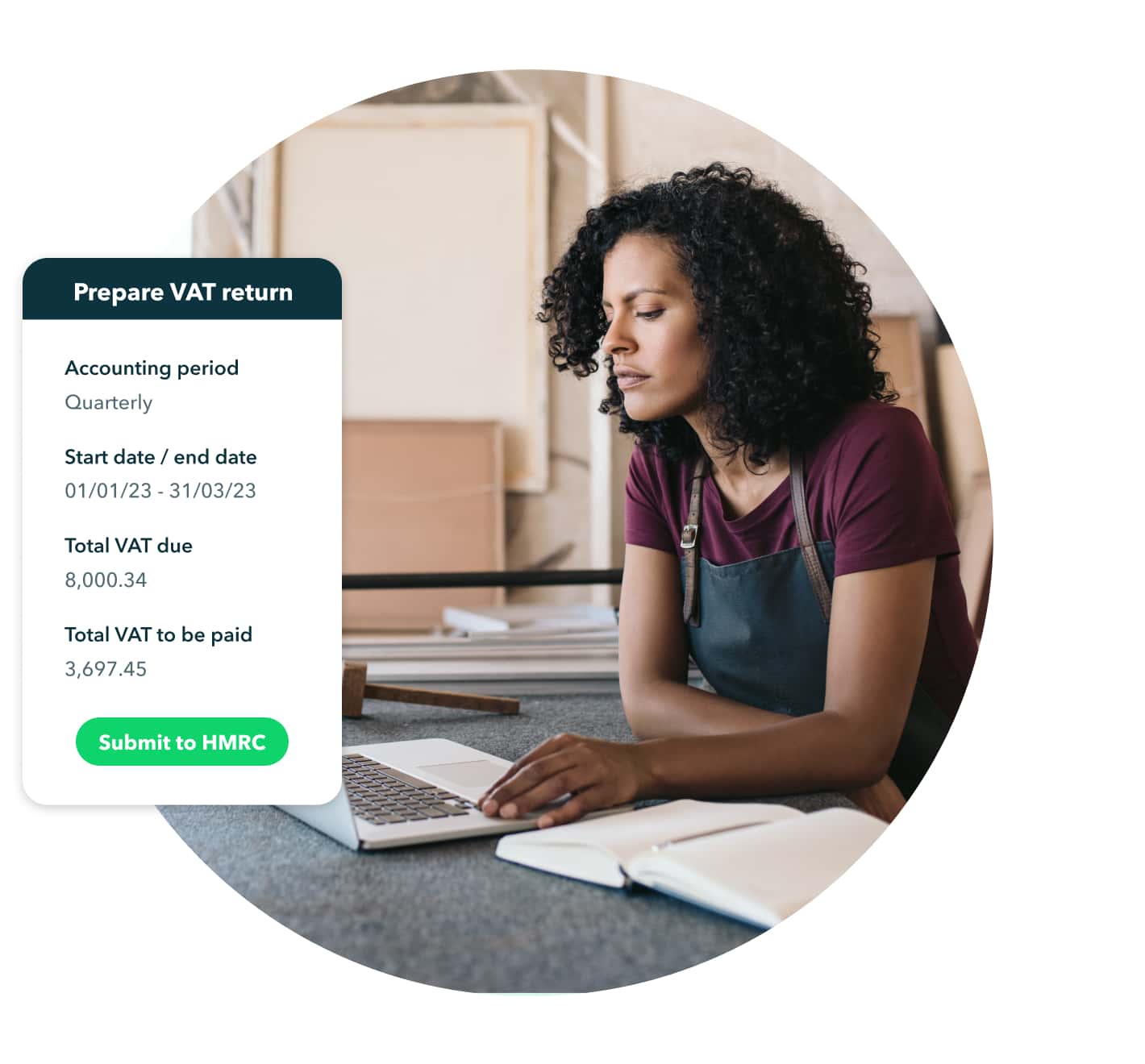

Both full-time and growing content creators need to register as self-employed with HMRC. If you’re making money as a content creator, you need to pay tax on the income you’ve earned.

The amount you’ll need to pay will depend on how much your income is and how much of the tax-free Personal Allowance you may have. The starting point is £12,570 (as per the 2022/23 tax year) but will depend on many factors personal to your circumstances.

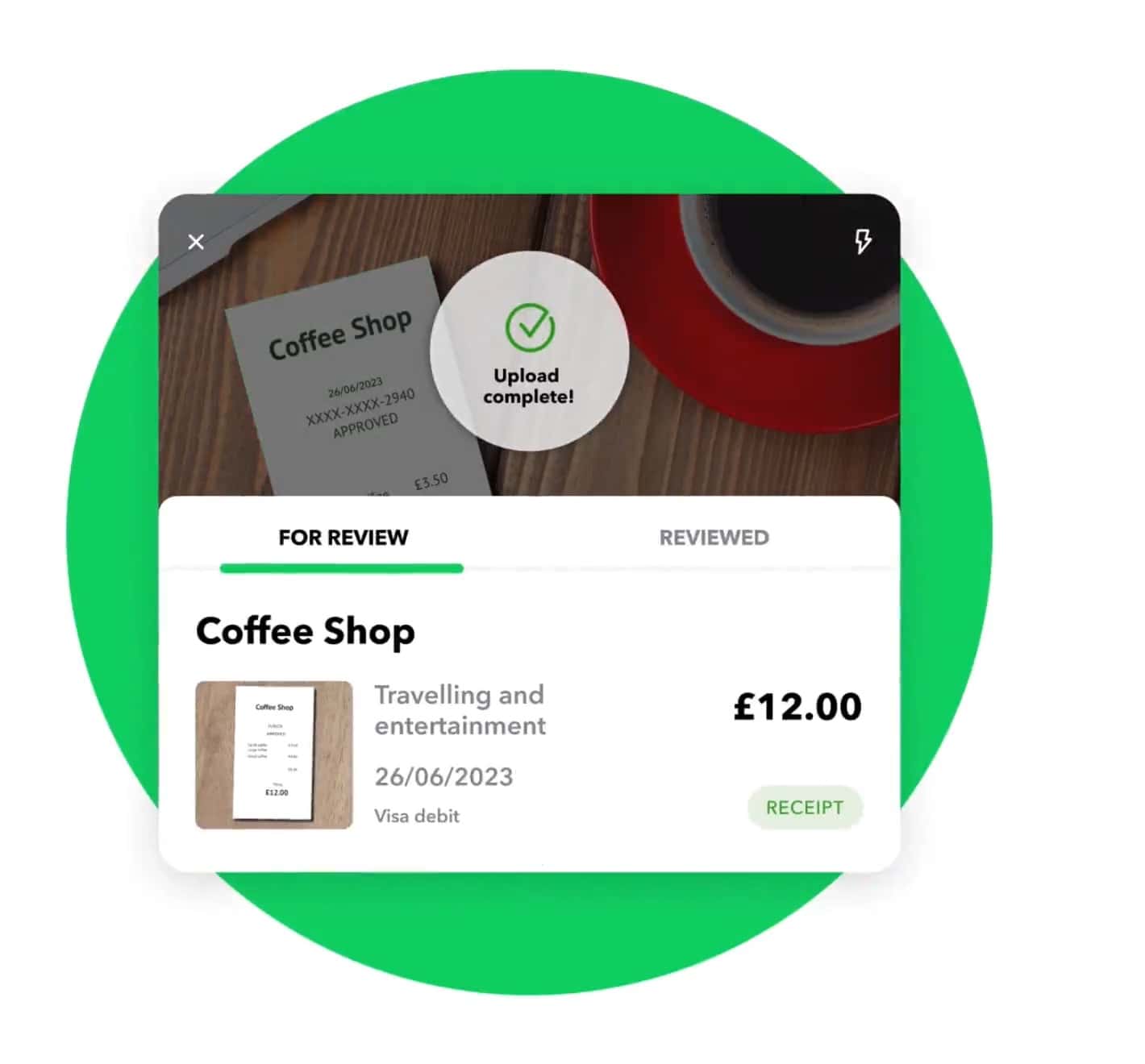

As a content creator, you can also claim certain expenses for your daily work. This will help to reduce your taxable income, leaving you with a lower annual tax bill.

You may be able to claim expenses against things like:

- Equipment (cameras, computers, phones etc)

- Non-gifted products that you bought to review

- Travel expenses, including mileage

- Phone & broadband bills

- Website expenditures

- Marketing costs

- Related training/courses

- Subscriptions (stock photographs, premium apps etc)

You may also be eligible for income tax relief, depending on your circumstances.

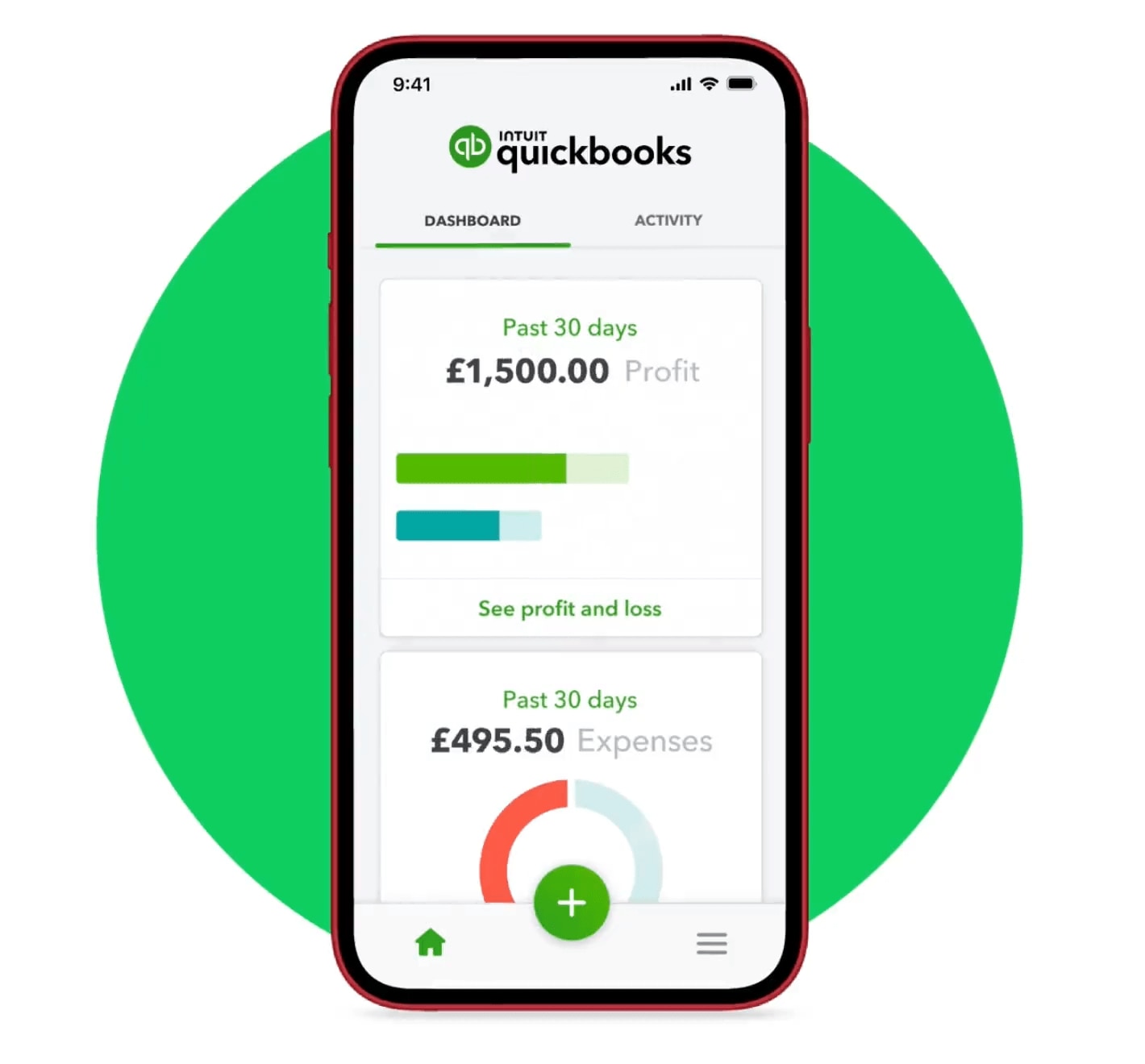

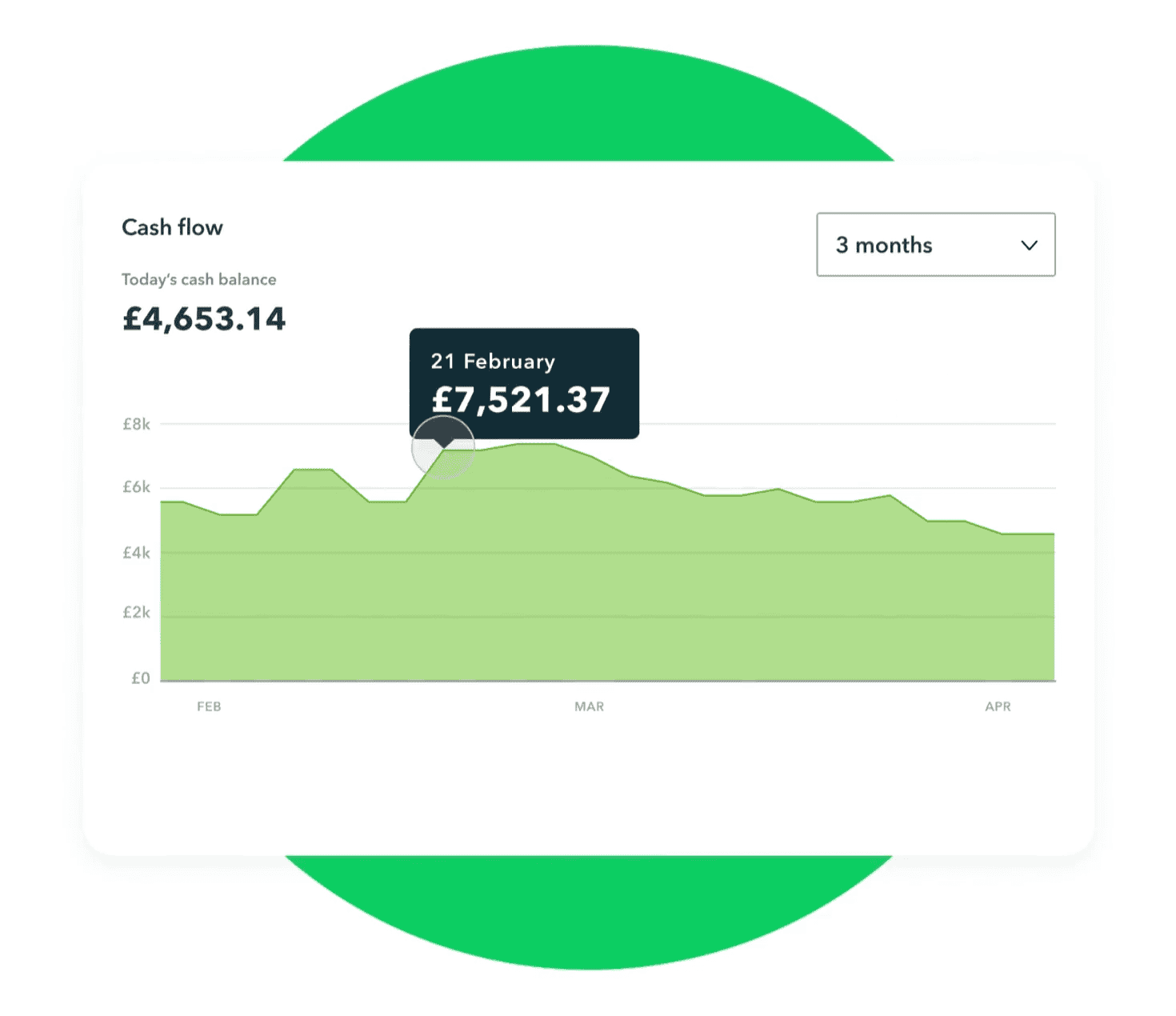

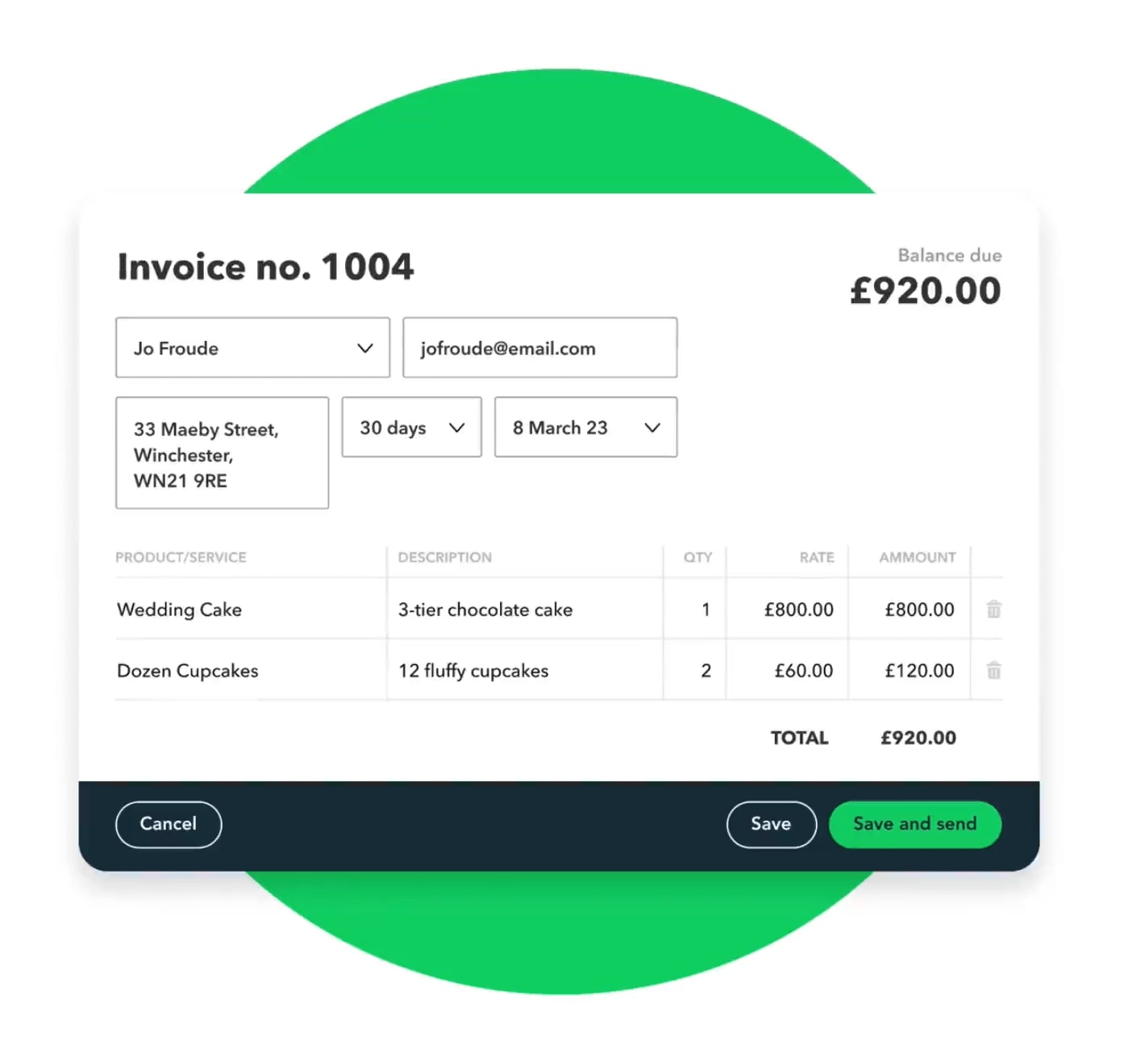

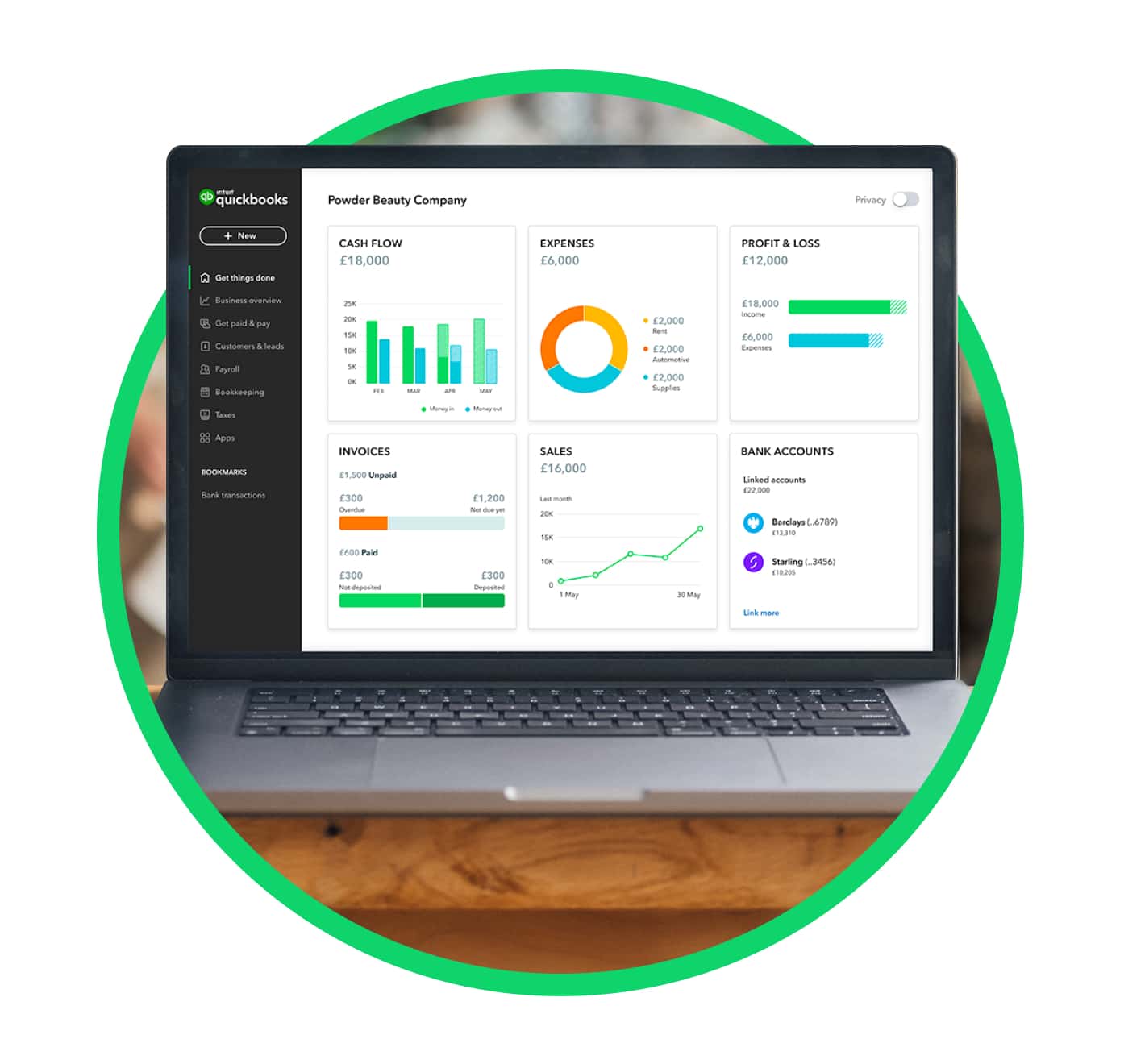

See how QuickBooks’ simple, smart accounting software can help you take control of your business finances.