Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowMy sales tax liability report is showing the wrong amount. I click "Adjust" and jump through the hoops, but when I return to the Pay Sales Tax window, the incorrect amount still appears. I've gone ahead and completed the transaction but the adjustment is not reflected in the payment amount as shown in the check register.

Solved! Go to Solution.

Solved! I was erroneously assigning my Sales Tax Payable (a current liability account) as the adjustment account. It requires an expense account so I created a Sales Tax Adjustment expense account. All is right with the world :)

Solved! I was erroneously assigning my Sales Tax Payable (a current liability account) as the adjustment account. It requires an expense account so I created a Sales Tax Adjustment expense account. All is right with the world :)

I have the same questions! I am hoping someone on here has an answer?

Hi there, kpeterson.

Thank you for reaching out to the Community.

I've tried adjusting the sales tax on my end, and it changed the "Pay Sales Tax" totals. In your case, since you're experiencing unexpected QuickBooks behavior, I recommend giving our phone support a call.

Checking the root cause of this requires tools, like screen sharing, that only the phone support team has and they can also create an investigation ticket if there are other customers experiencing the same thing.

Let me know the result or how the call goes, kpeterson. I want to make sure this is taken care of. Have a good one.

I am having the same problem when I try to reduce the amount of sales tax. When I increase the amount, there is no problem.

What specific error/problem are you getting, DukeHoopFan?

If you're looking to decrease the sales tax amount, you'll want use a Credit Memo. Here's how:

To adjust your sales tax due, you can choose the Reduce Sales Tax By radio button on the Sales Tax Adjustment screen.

The details about sales tax adjustment are found in this article: Process sales tax adjustment.

Let me know if you have more questions. I'd be glad to help you some more.

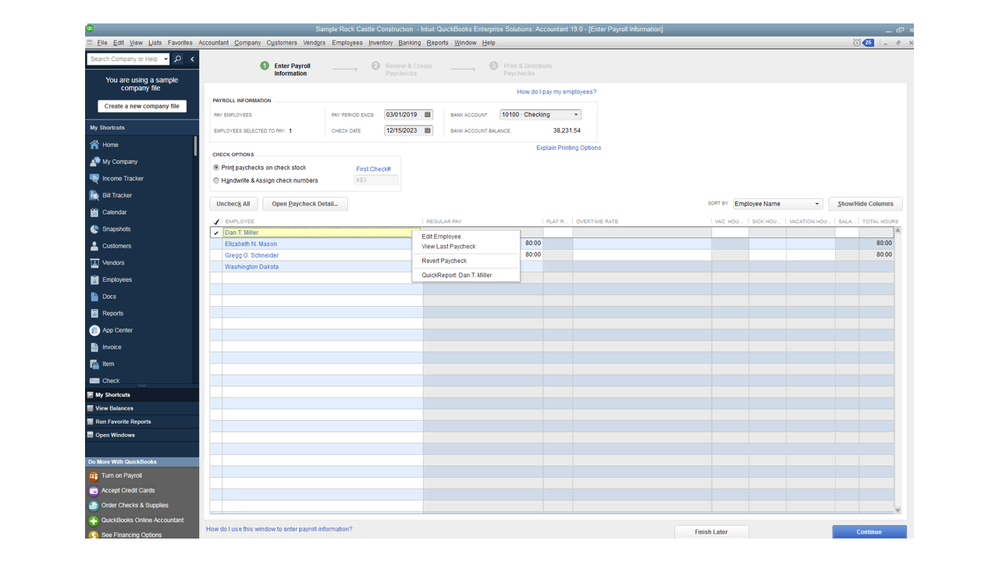

it's ot taking taxes out of the payroll

Thanks for joining this thread, nutek2010.

Allow me to chime in and help ensure taxes are calculated on your payroll.

To get around the issue, we’ll perform some basic troubleshooting steps. First, download the latest payroll tax table.

These updates will provide the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms and e-file and payment options. Next, refresh the paycheck information by reverting it.

The process is a breeze and I’ll guide you how.

You’ll have to perform the same process for each paycheck. Once done, open it to see if taxes are taking out.

For more in-depth troubleshooting steps, check out the QuickBooks Desktop calculates wages and/or payroll taxes incorrectly article.

These steps should help you get back to business in no time.

Let me know if you get the chance to try all these suggestions and what the results are. I'll be right here with you.

I have a similar question. In using the Pay Tax link, I have entered tax payments. When I make adjustments for the discounts for early payment that my state offers, it does show the correct amount to be paid in that window. However, when I check the bank register, it is showing the original amount instead of the adjusted amount. It also shows a payment in the amount of the adjustment in a separate line item, therefore making the amount deducted from the bank register incorrect. There is also an instance where it shows the tax payment as a deposit instead of a payment. I have double checked the entries and they are correct in the Pay Tax link, clicked on reduce the tax payment, etc. Any suggestions on how to correct this and what would have caused a tax payment to post as a deposit?

Thank you for posting here in the Community, @athensmobileattic,

Let me share some tips to correct your sales adjustment and payment.

First, let's check if the previous adjustment and payment are correct by deleting and recreating it.

Once you're able to remove all the entries, try to recreate them using these steps:

You may refer to this article for detailed information about processing tax adjustments: Process sales tax adjustment

Next, pay your sales tax again. Here's how:

Let me know the result once you've tried the steps or if you require additional help with this process. I'd be more than willing to lend you a hand anytime. Have a good one!

did you every get this to work correctly?

we are having the SAME problem, dated back to our March, 2020 tax payment.

When you "Pay Sales Tax" and try to make an adjustment or use the credits listed, the check register does not show the discounted amount... thus the check register is off. I have done this many times before, (we have been using quickbooks since 2004) and never have this happened till March 2020.

We want this fixed for you, BurlingtonTruck.

You can try the recommended steps provided by my colleagues.

If you're still encountering the same issue, though, I'd suggest reaching out to our customer care support. An agent has more tools the help you. Here's how:

Don't hesitate to get back to us if you have other concerns. You're always welcome to post in the Community.

I realize that this is an old post, but I'm trying everything I can. I'm having the same issue with sales tax. The journal entry is there, but it doesn't show up when I pay the sales tax. Support was of absolutely no help.

Hi there, pwstill,

Thank you for visiting the QuickBooks Community. I'll be sharing details on how sales tax adjustments work in QuickBooks Desktop. Then, ensure you'll be able to pay your sales tax without any issues.

QuickBooks Desktop helps you keep an accurate record of taxes so you can easily monitor and remit them to the appropriate tax collecting agency. That said, when adjusting a sales tax in QuickBooks, you'll have options to make a positive and negative one. I suggest creating a sales receipt or a credit memo for updating the tax amount. With this, a journal entry isn't necessary for doing adjustments and that's the reason it doesn't show up when you pay the sales tax.

Then, to see further details on how paying taxes works in QuickBooks, you can click this article: Pay sales tax.

Lastly, you may refer to this article to view different troubleshooting steps to resolve unexpected results you may encounter while managing your sales tax in QuickBooks Desktop: How to resolve common sales tax issues.

Keep me posted for additional questions about sales tax or other concerns related to QBDT. I'd be more than happy to help. Wishing you the best of luck.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.