Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I can definitely help you in resubmitting your tax payments, baylorplumbing.

If an e-payment is rejected, the rejected status will be recorded in the E-payment History window and in the audit trail for e-payment. We can resubmit it through the E-payment History window. It would only take a few steps to do this.

Here's how:

I've included articles that will help you handle rejected e-payments and e-filed form in QuickBooks Desktop:

If you have other concerns or further questions, please leave a comment below. I'll get back to you as soon as I can.

I'll help with your payroll question so you can resend the tax payment, CC24.

First, let's void the liability check so it'll go back to the Pay Liabilities section. Follow these steps on to do it:

Second, go back to the Pay Liabilities tab and look for the liability. Resend the tax payment and make sure to manually enter the new password and pin.

After re sending the payment, we'll send you an email notification about the status of the submission. You can follow the steps in this article on how to check if it's already accepted by the EFTPS: Check E-file Or E-pay Status.

We're just a post away if you need more help with payroll, specially when processing your year-end tasks.

Dear QB, my password changed created a rejection code in QB, however the payment actually cleared the EFTPS and is shown as paid. How can I reconcile this situation in QB? So far, the only thing I can do to eliminate a overdue notice in QB, is make a "fake" payment to Treasury in QB, and then not clear the check. I have proof of funds transferring to US Treasury after the rejection code. Jeff

Thanks for joining this thread, kingdawg.

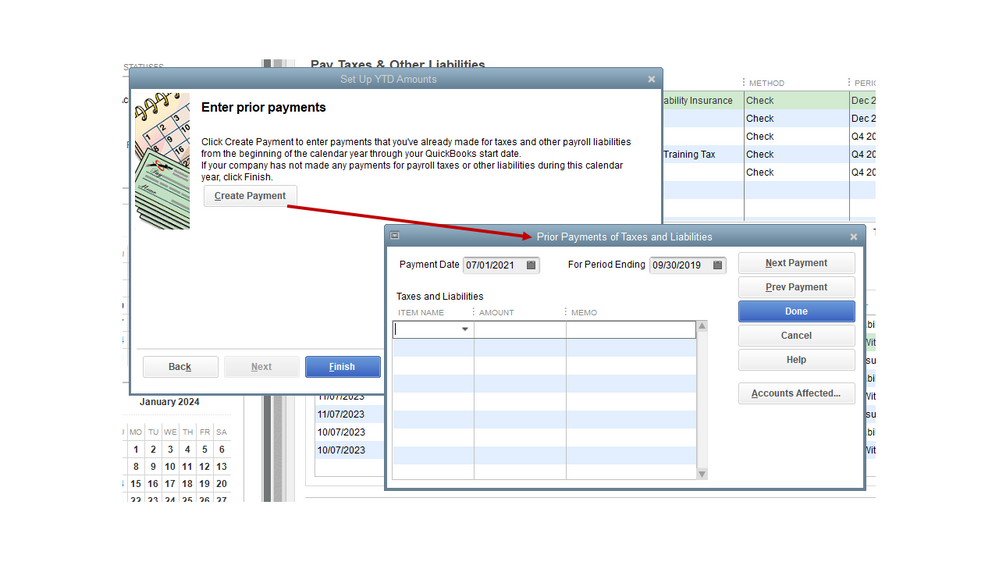

I’ll help make sure you can get past the overdue error in the Pay Liabilities screen. Let’s manually record the tax payments using the backdoor process.

Here’s how:

After completing these steps, the overdue notice will no longer show in QuickBooks.

You can read through this write-up for more insights into the process. It includes screenshots for visual reference and instructions on how to track historical payment via the Payroll Setup window: Enter historical tax payments in Desktop payroll.

For tips on how to handle tax payments rejection issues, see the following articles:

Feel free to visit the Community if you have more questions about QuickBooks. I'd be glad to hear more from you in the comment section. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here