Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGlad to have you here in the Community, @lynn23.

Currently, QuickBooks only allows you to set terms for the discount date before the specific day of the month.

I can see how beneficial it is for you and your company to set terms for the discount date before the day of the following month. But I want to let you know that your voice matters and I'm submitting feedback directly to our product engineers for consideration.

For now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

You can also read through this article to know more about setting up terms in QuickBooks Desktop: Set up payment terms.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day.

Explore the invoicing feature in this 3rd party app. You may find something useful. Unfortunately it only supports QBO. Consider an importer tool should you need to import the data in bulk to your QBD.

http://get.practiceignition.com/quickbooks

Hope it helps.

hi... the discount was well within the date it was taken.

I have the same question. We have a vendor that has all bills due by the 25th of the following month, and discount can be taken if paid within 10 days of following month. If the invoice date is 4/1/20 the discount date would be on 5/10/20, and due date on 5/25/20. Cannot figure out how to set up!

I'd be glad to show you how to enter the discount on advance bill payment, lmeyers.

You can create an account for the discount and then apply it when you enter the payment against the bill. Let me show you how to do that.

You can also refer to the screenshot I attach.

Also, I added this article for additional reference: Pay bills in QuickBooks Desktop.

Count me in if you need further assistance. I'll be here to help. Stay safe.

Customers not vendors I want the invoice to match the discount that was taken so that my books aren't off even though there's a category for discount...can that be done? I want the invoice to reflect the discounted amount.

Thx.

We can set up a discount item, eawarner1.

Yes, we can include the discount in our invoices by creating a Discount item. Let me show you how:

If we've already created an invoice, we can open and add the discount in another line item. The total amount is now with the subtracted discount.

Here's an article that you can refer to when receiving invoice payments.

Feel free to mention me in your reply if you need more help. Take care always!

Is there away to set up vendor terms for Net 60 10th Prox? I have tried everything I can think of. Please advise.

Yes, there is a way to set up vendor terms for 10 Net 60, @cagrimes.

It's just a few clicks to set this up. Let me show you how.

You can also emplace a default term on a specific vendor. Here's how:

Let me know in the comment section if you need further assistance. Have a good one.

I have this same need, using QBO! Help!

I'm glad to see you here, @TriciaGr.

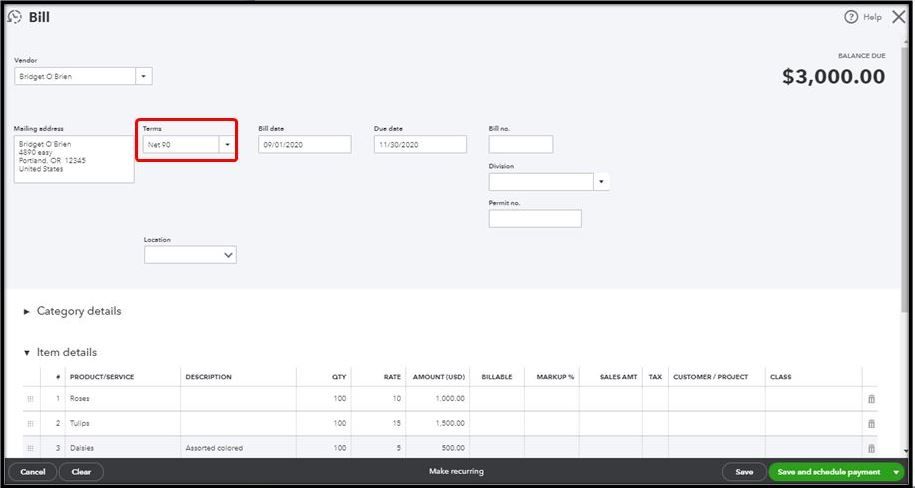

You can assign one type of payment term when creating a vendor bill in QBO. Here's how:

For reference, please visit this article: How to Adjust Invoice Payment Terms in QuickBooks Online.

Also, in QuickBooks, accessing a vendor report to view all money you paid is a breeze. For the detailed guide, visit this page: Run a report with vendor totals.

Let me know how this goes and leave a reply below if you need further assistance in setting up payment terms in QBO. I'm always here to help. Take care always.

I also have a need for a 3% 10th Prox Net 30 terms option.

Vendor offers 3% discount if paid by the 10th of the month with Net 30 payment terms. Quickbooks Premier desktop does not offer this payment terms option at this time. If the developers could add this it would be AWESOME!!

@lmeyers have you figured this out by chance? I have the same challenge.

@lmeyers have you had any luck with this? I have the same challenge.

Hi there,

I was just looking into this for a client and found that there is no perfect solution - but I have a better solution that I haven't seen posted yet. This is how I accomplished this for my client:

Assumptions

Each statement contains bills from the 26th of the prior month to the 25th of the current month.

The statement is dated the 25th

Payment terms are 30 days

All of the bills listed on the statement are eligible for a 1% discount if paid by the 10th of the month following the statement date

There is one major restriction to this method, however. The “30” day setting flexes the discount date depending on whether a month has 30 or 31 days. Using this setting, bills dated the 26th of a 31 day month would not meet discount requirements at time of bill pay (i.e. a bill dated 7/26/21 would have a discount date of 8/10 instead of 9/10). There are two solutions to this.

Solutions

Enter all bills dated the 26th as the 27th (easiest solution)

Manually apply a discount in the bill pay screen

This may be a ridiculous question, but it the terms are 1% by 10th, at what point does that roll over? My vendor invoices are not clear and I am not sure how to enter into QB. If I receive an invoice on the 4th of a month is it due by the 10th of same month to receive discount?

I've got you covered, @homebody1.

If you receive an invoice on the 4rth day and it's due on the 10th day of the same month, you can manually calculate the discount and enter it as a negative amount.

Here’s how:

Check out this reference to learn more about payment terms in QuickBooks Desktop: Set up payment terms.

Once everything is good, you can now use the payment term you’ve set up when creating customer invoices and vendor bills in the program.

If you have any other questions or concerns about payments terms. The Community team is always here to assist you. Take care!

Looking at the thread, I wonder if people are trying to ask if there is a discount that can be applied not just toward an item or a term specified but that say if a client pay's the invoice within the terms set that QBO can have a switch on the Receive Payment screen to apply the terms specified to the whole invoice. Same situation when Paying bills.. that if the bill is paid within the discount range it can be applied to those bills being paid versus going into each invoice or bill and adding a discount item, calculating it based on the invoice/bill total, saving it correct the amount due. This would be handy. not just the ability to specify in the terms list or from the client or vendor payment tab which has no ability set the $ or % discount IF paid by Date or Terms. That's what I'd like to know. Is there a way to apply specified terms to an invoice or a bill if the conditions are met.

Hello, Oluther2.

Thank you for taking the time to read the thread. You can set your payment terms to the Date Driven method. This will allow you to enter the day of the month that a payment is required within the due date.

For example: Your invoices are due on the 25th day of the month and you give your customers a 1% discount if they pay before the 10th of the month.

For the date Date Driven terms, follow the step-by-step process in this article and proceed directly to the Date Driven section.

I'm always around to help you with your questions. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here