Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have used a portion of a credit against an invoice that should have been applied to an alternate bill. I am still in the same month so I can delete bill payment, however, will the portion of the credit I used also make itself again available to use on the alternate bill? If not, I can't go into quickbooks to change the credit amount because it was originally entered in November. How do I put that credit amount back on the books to apply to the other invoice? Thanks

Ugh - nevermind - I will have to figure out how to correct with journal entries. Bill was actually paid in December w/ a Jan 19th vendor auto deduct from bank account. Thanks anyway......

Solved! Go to Solution.

I've got your back in handling your bill credits, @Plink.

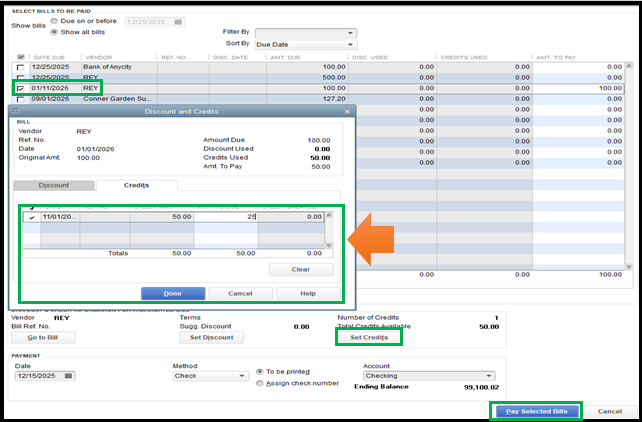

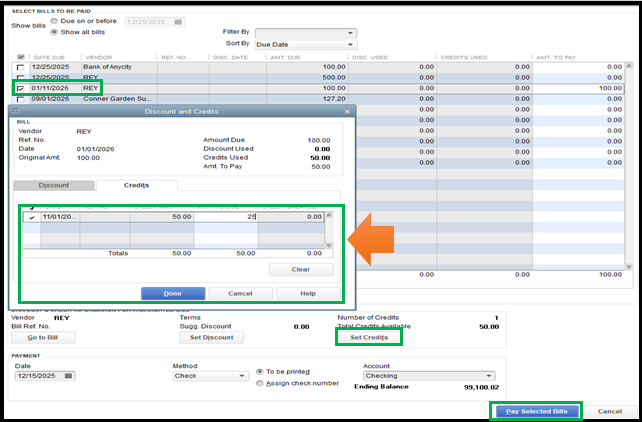

First, you can re-enter the credit amount as you normally would. Then, apply the partial or remaining portion of it (can be dated November) to your bills.

Here's how to do it:

Also, yes, another option is to create a journal entry to clear off those balances. This task can be tricky. Thus, I recommend working with your accountant for further guidance.

If you don't have one, we can help you look for an expert through our Find-an-Accountant tool.

You can refer to this article for more insights: Write off vendor balances.

After that, you can do the normal pay bill process.

Lastly, you can run vendor-related reports to monitor your bills. To do that, go to the Reports menu. Then, select one from the Vendors & Payables section.

Please comment back below if you need a hand with managing your bills or any QuickBooks concerns you may have. I'd be glad to help you some more.

I've got your back in handling your bill credits, @Plink.

First, you can re-enter the credit amount as you normally would. Then, apply the partial or remaining portion of it (can be dated November) to your bills.

Here's how to do it:

Also, yes, another option is to create a journal entry to clear off those balances. This task can be tricky. Thus, I recommend working with your accountant for further guidance.

If you don't have one, we can help you look for an expert through our Find-an-Accountant tool.

You can refer to this article for more insights: Write off vendor balances.

After that, you can do the normal pay bill process.

Lastly, you can run vendor-related reports to monitor your bills. To do that, go to the Reports menu. Then, select one from the Vendors & Payables section.

Please comment back below if you need a hand with managing your bills or any QuickBooks concerns you may have. I'd be glad to help you some more.

Thanks for following up with the Community, Plink.

I'm happy to hear ReyJohn_D's information was helpful and that your credit issue's now fixed.

You'll additionally be able to find many useful resources about using QuickBooks in our help article archives.

Please feel more than welcome to make a post if there's ever any questions. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here