Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

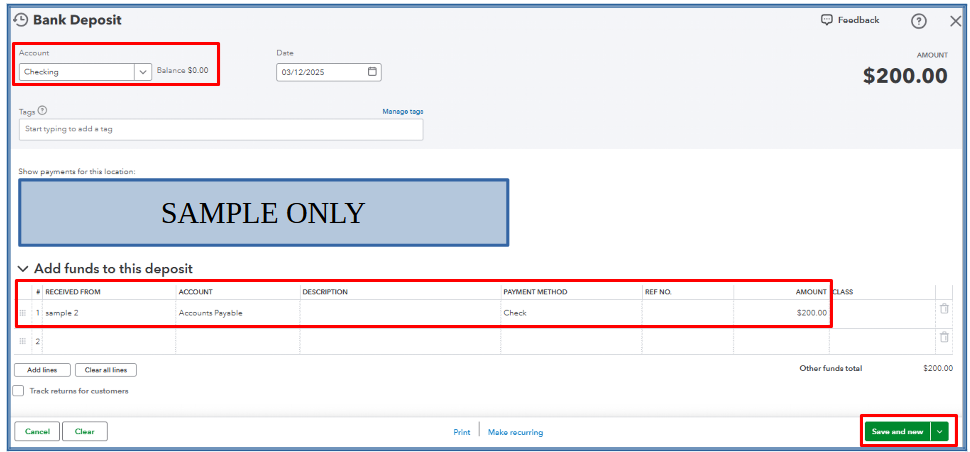

Buy now**Make sure that for step 4 you choose Accounts Payable. You won't be able to tie the deposit to a credit, if you don't choose this account.

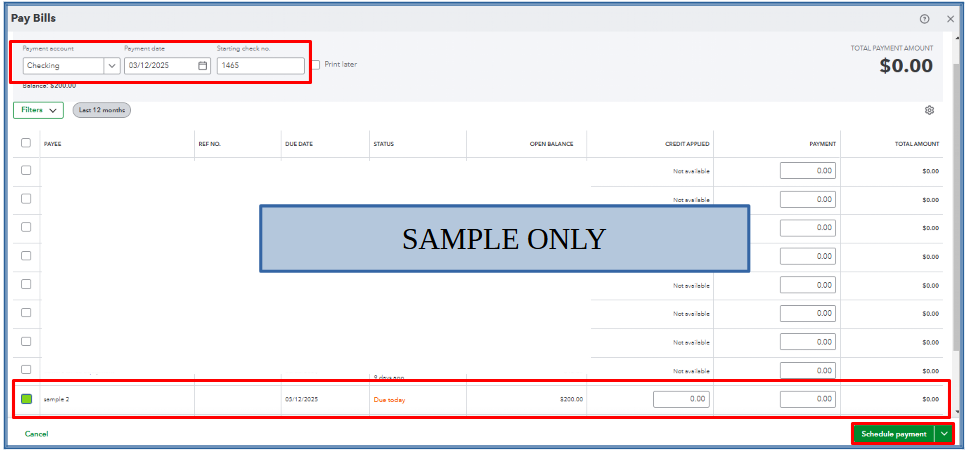

Then Pay Bills if you want to connect the bank deposit to the vendor credit. Even if you're not paying a bill, it's the right thing to take this last step to ensure accurate vendor expenses. I'll show you how:

Welcome to the Community, @pat114. Let me guide you how to enter a vendor credit in QuickBooks Online (QBO).

To start, you'll need to record a vendor credit and ensure it is applied to the expense account. Next, enter a bank deposit from the refund check you'll receive, and connect both transactions using the Pay Bills feature. I'll walk you through the steps.

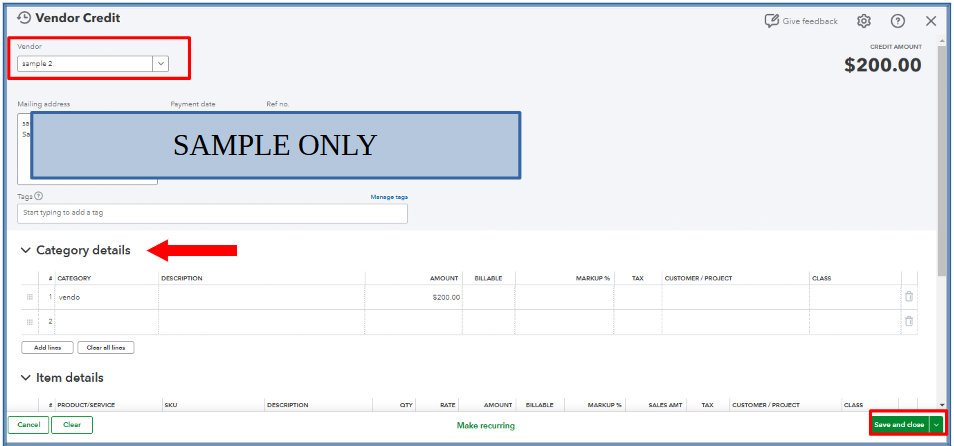

First, let's input a vendor credit by following these steps:

Next, you'll need to record a bank deposit for the refund check:

After recording the bank deposit, you can link it to the vendor credit using the Pay Bills to maintain accurate vendor expenses.

For more detailed guidance on this process, you can refer to this article: Enter vendor credits and refunds in QuickBooks Online.

Additionally, you might can access this article to learn how to view transactions with your vendors in QuickBooks Online: View vendor transactions.

Moreover, we have a great avenue that can help your bookkeeping workflow. You can check our QuickBooks Live Expert Assisted. It's an additional service that will help you keep your business organized.

You can always tap me if you have additional questions about managing your vendor's credit in QBO. Take the best care always and have a wonderful weekend ahead!

I was able to resolve my issue with your reply.

THANK YOU!!! Aloha from Hawai'i and have a great day!!

It's so good to hear that the resolution provided is working on your end, @pat114. We ensure that we'll continue to provide quality service to you, our customers.

With that in mind, don't hesitate to route back here if you have additional questions about managing your vendor transactions or any QuickBooks-related concerns. We'll make sure you'll get the help you need. Keep safe, and have a great day also!

"It's so good to hear that my colleague @ShaniamarieC provided the exact steps you're looking for,"

No, @Just_me provided the exact steps. You should acknowledge the contributions of users that donate their time to this forum, not a QB employee that simply reposted another user's contribution.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here