Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey there, @mthann.

Yes, you can link your Venmo account to QuickBooks Online (QBO). Let me show you how:

Once done, QuickBooks automatically downloads and categorizes bank and credit card transactions for you. All you have to do is approve the work. Here's how to review and categorizing downloaded transactions.

Keep me posted if you need anything else or if you have other banking concerns in QuickBooks. I'll be here to help. Have a great weekend.

Hi Customer, @mthann.

Hope you’re doing great. I wanted to see how everything is going about the Venmo Accountissue you had yesterday. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

How do I link ONLY my Business Venmo?

Right now I have Venmo linked, but Quickbooks is also pulling transactions from my personal venmo account.

I’m here to help you, @Tinyforest.

When you connect your accounts, QuickBooks will automatically download recent transactions, whether personal or business transactions.

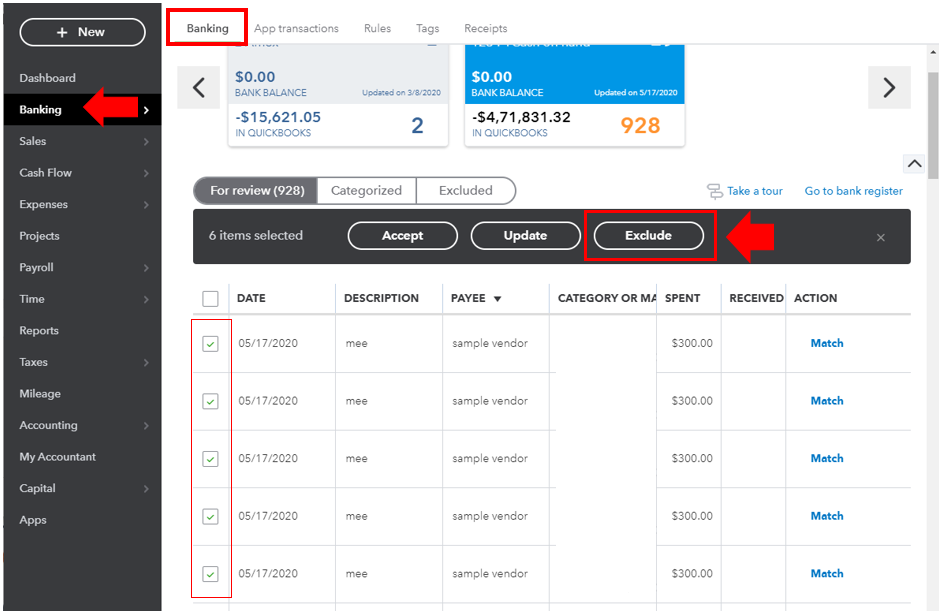

If your Venmo account consists of these types of transactions, you’ll want to exclude those personal entries so only business entries will show.

Here’s how:

The excluded transactions will not appear in any account registers or financial reports.

On the other hand, you can create a separate Venmo account intended for business. This way, QuickBooks will only pull out business transactions.

You can use this information to categorize and match online bank transactions in QuickBooks Online. This helps organize your income and expenses so monthly reconciliation will be accurate.

Don’t hesitate to leave a message if you have other banking questions or concerns. I’ll be here. Always take care!

What about the venmo processing fees? I don't see them on the download. Is there a way to make them also come down into qbo?

Yes, there's a way to download your Venmo processing fee, @sigal4lasi.

Connecting your bank account to QuickBooks Self-Employed (QBSE) automatically downloads your recent transactions. The system looks for a similar transaction you've recorded and categorizes them.

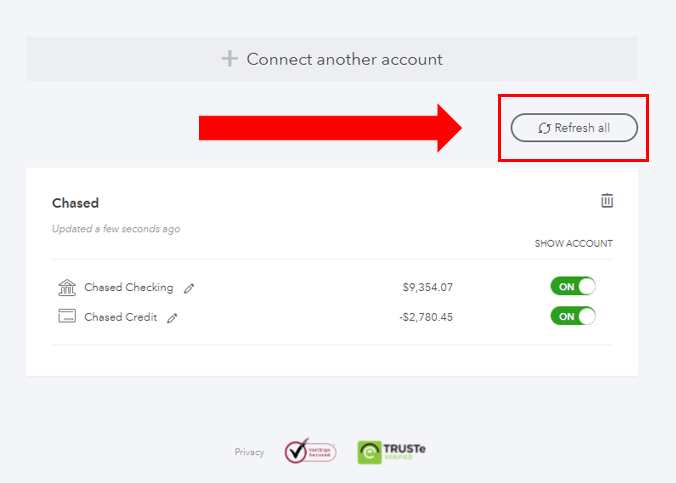

If you don't see your Venmo fees from the downloaded transactions, we can perform some steps to fix this. You'll need to update your bank to refresh the connection and download the recent entries. I'll be glad to guide you how.

If the issue remains, I propose to manually upload your Venmo processing fees. Also, I'd recommend contacting the Venmo support team and verify if there are any issues on their end.

Once everything is settled, you'll want to categorize your transactions to ensure it's in the correct line with your Schedule C.

Keep me in touch if you still need help downloading your Venmo fees or managing your transactions. I'll be here to assist you anytime. Have a great weekend ahead!

I don't have QuickBooks Self-Employed, I have QBO Plus. I disconnected the Venmo "bank account" and reconnected. I down loaded transactions and the fees did not drop. I am getting the gross amount. Not the gross minus the fees = net. I had to manually enter the fees. Any other advice?

I've come to help you manage your Venmo processing fees when recording your transactions in QuickBooks Online (QBO)., @sigal4lasi.

QuickBooks is dependent on the information that was transferred from your bank. To appropriately deduct the fee to the downloaded gross amount, you can utilize the Resolve difference feature. You'll have to incorporate the process while matching transactions so you can get the total net amount. To do this, here's how:

I've attached screenshots below for your reference.

To learn more about reviewing and/or matching your bank transactions in QBO, you can check out this article: Categorize online bank transactions in QuickBooks Online.

Also, I encourage you to reconcile your Venmo account every month. This way, you can effectively monitor your transactions and detect any possible errors accordingly. For the step-by-step guide, you can refer to this article: Reconcile an account in QuickBooks Online.

You're always welcome to comment below if you have any other questions or banking concerns. I'll make sure to get back to you as soon as I can. Take care always.

Unfortunately, it also links my personal Venmo, which has totally screwed up my books. Please help!

Thanks for chiming in on this thread,

I'd like to verify some information. Are you using QuickBooks Online? Do you want to categorize the personal transactions downloaded from your bank? If so, It's best to add them, so it matches with your bank statement when you reconcile the account.

To avoid recording the transaction as a business expense, many business owners add the transaction to an equity account they’ve created, called an owner’s draw. Before doing so, I recommend consulting with your accountant if you’re not sure how to handle a personal expense.

If you're not affiliated with an accountant, you can visit our Intuit Find-A-ProAdvisor site to find certified professionals near you.

On the other hand, if you decide to remove the personal transactions, you can follow the steps provided by my colleague MadelynC. Please note that excluding a transaction doesn't appear in any account registers or financial reports.

For more information about the process, feel free to read these articles:

Should you have any additional questions or other concerns, please leave a reply below. I'll be right here to help you out some more. Take care and stay safe!

did this ever get resolved as im having the same issue! i really want my business venmo linked but it only syncs my personal

Hello there, @auntjaimeorganizes.

Thank you for participating in the discussion. Your question on integrating a Venmo online bank account to QuickBooks Self-Employed (QBSE) will be handled by me.

On the Connect an account screen, I looked for Venmo and only found one result. I believe you're referring to your personal Venmo account.

I recommend logging in to your business account's webpage to see whether the Business Venmo account is available to sync. Copy the web address or URL from there and paste it into the search box on the Connect an account page.

If you're still having trouble finding your bank account, go to the screenshot above and click the Still can't find your bank? link.

You'll be routed to this page:

It will allow you to request that the online bank be made available for QBSE to sync with. Fill in the required information, then click the Request button.

You can upload bank transactions by hand while you wait for the connection to become accessible. The steps are outlined in this article: Manually upload transactions into QuickBooks Online.

If you have any additional questions about integrating your online bank account to QBSE, please leave a comment. I'll get back to you as soon as possible.

Can venmo or Square credit card processing be linked to QB Desktop. Also struggling with linking PayPal.

Allow me to step in and share how you can link a Venmo, Square, or PayPal QuickBooks Desktop (QBDT), aliveel.

You need a connector as the bridge to integrate your third-party accounts. In QBDT, you can use Synder to connect the app.

To use the connector, you can find this through our QBDT marketplace. Let me guide you through the steps.

You can also use another third-party connector outside of QuickBooks to help sync your sales to QBDT. IF not, you can manually import lists and transactions using Intuit Interchange Format (IIF) files.

I'm adding this link to learn more about the process: Export, import, and edit IIF files. It includes export limitations and steps to guide you through the process.

Stay in touch with me if you have an update about linking a third-party application with QuickBooks. I'm always glad to help you.

Recently my Venmo account stop feeding QBO. I re-entered credentials (confirmed these are accurate via Venmo) and still no connection. I therefore removed Venmo and attempted to re-link the account. Each time I am still getting Error 103; saying my account credentials are not accurate. I contacted Venmo and they confirmed my credentials. I believe this to be an QBO issue. I contacted support a week ago and no response. Suggestions?

Thanks for joining in on this thread, Sewing RL.

I'll share some information about the error and steps to help you fix it.

We currently don't have any reported issues regarding the bank error 103. However, you'll encounter this due to the following:

Since your credentials are correct, you'll want to visit your bank’s website. Then, check if your bank has this requirement. If so, follow your bank’s instructions to turn it on.

Once done, sign in to your bank account in QuickBooks by following these steps:

You can click on this article for reference: Fix bank error 103.

In case you have all the transactions updated in the For review tab, you can start categorizing and matching them. The steps are included in this link: Categorize and match online bank transactions in QuickBooks Online.

If you're still getting the same result, I recommend reaching out to our Customer Care Team. They can review your account and investigate what's causing this error.

Please take note that our support for QuickBooks Online Payroll Core and Premium is available from M-F 6 AM to 6 PM PT. For QuickBooks Full Service Payroll, QuickBooks Online Payroll Elite/Premium, we're available any time, any day.

Here are the steps:

If you have the new QuickBooks Assistant help update, you can follow these steps:

You can also get our direct phone number in this article: Contact Payroll Support.

You're always welcome to post a reply here if there's anything else you need. Have a good day ahead.

Same issue with my Venmo account. It stopped feeding and when reconnecting I keep getting

Looks like the connection to Venmo isn’t available right now.

Try again in a few hours. (102)

I am also receiving attempted login emails from Venmo.

Glad to have you here, TiffanyMM.

I received similar issues from other users, and our engineers are working on a fix.

I'll make sure you'll be notified once the issue is fixed. I suggest contacting our QBO support team to add your company to the affected users' list. This way, you’ll receive a notification when a fix is available. Here's a link to contact them at a time convenient to you: QuickBooks Online Support.

In the meantime, you'll want to download your Venmo transactions via a CSV file and upload them to the Banking page. You can refer to these articles for your guide in uploading them into QBO:

I'll be right here to keep helping if you have additional concerns about banking.

I do not have a transaction tab on my quickbooks online. I do have banking and have already set up my bank accounts to my quickbooks. Wanting to link my business venmo. Can you help?

I too have been trying for two weeks to get Venmo to automatically download transactions. Mostly it returns Error 102, try in a few hours. Once it downloaded a single transaction.

I know you can download a CSV of the transactions. When doing this I disconnected the Venmo account so I could process the CSV BUT, A BIG BUT...after processing the CSV transactions, QBO automtically without asking reconnected the Venmo account (the little lightning bold shows up in the COA).

I have reported this bug to QBO as it applies to other bank accounts as well.

When bank accounts are not connected their panel does not show up in the Banking Tab, but after downloading transactions from other bank accounts the bank is magically reconnected.

All this leads to duplicated transactions which are a mess to clean up.

This all needs to be cleaned up as it causes a lot of unnecessary work in QBO, and keeping track of duplicated transactions.

Can someone help me? I have my Venmo linked and it pulled in all the transactions but not the opening balance. So, in QBO it looks like my Venmo balance is negative.

Hello there, @Pip and You,

I can definitely help you out! For this, we can fix your negative balance by editing your opening balance in the Chart of Accounts.

You can follow these simple steps:

For more information, you can visit: Enter and manage opening balances in QuickBooks Online.

If editing your opening balance still doesn't reflect, you can refer to this article: What to do if you didn't enter an opening balance in QuickBooks Online.

I will also add articles here that you can refer to for future use if you happen to want to reconcile, categorize, and match your banking transactions:

Please don't hesitate to reach us back or simply add a reply under this post if you need more assistance with your banking transactions. Have a great day!

The register doesn't have an entry for open balance. That is where I'm confused. All my other accounts do but the Venmo register does not. It just starts with the first transaction that occurred this year.

Hi there, Pip and You.

It's good to know that you've already checked and reviewed the register. I appreciate you for doing that.

If you didn't see an opening balance entry, you'll have to use your bank statements to make sure the opening balance is correct. Then, take note of the date and amount of the oldest transaction in the account. Once done, you'll need to create a journal entry for this.

Once done, make sure to manually reconcile the transaction in the bank register. This way, the beginning balance shows up on the reconciliation page.

Here's how:

Please see sample screenshots below:

Also, I'd recommend reaching out to your accountant for further advice on fixing the beginning balance issue in QBO, especially when creating a journal entry.

I'm also adding these articles about managing opening balances in QBO:

Please post or comment in this thread if you have additional questions about opening balances or anything else. I'm always ready to lend a hand. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here