Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Banking

- :

- Can I apply part of a bank deposit to an open invoice and exclude the rest?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

Hi-

We received 2 checks from a client and they were deposited into our bank together. However, one of the checks had a stop payment and was reversed in our bank account several days later (they subsequently sent us a replacement check, which has been applied to the open invoice.)

The initial deposit comes into Banking as one transaction, so if I try to match it, there is a variance. Ideally, I want to match part of the deposit to an open invoice but I want to exclude the balance since this is the check that was returned and has an offsetting transaction. How can I accomplish this? I attempted to play around with the undeposited funds feature but didn't achieve the desired result. Can someone walk me through the steps I would need to take? Also to note- the check was deposited end of Feb but returned beg of Mar so the 2 transactions are in different accounting periods.

Thanks,

Jaime

Solved! Go to Solution.

Labels:

Best answer March 22, 2021

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

I appreciate the screenshot you've provided, jkope26. Allow me to step in and share some insights about changing transaction types in QuickBooks Online (QBO).

As referenced by my peer above, the system is dependent on the information and description shared by your financial institution. Thus, changing the transaction type isn’t possible in QuickBooks Online.

You can only categorize them to the correct income and expense account. I'd suggest coordinating with your bank and check how they send the downloaded transactions.

In the meantime, as a way around, you’ll want to manually download your bank statements and edit the transaction type. Then, upload it to your QBO account. I’d be glad to show you how.

- Log in to your bank or credit card website and download the transactions from there.

- Ensure the file size and format are supported (maximum file size is 350 KB).

- Comma-Separated Values (CSV)

- QuickBooks Online (QBO)

- Quicken (QFX)

- Before uploading it to your QBO account, ensure you’ve already made changes to the transactions such as the transactions type.

- Then to upload the transactions, go to the Baking or Transactions menu.

- Select the Banking tab.

- Locate the select the appropriate bank and click File upload from the Update drop-down menu.

For more details about this process, you can check this article for your reference: Manually upload transactions into QuickBooks Online. On the same link, you'll find a write-up on how to use banking rules as well as reconciling your account.

Kindly update me on how things go by adding another comment below. I want to make sure you're all set, and I'm here if you have any follow-up questions in mind or need further guidance. Have a great day! All the best.

7 Comments 7

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

Thank you for providing details of your concern, @jkope26!

Let me help you match your invoices in QuickBooks Online.

When recording a payment via bank deposit, it will not be applied directly to the open invoice. You'll have to enter the customers' payment via the Receive Payment screen and match it with the deposit.

You can exclude it and create the deposits manually.

Here's how:

- Select + New.

- Click Bank Deposit.

- From the Account ▼ dropdown, choose the account you want to put the money into.

- Select the checkbox for each transaction you want to combine.

- Make sure the total of the selected transactions matches your deposit slip. Use your deposit slip as a reference.

- Click Save and new.

Make sure everything matches between invoice and payment, like dates, etc.

You can check this article: Matching transactions. You'll avoid getting duplicate records of your transaction in the bank register.

If there's anything else that I can help you with, let me know in the comments. I'll be here to lend a hand.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

thank you, but I'm not sure this answers my question.

we have our bank account linked to quickbooks. I pulled in a deposit that was made to our bank account, lets say it was for 100K. Usually, in the case of deposits, I can just "match" them to open invoices. However, in this case, I want to match part of it and exclude part of it.

60K is for an open invoice

40K is the amount I want to exclude (this amount was reversed from our bank account a few days later, as a stop payment was put on the check by our client.)

how can I apply the 60K to an invoice and exclude the 40K from being mapped anywhere (it is going to be offset by a -40K and I just want them to cancel each other out.)

thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

I got you cover, @jkope26.

I have some information about matching and excluding deposits. Since using the exclude function will exclude your entire deposit, you'll want to record your reversed payment into an account. This way, you can match the other part of the downloaded deposit.

Here's how to do it:

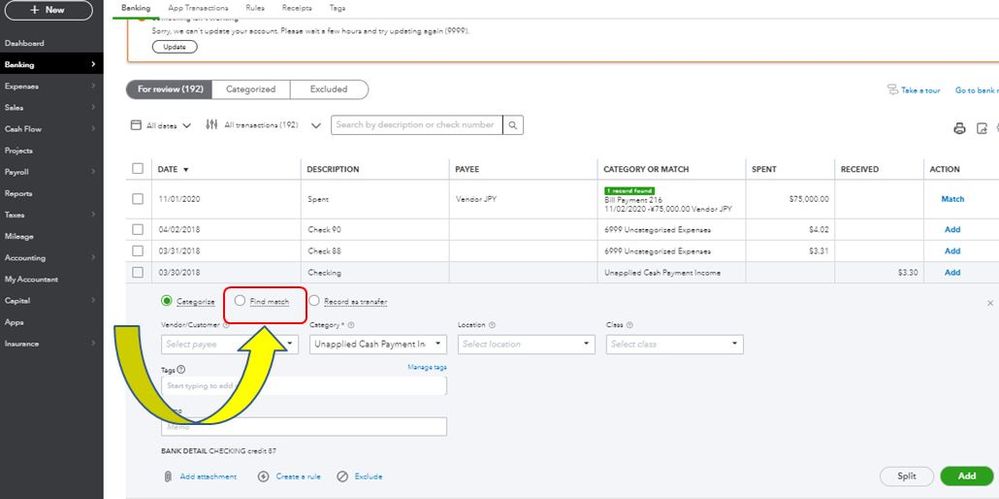

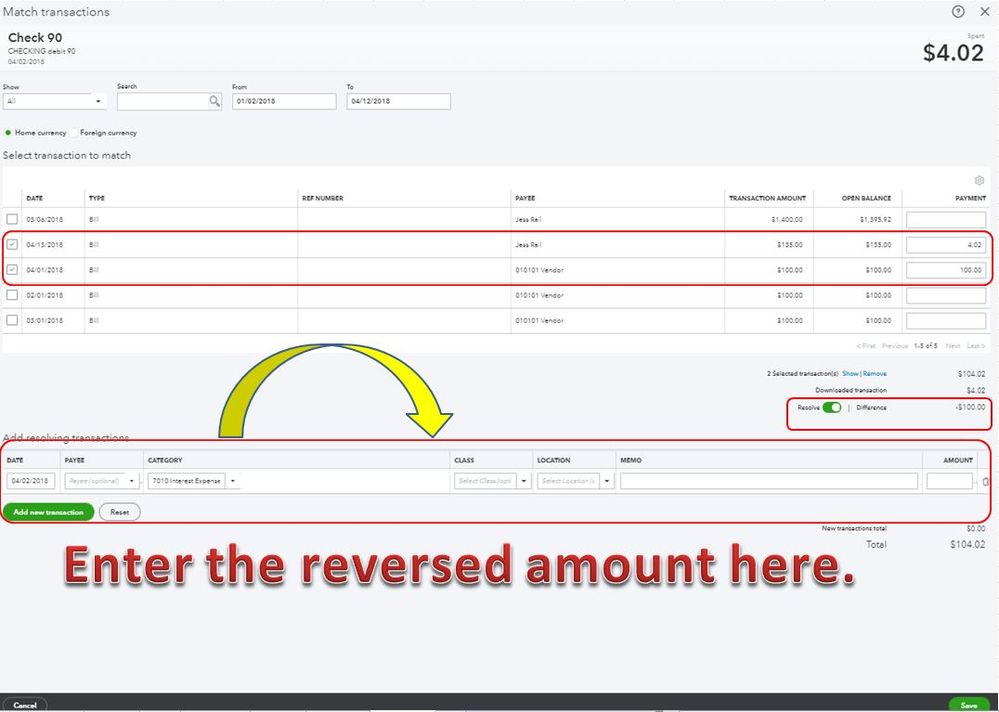

- Go to Banking, then tap the Banking tab.

- Select the deposit to open, then tick the Find match radio-button.

- Mark the invoices that are included in the deposit amount. Then, switch the Resolve| Differrence button.

- In the Add resolving transactions section, choose an account under Category.

- Memo is optional, and then add the Amount.

- Click Save.

Here's how it looks like:

You can check out this article for more information about matching transactions: Categorise and match online bank transactions.

Additionally, here's a link that covers all the tasks you can do when using the banking feature in QBO. Just look for responses that suit your concern.

Let me know in the reply section below if you still have questions or concerns with bank transactions. I'll be around for you. Take care and happy weekend.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

thank you, this seems to work for the most part. however, one thing I can't figure out....the check deposit obviously got tagged with a "deposit" transaction type. the stop payment (reversal in bank account) is tagged with an "expense" transaction type. I have a cash receipts report I created and the issue is that its pulling in the deposit, but not pulling in the subsequent reversal b/c its tagged as an "expense" (and not payment or deposit). is there anyway to change the transaction type on a transaction that comes in from my bank account? thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

Yes, you can change the transaction type, jkope26.

QuickBooks Online depends on what your bank shared with us. This could be the reason the transactions has different transaction type.

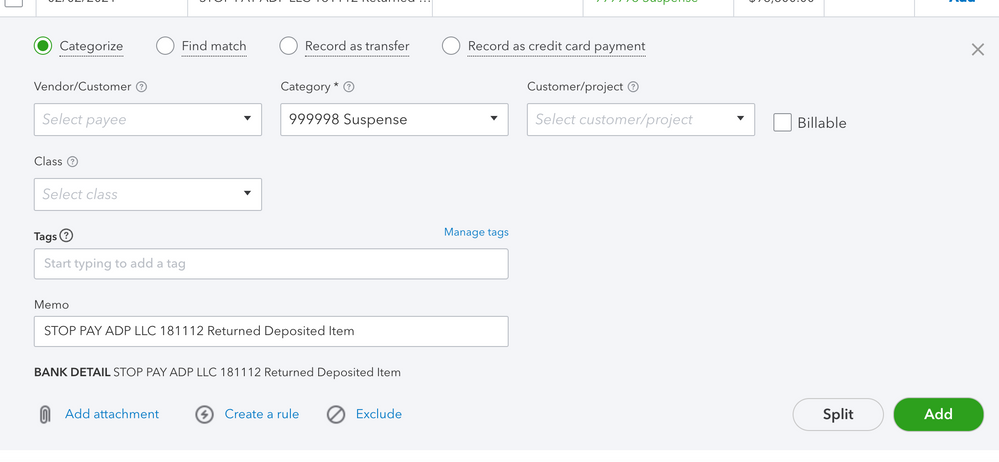

I'd suggest following these steps if the transactions are still in the For Review tab.

- Go to Banking from the left menu.

- Select the For Review tab.

- Locate and open the transaction.

- Choose the appropriate income account from the Category drop-down.

- Click Add.

If they're already in the Reviewed tab, you'll have to undo them. They'll be moved back to the For Review tab so you can categorize them to the correct type.

After that, I encourage reconciling your account monthly. This ensures your QuickBooks accounts match the bank statement.

Don't hesitate to let me know if you need more help in handling your bank transactions. I'm always here to back you up.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

thanks, but I don't see where to change the transaction type, only where I want to map (categorize) the transaction. how do I change the transaction type?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I apply part of a bank deposit to an open invoice and exclude the rest?

I appreciate the screenshot you've provided, jkope26. Allow me to step in and share some insights about changing transaction types in QuickBooks Online (QBO).

As referenced by my peer above, the system is dependent on the information and description shared by your financial institution. Thus, changing the transaction type isn’t possible in QuickBooks Online.

You can only categorize them to the correct income and expense account. I'd suggest coordinating with your bank and check how they send the downloaded transactions.

In the meantime, as a way around, you’ll want to manually download your bank statements and edit the transaction type. Then, upload it to your QBO account. I’d be glad to show you how.

- Log in to your bank or credit card website and download the transactions from there.

- Ensure the file size and format are supported (maximum file size is 350 KB).

- Comma-Separated Values (CSV)

- QuickBooks Online (QBO)

- Quicken (QFX)

- Before uploading it to your QBO account, ensure you’ve already made changes to the transactions such as the transactions type.

- Then to upload the transactions, go to the Baking or Transactions menu.

- Select the Banking tab.

- Locate the select the appropriate bank and click File upload from the Update drop-down menu.

For more details about this process, you can check this article for your reference: Manually upload transactions into QuickBooks Online. On the same link, you'll find a write-up on how to use banking rules as well as reconciling your account.

Kindly update me on how things go by adding another comment below. I want to make sure you're all set, and I'm here if you have any follow-up questions in mind or need further guidance. Have a great day! All the best.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...