Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have figured out how to enter a bill and say it was paid with a credit card, but I do not know how to show that I paid my credit card bill at the end of the month and how does that affect the fact that the bills are already showing as paid by a credit card? I'm afraid if I enter the information wrong it will screw up my bank account information.

Please help!

Solved! Go to Solution.

I can handle this for you, @ScubaPro.

When you make a purchase, you’ll want to enter a bill then use the Pay bill feature to mark the items paid. Then match it to the credit card transaction under bank feeds.

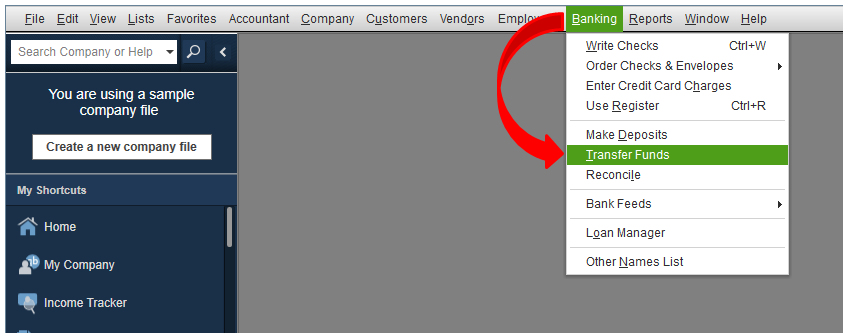

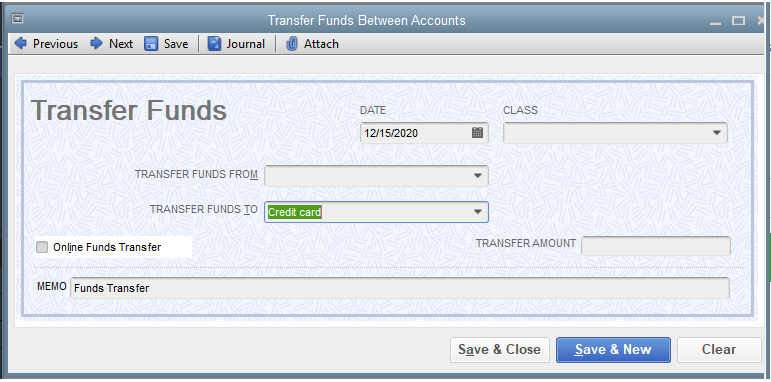

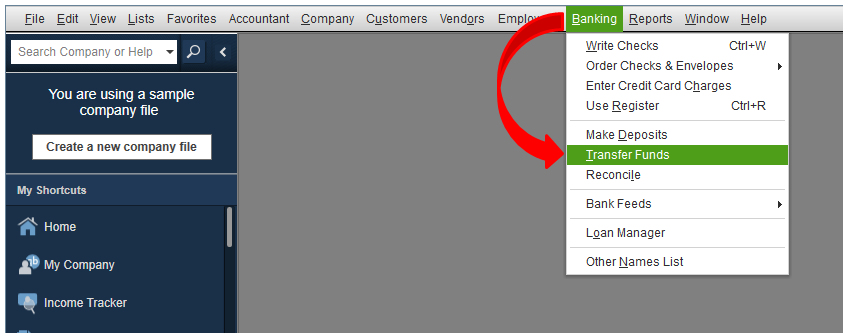

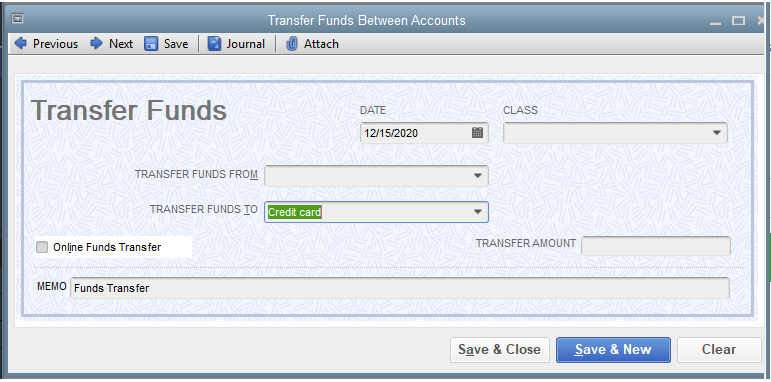

Since you’re using a credit card to pay for the said purchase, you can enter the payment by transferring the record. That means you’ll need to create a bank transfer to pay your credit card bill and to show it settled in the program. Here’s how:

Once you're done with the transfer process, you need to match it with your downloaded events. Doing this presents that you have paid the credit card bill amount.

You can use this article for your future reference about reconciling accounts in QuickBooks Desktop. It has complete instructions to ensure everything is properly recorded.

By these steps, books are surely accurate. Don’t hesitate to leave a message below if you have follow-up questions about your transaction. The Community is always here to lend a hand.

Thanks for coming here, ScubaPro.

You'll want to enter a Pay Bills to show that you paid the credit card bill at the end of the month. To do that, please follow the steps below:

You'll want to review the bills you created and paid by running the Transaction List by Vendor and filter it to show bills paid.

For more details about customizing reports, you can check out these articles:

Of course, you're always welcome to visit us again if you need help while working with QuickBooks. It will be my pleasure. Stay safe and have a great day ahead!

I hate being long winded, but I see I was exactly clear.

Once I have logged a bill as paid by credit card, I will need to eventually pay my credit card bill. I do that online. I am, to say the least, and QBD novice so some of these instructions do not make sense and appear to be overly complicated to perform simple functions. I'll be a bit more specific in what is confusing me.

As I do through the below steps I have these question and comments.

When I pay bills under vendors, does that mean I used my credit card to pay the bill or that I paid my credit card bill?

I am very confused about the reports instructions. The instructions say to select "Bill" and "Bill Payment", however, those are not options for me to select in QBD 2021 Pro. Is there something else I need to select? Once I do select the right option, is that where I enter that I paid my credit card bill?

The instructions below end at step 5 and that seems to be incomplete to me. Is there a QB for dummies I can read because this is not intuitive at all (to me).

Thanks again

Thanks for getting back to us, ScubaPro. Let me clear your confusions about paying bills in QuickBooks Desktop.

If you have a Bill that could only mean it should be from your Vendors and not from (Credit Card Company). Then you can record payment for that bill to report that you've paid your vendor for that specific bill.

On the other hand, for your Credit Card payable, you'll create a Credit Card Credit and not a Bill. I'll show you how:

That should do it! If you have any other additional concerns regarding bills, please do add them below. I'll be sure to get back to you to help.

To be clear, once I enter the credit card credit, that is how I show that I paid the credit card bill?

To be clear, entering the credit card credit under banking is how I show I paid the credit card bill?

Sorry I'm still confused so correct me if I'm wrong. When I enter the bill under vendors and say pay bill, is that saying I paid the vendor but re-entering the same information under banking shows I paid the credit card bill?

If so, it seems like a lot of steps to enter each item separately under banking instead of just entering a payment to the credit card for the entire amount to show that payment as a single bill instead of having to re-enter all the same information individually again.

If I have that wrong, please let me know.

I can handle this for you, @ScubaPro.

When you make a purchase, you’ll want to enter a bill then use the Pay bill feature to mark the items paid. Then match it to the credit card transaction under bank feeds.

Since you’re using a credit card to pay for the said purchase, you can enter the payment by transferring the record. That means you’ll need to create a bank transfer to pay your credit card bill and to show it settled in the program. Here’s how:

Once you're done with the transfer process, you need to match it with your downloaded events. Doing this presents that you have paid the credit card bill amount.

You can use this article for your future reference about reconciling accounts in QuickBooks Desktop. It has complete instructions to ensure everything is properly recorded.

By these steps, books are surely accurate. Don’t hesitate to leave a message below if you have follow-up questions about your transaction. The Community is always here to lend a hand.

That's what I was looking for! Thank you so much for the help.

Good afternoon, @ScubaPro.

Thanks for reaching back out to the Community. I'm so glad that my colleague was able to provide you with the steps you needed to fix the issue that was occurring in your QuickBooks Desktop (QBDT) account.

In addition, you can check out these guides below to help your business in the future.

The Community is always here to have your back. Let me know if you have any more questions or concerns. I'll always be around to help. Take care!

Until now I have been doing this as follows:

When reconciling the credit card statement, I select "enter a bill for payment later" - this moves the credit card bill amount into Accounts Payable. I then use "Pay Bills" to pay the credit card bill. This causes a problem though if a balance rolls over, and if I pay more than the previous balance during the billing period I need to enter a credit card credit to move that into AP as well.

Are you saying that instead of all that, I can just transfer the funds from my bank to my credit card in QB to signify a payment against my CC account?

If I do so, I assume I would not select "enter a bill for payment later" - is that correct?

Thanks for following this thread, @bookkeeping36.

Yes, you're correct with recording the bill and using Pay Bills to pay the credit card purchase. Also, entering a credit card credit will be your best option when you move it into an AP if you pay more than the previous balance during the billing period. This will lead you to reconcile the account correctly. You can select the enter a bill for payment later in your case when you signify a payment against your CC account.

In the main poster's case, they need to create a purchase by entering a bill and paid through a credit card. And then paid the credit card bill by a credit card which means to create a fund transfer in that specific scenario. That's why it would not need to create a credit card credit.

After that, the main poster can now follow the steps displayed in this article when matching transactions to reconcile them: Add and match Bank Feed transactions in QuickBooks Desktop.

I've attached some pages that help you managing banking transactions, different reports, and other related matters.

Feel free to leave a comment if you have other concerns with recording vendor transactions. I always want to help here in the Community. Have a nice day.

The thread is helpful but why not do the following?

When a purchase is made and paid through a credit card, don't we want to use the icon in the lower right of the main screen "Enter Credit Card Charges"?

The screen comes up and lets you put it to the proper Vendor (A/P) account and categorize the expense(s) correctly.

Then when the statement come in, you do Banking / Reconcile like you would with your checking account.

Am I right about this?

Thanks -

I have read through this thread and I still am confused. I am using QB Desktop Wholesale Premier.

1) I received a bill for inventory from my supplier.

2) I entered the bill's items on the items tab

3) I paid the bill selecting "credit card" as the method, so now that payment shows up as a credit card liability

4) Now I am entering the credit card bill for this month, and the payment to my supplier is reflected on their statement, of course, adding to the total that I will pay to the credit card vendor.

How do I connect these? When I make a payment by credit card, why does that not show up as a pending charge when I create the bill from my credit card vendor?

Good day, terrafirmawine!

Thanks for joining this thread. You can simply record a bill payment. Let me show you.

When using a credit card to pay what you purchased, it won't be linked to the credit card vendor since the bill and bill payment is linked to a different vendor. Now, you can simply create a check to pay your credit card charges. Follow these steps:

If you used a bill to track and pay the credit card charges, you can select the credit card account on the Expenses tab, just like the steps above. This will zero out the liability balance of your credit card account when you pay it, but make sure to use a bank for the payment. Please check this link for your reference in managing your credit card accounts: Set up, use, and pay credit card accounts.

Also, I added this link if you need help in balancing your accounts: Reconcile an account in QuickBooks Desktop.

I'm only a post away if you have additional questions. Stay safe!

I have the same question but for QBO

Hi AMR,

Since the original post, Intuit has added a feature to make the credit card management easier and less confusing.

To pay the credit card, go the that register and do New, Pay Down Credit Card. This way you an confirm what account you want to pay it from. (This is, in effect, a transfer from one bank account to another.)

To get the expenses in there, set it up to get the bank feed for the credit card. When the transactions come in, make sure in Review you are getting the categories correct (set up Rules wherever it makes sense).

Then when you go to reconcile the cc each month, all will be good.

Hope this helps and that I'm understanding your question correctly.

I'll walk you through entering credit card purchase and paying the credit card, @AMR19.

When purchasing using the credit card, you can record it in QuickBooks using pay bills or expense transaction. Make sure to select the credit card used under the Payment account.

Use the Pay down credit card option under + New to record credit card payment.

Here's how:

You can read this article for the complete details or alternative methods: Record your payments to credit cards in QuickBooks Online.

I've also included this article to assist you in checking your QuickBooks accounts to ensure they align with your bank and credit card statements: Reconcile Workflow.

Let me know if you have questions about paying credit card in QuickBooks Online. I'm always here to help. Have a great day.

One more question in regards to credit cards. Is it necessary to post the monthly credit card bill when it is received? Or can we just pay down the balance from the posted expenses?

Thank you!

Best practice from an accounting standpoint is to reconcile the credit card account when the monthly statement is issued. Then, New, Pay down Credit card. What you are seeing should match the statement except for any transactions posted after the statement ending date.

Is this what you mean?

Is there a method for downloading a credit card statement to Quickbooks and then disbursing the credit card charges to the proper general ledger accounts?

Thanks for chiming in on this thread, mbookman. I've come to help you import credit card transactions and transfer these charges to the correct accounts.

With QuickBooks Online, you can directly download the latest credit card transactions from your bank or manually import them to QuickBooks. To help you download these transactions, you can follow the steps below:

Once your recent credit card statements are in your bank feeds, you can match and categorize these entries. You can also set up bank rules to help you streamline the review process and automatically categorizes the transactions for you. In that way, these credit card charges will disburse to the correct General Ledger account. For additional information and detailed steps, you can refer to this guide: Set up bank rules to categorize online banking transactions in QuickBooks Online.

However, if you're using the QuickBooks Desktop program, you can download your transactions and create rules to categorize them to the correct GL account.

Additionally, I'd recommend consulting your accounting professional to guide you further on what account to use and help you manage your financial data.

Moreover, to ensure your accounts are reviewed and matched to your bank and credit card statements, you can reconcile them to make your books balanced. For QBDT, please refer to this article: Reconcile an account in QuickBooks Desktop.

Keep us posted in the comments below if you require additional assistance managing your transactions. We'll always be here, willing to help. Take care!

You will set up different credit card accounts as different accounts in the COA (chart of accounts). Then link each one separately.

Be aware of this, however: Is your credit card account one where there are numerous card holders? If that is the case, here's what you want to do. For example, if the card issuer is Chase. You would set up a "main" Chase credit card in the COA. We like to use account numbers so let's say you make it #3005.0 Chase card . Then set up the card holders and make them sub accounts of 3005.0 in the COA. For example: 3005.1 Sally Chase, 3005.2 Bob Chase, 3005.3 Martha Chase.

Then you'll connect the subs to the bank feed but NOT that main card. This allows you to get the feeds to each individual card, but reconcile at the main bank card level.

And you'll "pay card" to the main card account which is what you probably do in practice.

Hope this helps!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here