Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

My credit card processor is holding funds in a reserve, until our agreed upon reserve amount is met. They then deposit the difference.

Sale $100

Reserve $10

Bank Deposit of $90

When I go to match the sale of $100 to the deposit of $90 and resolve the difference. The sales order doesn't appear as an option.

How do I get the sales order to appear as an option?

Greetings, luxurytoyx.

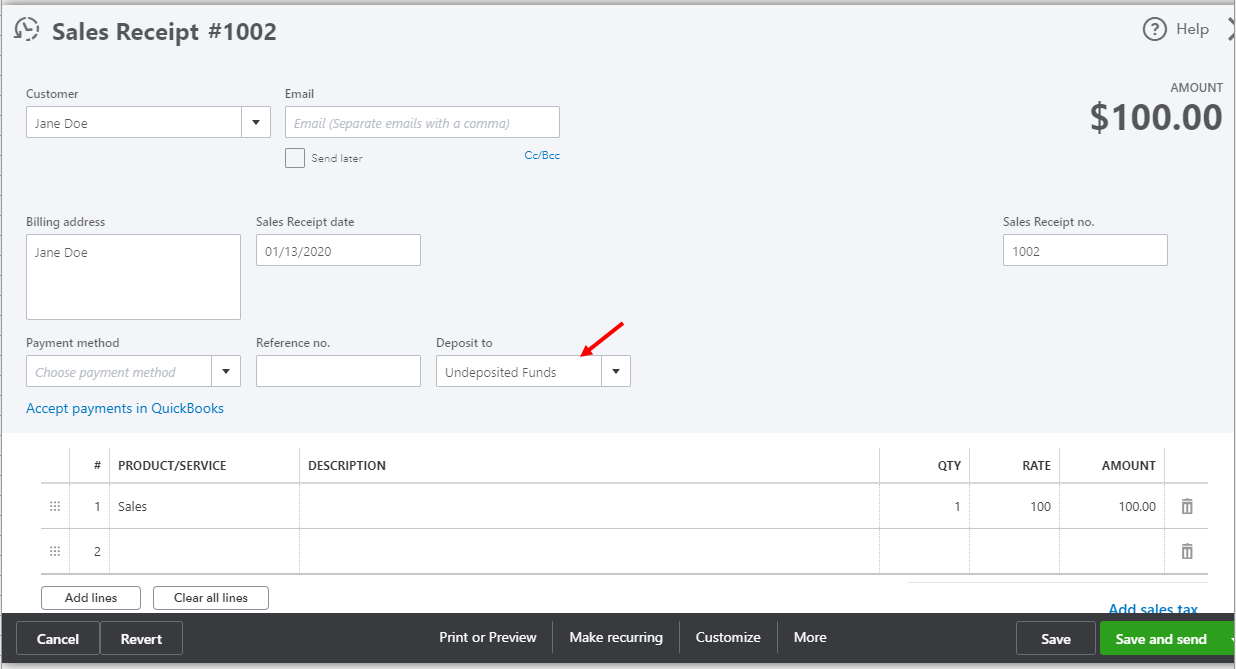

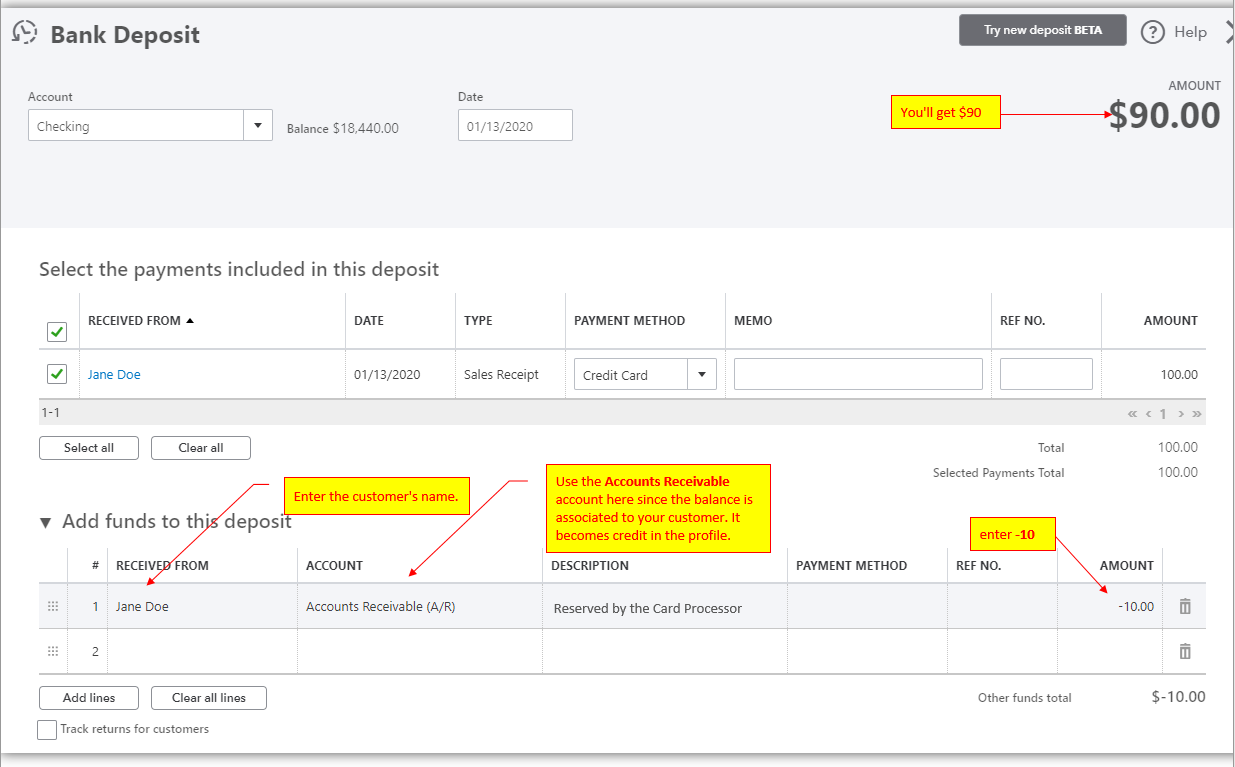

Sales Receipt may be still in the Undeposited Funds. We need to record a Bank deposit and include the Reserve amount. I'll show you how:

Please see attached screenshots for your reference:

Once done, we can find match the deposit on the banking page.

If you need help in managing your transaction, here's an article on how you can download, match, and categorize your bank transactions in QuickBooks Online for reference.

Please let me know if you need further assistance in managing your transactions in QBO.

Hello,

The sales order isn't there for me to select. It only has a more recent sales order. I tried changing the dates as well but it still only shows the sales order below.

I can share additional information, @luxurytoyx.

Let's first locate the sales you've initially recorded. Once located, ensure that the information on the sales exactly matches the deposit details.

Here's how to locate your sales transactions:

Once you've located the sales transaction, let's make sure that its date and other information matches with the downloaded transaction in your For Review page.

Once verified, select the Find Match option. From here, you can perform resolve difference to add

For more detailed insights about managing your downloaded bank transactions, you can read through these articles:

Feel free to get back to us if you have other questions. I'm always here to help.

Hello,

That doesn't appear to work either.

Extra info -

1) If I select another received amount that's much higher. I can see the order i'm trying to match up. Yet I don't see that order when I'm trying to match up a lessor amount than the deposit. I don't even see the S/O for that higher amount.

2) I spent over an hour with tech support and they weren't able to figure it out.

3) This was happening with a PayPal order, but we found that a discount needed to be applied to the sale receipt and and magically the order appeared for me to match up.

Based on the info above. It seems like a design flaw? It would seem I need one of two things to happen.

1) My Processing Bank doesn't hold funds and deposits the full amount. Then separately debits my account for the reserve.

2) Be able to see all sales transaction regardless of dates/amounts.

Before switching card processors, everything matched up perfectly, but the previous wasn't holding a reserve.

New Question - Is there a another way to match sales orders to deposits and resolve the there?

Thanks,

Hi luxurytoyx,

I guess there was a misunderstanding in the replies above.

A Sales Order (S/O) is a non-posting transaction, meaning it doesn’t affect your balances. Thus, it shouldn’t be a matching entry to your bank feed entries. It has a similar effect to an estimate, purchase order and vendor credit. They are non-posting transactions, and you won’t see them in your bank register.

On the other hand, a Sales Receipt is a posting entry and can be matched to your bank feed entries.

I’m wondering if the “order” you mentioned in number 3 is a sales receipt or a sales order. However, you kept on mentioning the word sales order (S/O), so I’ll take the missing entry as an S/O.

Let’s go back to the information above:

Our goal here is to show a $90 deposit into your bank register, so it can be matched to your bank feed entry ($90).

In QuickBooks:

Now that you have a $90 deposit, you can match it to your bank feed entries.

On the other hand, the $10 stays as an open deposit (credit) on your customer's Transaction List. When the actual $10 is deposited to your actual bank account, you can make a Receive Payment entry. Then, select that deposit.

Feel free to let me know if you have other questions in mind.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here