Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy client transfers money from her personal checking account to pay her business credit card in QBO Essentials. I changed the Transfer Funds From to Owner's Investment and left the Transfer Funds To as the Credit Card. The credit card is out of balance in the negative by the amount of the payments. The client's account is with Schwab and when I spoke with them they told me that they are not set up to download transactions. However, the Schwab Business Checking account is in balance. I have no idea how to fix the difference and how to handle future payments.

I would truly appreciate some help!

Hello there, @kevynq.

The negative balance only means that the deposit on the credit card account is more than the payable amounts. There may be duplicate entries recorded causing this balance. For now, you'll have to check each transaction and make sure they're posted correctly. In QuickBooks Online, you can't create a transaction using equity as a bank account.

For additional references about managing personal or business expenditures, check out these articles:

Also, feel free to read the topics from this link in case you need guides while working with QuickBooks or payments in the future.

Add a comment below if you have any other questions. I'm always here to help you out. Have a good day!

Thank you, Angela. To be more specific, can I go in and delete all of the credit card payments an make separate journal entries for each one? If I do that I will be entering transactions for statements that have already been reconciled. I've never had to deal with that but can I undo all of them (this year) and start over?

Thank you,

Kevyn

You're welcome and thanks for the additional details, @kevynq.

To answer your first question, yes, you can delete all the credit card payments and create journal entries for each of them. Before doing so, I suggest reaching out to an accountant for the best advice. Once ready, here's how to proceed:

To delete the payments made, here's how:

Then, you can now create journal entries for each of them.

For your second question, yes you may undo the entire reconciliation and start over. Once again, I recommend consulting an accountant to help you along the process to prevent messing up your books.

I'll be adding this resource in case you encounter reconciliation issues in the future. It outlines the steps on how to resolve them: Fix reconciliation issues.

I'm always around to help if you have more questions about managing payments or anything else related to QuickBooks. Take care and stay safe always.

Thank you, ReyJon. Further question: When I make the journal entry I will credit the Credit Card account but what is my debit? As Angela T said, I can't debit an Equity account and I don't see an appropriate account elsewhere. Should I create something new?

Thank you!

Good day, kevynq.

Let me show you how to properly record this in QuickBooks Online.

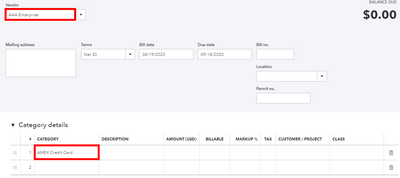

The first thing we need to do is to enter a bill and let's select the credit card account in the Category section. This will reduce the credit card balance and will transfer it into a bill.

Then, we can create a journal entry, and let's debit the Owner's Investment and credit the account's payable (A/P). This put credits into the A/P to pay the vendor.

You can follow these steps:

You can click this link on how to create a journal entry in QuickBooks Online. Just make sure to tag the vendor before saving it.

Once done, we can reimburse the personal account by following these steps:

I've added this article if you need to track your cash flow in QuickBooks Online .

Please comment again if you need anything else. Wishing you all the best!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here