Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQuickbooks deposited two small amounts into my bank account so that I can verify the account to transfer money from my Quickbooks cash account to this bank account. What exactly I do with the transactions that were made into my account? Do I wait and they get credited back to QB? Or how do I file them? Thanks!!

Solved! Go to Solution.

Thank you for connecting with the Community, Steve C. QuickBooks will credit the amount back into your bank account, but you still need to verify the amounts. The charge will show on your bank statement as either "QuickBooks: Verify Bank" or "Intuit: Verify Bank".

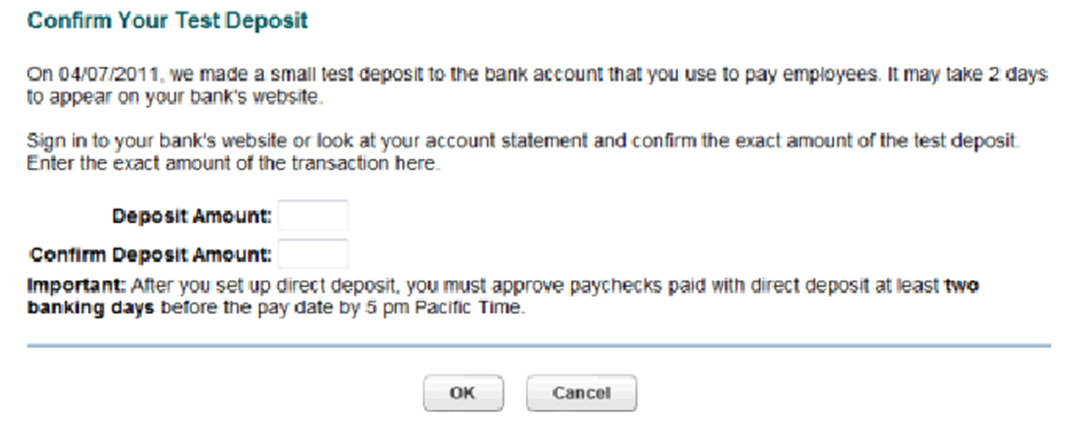

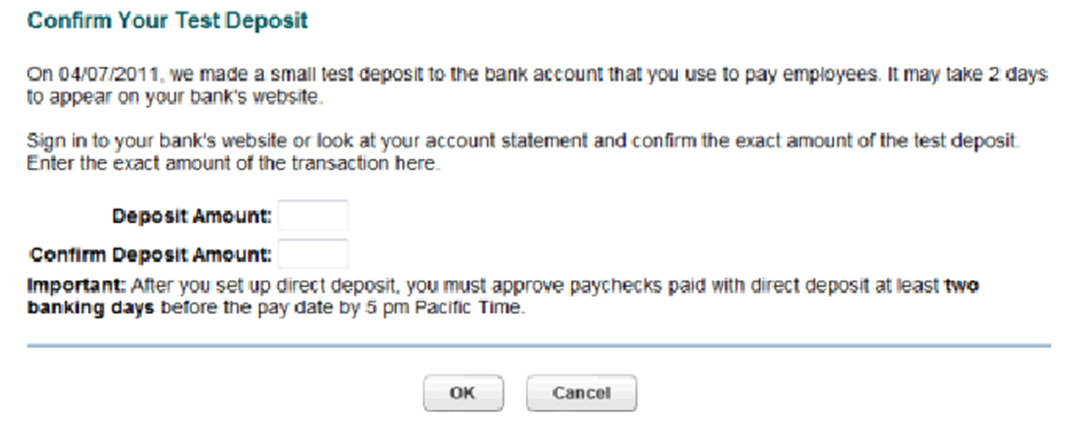

If you are using Intuit Online Payroll, follow these steps to test the transaction:

If you have a different online payroll service, use this article to find the instruction to verify the amounts. Once completed, you will be able to start using the service.

Please let me know how this goes. The Community and I will be on standby to answer your questions. Take care and enjoy your day.

I would code it to wherever you plan on coding your Intuit transactions (i.e. Computer/Software, Subscriptions, etc.)

Even though it is a deposit into the account? And not an expense? Thanks for your help! Still strying to learn all of this!

Thank you for connecting with the Community, Steve C. QuickBooks will credit the amount back into your bank account, but you still need to verify the amounts. The charge will show on your bank statement as either "QuickBooks: Verify Bank" or "Intuit: Verify Bank".

If you are using Intuit Online Payroll, follow these steps to test the transaction:

If you have a different online payroll service, use this article to find the instruction to verify the amounts. Once completed, you will be able to start using the service.

Please let me know how this goes. The Community and I will be on standby to answer your questions. Take care and enjoy your day.

Yup. It is not part of your income and is basically treated as if it were a refund from a vendor.

Hey, no worries :) That is what this is for! We all learn it at some point!!

I had someone pay an invoice using ACH and the money was deposited into "quickbooks Cash" and now i want to transfer it into my business checking account. when i select transfer it mentioned that i need to verify my bank account. Where do i "verify my bank account?

Good morning, @3150bcstore-gmai.

Thanks for following the thread. I hope you're enjoying the day so far. I'm happy to lend a hand with verifying your bank account.

When you start using the Cash account in QuickBooks, you go through a process of verifying your bank account. It sounds like you may not have done this yet. No worries, I'll walk you through the steps below.

Once you've started the connection, QuickBooks will send two small deposits to the account within the next 3 days. After you get the confirmation email, come back to QuickBooks to verify the transactions.

That's all there is to it. Check out Use your QuickBooks Cash account for more details.

Please let me know if you have any questions or concerns about this process. I'll be here every step of the way. You can reach out to the Community at any time. Take care and have a wonderful week ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here