Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have a vendor that requires payment at time of purchase and the total comes out of the bank account. Those items went into inventory. A month later the items had to be returned so I had to do a credit to take the items out of inventory. The vendor deposited the money back into the bank.

Now I have a credit that I don't know how to apply as a deposit into our QB's checkbook so I can reconcile.

How would I do this?

Thanks

Solved! Go to Solution.

It's nice to have you back here, AZEmbroiderer.

Let me give you additional details about your concern.

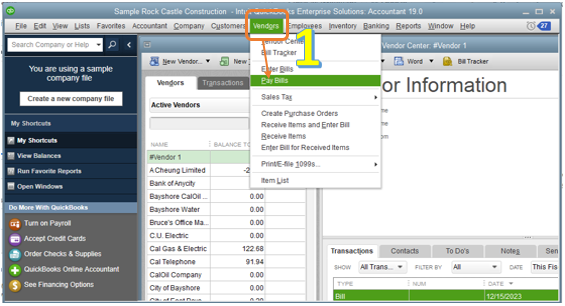

We're doing Accounts Payable to affect the Vendor's accounts and show the available credits in the Pay Bills page. When you reconcile, the deposit will show in your bank. I'll show you how:

If in case you'll encounter issues reconciling your account, please refer to this article: Fix issues when you're reconciling in QuickBooks Desktop.

Feel free to comment below if you need anything else.

Let me help you in depositing the credit to your bank, @AZEmbroiderer.

We can simply create a deposit to zero out your credit. Here's how:

You can also run the Vendor Balance Summary report to check your company's current balance with each vendor. Simply follow these steps below:

If you need further help in recording your transactions in QuickBooks, click the reply button below so I can provide you assistance.

ReymondO

I think you didn't finish the steps.

After I've done the Vendor, Accounts Payable, Dollar Amount, Save/Close, how do I apply the credit? Does this apply the credit toward the deposit? Does this just 0 it out? Is there another step that I need to do other than check to see what the balance is for that vendor?

Here's where it is confusing to me -

Normally, when I am paying an invoice, I can apply the credit toward that invoice. So I don't understand the difference between applying the credit to basically nothing and zeroing out.

I'm sorry, but I am flying by the seat of my pants when I have something new happen with a vendor/customer and am better with audio learning rather than visual. Thank you for being patient.

Thanks for performing the steps provided above, AZEmbroiderer.

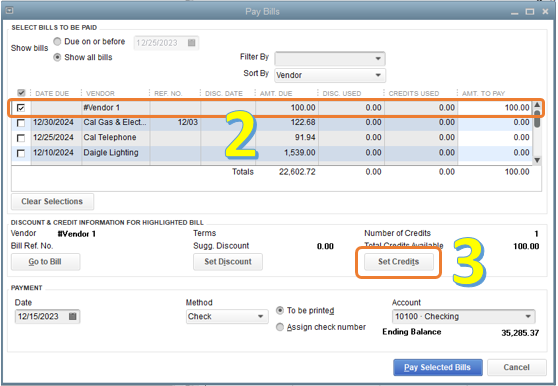

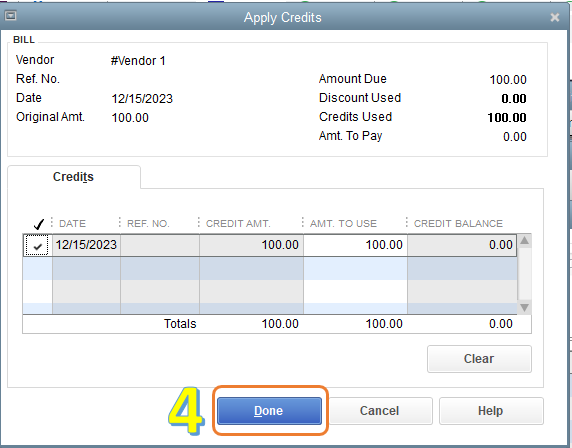

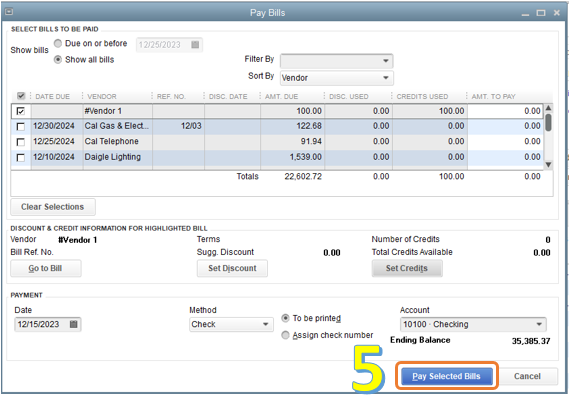

Let's do the missing steps by linking the deposit to the Bill Credit you've created. The process is quick and easy. Here's how:

You can check this article that will guide you in recording refunds from vendor: Record a vendor refund in QuickBooks Desktop.

That's it! Doing the steps will surely link your credit to the deposit.

If you have any other questions, please feel free to comment below.

Question -

Why am I doing Accounts Payable? I'm receiving the credit from the vendor who did a direct deposit into our bank account. If I do Payable, then this will just show a 0 and not be a deposit into the bank and I can't reconcile the deposit with my bank statement.

It's nice to have you back here, AZEmbroiderer.

Let me give you additional details about your concern.

We're doing Accounts Payable to affect the Vendor's accounts and show the available credits in the Pay Bills page. When you reconcile, the deposit will show in your bank. I'll show you how:

If in case you'll encounter issues reconciling your account, please refer to this article: Fix issues when you're reconciling in QuickBooks Desktop.

Feel free to comment below if you need anything else.

Thank you!

Now I know what to do should this ever happen again.

Hello, when I get to the step about applying the credit to the deposit the deposit does not show in the Pay Bills screen. How do I get the deposit to show so that I can apply the credit to it?

Thanks

My apologies, I found it. Please disregard my question

Thanks for this post!

We returned something to a vendor so put a credit in so that next time we pay a bill from them we can use the credit. Well they ended up putting a credit to our credit card instead. How do I put that to my credit card? I know I can just enter a line under my credit card for them but then it doesn't put the inventory back in. Suggestions??

Hello, LRIESBERG.

It appears that this is a duplicate post. My colleague has responded to you with some details and steps.

Check out the thread here: Direct link to the thread.

Please don't hesitate to reply if you have any other concerns with your vendors.

How do I find the deposit in the Pay Bills screen? I have created the credit in the vendor center. I have created a deposit. I have reconciled. But when I go to link the credit with the deposit the deposit doesnt show in the pay bills screen.

Hi FConst03!

Thanks for reaching out to us. I'll assist you in recording vendor refunds.

When you create a deposit, you'll want to make sure to select Accounts Payable under From Account column. Aside from that, don't forget to select the vendor's name.

In the Pay Bills window, you'll see the available credits from the Total Credits Available section. Simply click the Set Credits button to link them.

Please refer to this screenshot:

I suggest you update your QuickBooks Desktop and run the Verify and Rebuild Data tool. This can fix and prevent any unusual behavior or issues.

Also, I added this article if you need help in importing your bank transactions: Set up bank accounts for Bank Feeds in QuickBooks Desktop.

Leave a reply again here if you need more help in recording transactions. Take care!

Just saw this and thought maybe you could help me. When I go to the bank deposit screen and go to the bottom to add deposit for my vendor credit, in the account field it does not allow me to put accounts payable in their. It use to but just recently, within last month, it quit showing that. The only categories it lets me choose from are the Banking ones. Any ideas or suggestions?

I want to stop this from happening to you, @Linda Padie.

I have a solution for you to select the Accounts Payable (AP) in deposit the vendor credit in QuickBooks Desktop.

Normally, you can always use AP in depositing transactions. With this, ensure that the AP account is active. To check this, follow the steps below:

Once confirmed, go back to the Deposit page and re-select the AP in the Account drop-down. For more information, click this article: Record and make bank deposits in QuickBooks.

If the issue persists, I'd recommend running the verify and rebuild tools. Doing this will help fix the data and integrity issues within the company file.

Proceed as follows:

For complete steps, see this link: Verify and Rebuild Data in QuickBooks Desktop.

Further, read through these articles below to learn more on how to reconcile an account and manage vendor transactions:

I always check my notifications to reply to any responses. Don't hesitate to leave a comment if you have any further questions. I'm delighted to assist you again. Keep safe, Linda.

Thank you for this information. I think I failed to say I am working with QB Online so I haven't been able to find anywhere that I can do anything like this which I think is odd.

Learn how to record a refund from a vendor in QuickBooks Online.

Just got a refund for a business expense? We'll show you how to create a vendor credit.

How you enter the refund depends on how you record your purchases. Choose the section below that applies to you. If you’re not sure, ask your accountant. Or, we can help you find a ProAdvisor.

This makes sure the credit hits the expense account you use for this vendor.

Even though you aren’t paying a bill, this is the right thing to do. This last step is to keep your vendor expenses accurate.

Good afternoon, @Linda Padie.

Thanks for reaching back out and clarifying the situation.

Since you're using QuickBooks Online, all you need to do is try some of our troubleshooting steps to help fix this problem. Using a private browser or incognito window will help eliminate any glitches or errors in the system. Here's how depending on your browser session:

If this works, go back to your regular session and clear your browser's history. If not, please let me see some additional screenshots on the issue.

This should do the trick. Keep me updated on how this goes. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here