Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowPrepare the Deposits data with the following template

| DepositToAccount | Location | Entity | LineDesc | LineAmount | Account | PaymentMethod | PaymentRefNumber | Class | CashBackAccount | CashBackAmount | CashBackMemo |

| Checking | Robert | Deposit | 10 | Account1 | Cash | ||||||

| Checking | Robert | Deposit | 20 | Account1 | Check | 12345 | |||||

| Checking | Robert | Deposit | 30 | Account1 | Cash |

then utilize an importer tool

https://transactionpro.grsm.io/qbo

Welcome to the Community forum, @thomascaves32-gm.

I'd be happy to show you how to make a manual deposit in QuickBooks Online (QBO).

Here's how:

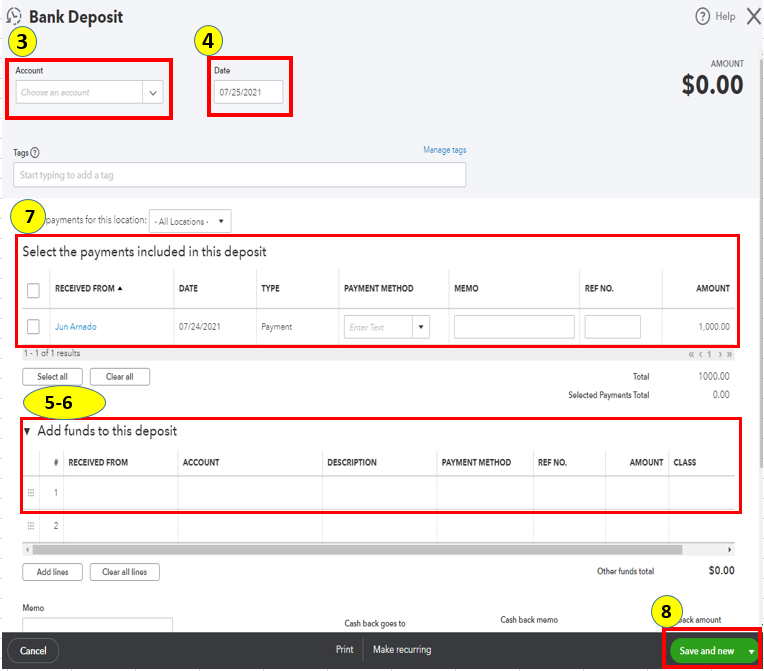

1. In the left menu, click the +New button.

2. Under OTHER, select Bank Deposit.

3. On the Account menu, select your bank account.

4. Enter the Date.

5. Go to Add funds to this deposit section.

6. Enter the necessary information.

7. If there's a deposit you want to include in the Select the payments included in this deposit, put a checkmark for that transaction.

8. Select Save and new

To learn more about creating a bank deposit, see this article: Record and make Bank Deposits in QuickBooks Online.

Here's also some resources that you may find helpful when managing bank transactions:

• Categorize and match online bank transactions in QuickBooks Online

• Reconciliation Hub for QuickBooks Online

If you need anything else, please let me know in the comment below. I'll be right here to help categorize your bank transactions. Have a good one!

Where do I then see or edit the deposit?

After entering a manual deposit, where do I see &/or edit it?

Hi there, Maryjane10.

Thank you for visiting the QuickBooks Community. I'll be sharing details to ensure you're able to see the manually created deposit in QuickBooks Online.

The account register page is where you can find all the past and recent transactions. It also includes the account history and where you can enter the deposits. This way, you can review or edit them. I suggest going to the Chart of Accounts page and find the specific bank account where the deposit was placed.

Here's how:

For further details on how you can use the account registers page to make any changes to your transactions, you can click this article: Find, review, and edit transactions in account registers.

Additionally, I'm adding this article to see detailed steps on how you can reconcile your accounts so they always match your bank and credit card statements: Reconcile an account in QuickBooks Online.

If you require more help with managing your transactions in QuickBooks, just let me know and I'm always here to help.

I made an error when I did a manual deposit. This was for a vendor credit that was credited back to my bank account. When I went to add the deposit I inadvertently put the wrong account and it has messed up my accounts payable. Also I have already reconciled this particular month. Is there an easy way to correct? When I try to correct this by changing that account it only brings up the banking info. It won't let me enter the accounts payable.

When I try to pick the account under the add deposit section it will only come up with the bank accounts. It does not show the Accounts Payable or any other part of the chart of accounts. Do I need to reset something?

Keeping your accounts updated is my priority, @Linda Padie. That's why I'm here to guide you as to how you can correct the account used for one of your deposits in QuickBooks Online (QBO).

Before we start, can you provide further details of your concern like a screenshot of the display error you have? This is to see where's the exact page you're unable to select Accounts Payable (A/P) when updating the deposit account.

When you make a bank deposit, you're able to choose the account you want to put the money into and the payments and additional funds or fees included. Based on your description of the issue above, you may unable to select the appropriate account because you've already reconciled for that particular month. With this, you can manually remove the deposit transaction from reconciliations to correct its account details. To do this, here's how:

Once you're done, go ahead and update the deposit's account details. Then, reconcile the account again to make sure it matches your bank statement and detect any possible errors. You can refer to this article for the complete guide: Reconcile an account in QuickBooks Online.

Also, to further guide you in doing or fixing a reconciliation in QBO, I'd recommend checking out this article: Learn the reconcile workflow in QuickBooks.

Keep me posted in the comments if you have other concerns about managing your deposit transactions in QBO. I'll gladly help. Take care, and I wish you continued success, @Linda Padie

Thank you for the information. The other issue I have with this is when I go into correct the bank deposit, under add deposits, which is where you enter the customer/vendor then the account, it does not let me enter anything under accounts other then the bank accounts. When I had originally done this bank deposit it was a vendor credit that was credited back to my bank account. When I added it I inadvertently put the expense account it originally went into when it should have gone to accounts payable. I am not so sure that this is not a quickbooks problem but do not know who or how to contact someone to help me with it. If any suggestions I would greatly appreciate it.

Hey there, Linda Padie.

When a browser stored a lot of caches, it could cause problems like latency issues. As an initial step, you can press the F5 key on your keyboard to refresh the page.

If you're still getting the same result, we can do some of the basic troubleshooting steps. You can use these shortcut keys depending on the browser you're using:

Once signed in, go back to your bank deposit and choose the correct account from there.

If it rectifies the issue, go back to your main portal and clear its cache to remove the browser's history or you can press CTRL+Shift and Delete key on your keyboard altogether. You may also try accessing your account using another supported browser.

You can visit the following article to know more about how deposit works in QuickBooks Online: Record and make bank deposits in QuickBooks Online.

Additionally, in case need to link a deposit to an open invoice, you can scan through this write-up: How to link a bank deposit to an invoice. You'll find detailed instructions on how to apply them as payment.

Should you need anything else, please let me know. I'd be more than willing to lend you a hand. Have a good one!

None of those suggestions is helping. My issue is that when I go into the bank deposit to enter the add to bank deposit at the bottom of the page, I put in the vendor name then the next thing is the account, which needs to be Accounts Payable, however when I go to look for that account it only gives me the option of the bank accounts. All of my other categories, i.e., liabilities, expenses, assets, are not there. I am at a loss as to what to do.

Appreciate the update, @Linda Padie. I want to ensure you can add your accounts payable account on bank deposits.

Since the issue persists even after following the suggestions above, I recommend contacting our Customer Care Support. You can work with one of our online specialists in letting our engineering team investigate why only bank account types show up even after selecting a name on a bank deposit.

You can do so by following the steps below:

I want to include that reaching out to our Customer Care Support is best during business hours from 6 AM-6 PM PT Monday-Friday. Use this article to learn more: QuickBooks Online Support.

You may also read this reference with the topics to use while working with your bank accounts and transactions: A Series of Articles that Covers Bank Feeds in QuickBooks.

I've got you covered if you've got questions about bank deposits in QuickBooks. Let me know by leaving a comment using the Reply option below. Take care always!

I’m struggling to categorize the deposit as income. In the “Add funds to this deposit” area, I enter the checks that make up the deposit, but am unable to categorize them as income. The only options available in the Account field are bank accounts, not categories of income. How to I code a deposit as income? For example, I received a check for services. I want to code as consulting income.

I've got some tips to share with you about categorizing a deposit in QuickBooks Online, @LJB3.

When making a deposit in QBO, you can select an Income account from the Add funds to this deposit field.

If you haven't created an account yet, I recommend adding it on your Chart of Accounts.

Here's how:

On the other hand, if you're unable to see the Income account you already created, I suggest performing some basic troubleshooting steps. This way, any browser-related issues will be fixed.

To start, log in to your QBO account using an incognito browser. To open it, follow these shortcut keys:

In case you're able to deposit without issues, then you'll have to clear your regular browser cache to resolve unusual browser behavior.

If issues persist, try using another supported browser.

Let me also add these helpful guides on handling deposits in QuickBooks:

Feel free to keep us updated whenever you need extra help with banking or QuickBooks. Have a good one and take care!

When I enter & save a deposit and then go back to the ledger view for that account, the Payer field is blank. How do I get it populate when I enter it the first time?

Thank you!

I’ve got you covered, @atx1.

As long as you select a name when creating deposits in QuickBooks Online, the Payee field won’t be blank. Make sure you add this information, so it automatically populates in your account ledger.

On the other hand, if it’s already added and the field is still blank, your cached data might be the reason behind this. Please know that once the browser's cached files have issues, QuickBooks functionalities may get affected. You can perform some troubleshooting steps to get this fixed.

First, open your QuickBooks account in a private or incognito window for testing. You can use these shortcuts keys below for quick navigation:

After logging in, go to your account ledger and check the field. If the payee is now showing up, get back to your regular browser and clear its cache. Doing this helps the program to run better. You can also use other supported browsers as an alternative.

Here’s a complete reconciliation guide to ensure your accounts are balanced and accurate. It includes instructions to fix issues and ways to make changes after the process.

If you need further assistance with your deposits, please don’t hesitate to add a comment. I’ll make sure everything is taken care of. Always take care!

I have chosen the bank account I want to record the deposits however it gives me an error message that I need to select a bank account. why is it not recognizing my bank?

Thank you

Cindy

I see the inconvenience of going back and forth in choosing a bank account, @Cindy N. I'm here to provide some troubleshooting to get rid of the error.

Let's start by accessing your QuickBooks account via incognito or private window. This mode doesn't retain cache, so we can verify if it is a webpage issue.

Here are the keyboard shortcuts you can use:

From there, sign in to your QuickBooks account to see if you can record deposits successfully. If it works, I recommend clearing the default browser's cache. Please do not include the cookies because they store helpful connection information. You can also use other supported browsers to isolate this issue.

See this article to learn how to enter deposits in the program: Record and make bank deposits in QuickBooks Online.

If you need to combine them as one, you can keep them in the Undeposited Funds account. This way, it will match your bank records.

Hope this goes well so you can continue recording deposits. Let us know if you have more banking concerns. Stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here