Hi there, @allwayspha.

There are different ways to record a bounced check in QuickBooks Online (QBO). I'd be happy to share them with you and get you back to working order.

If your check bounces but your bank covers it and charges you a bank fee, you can record the bank fee since the check was processed. Here's how:

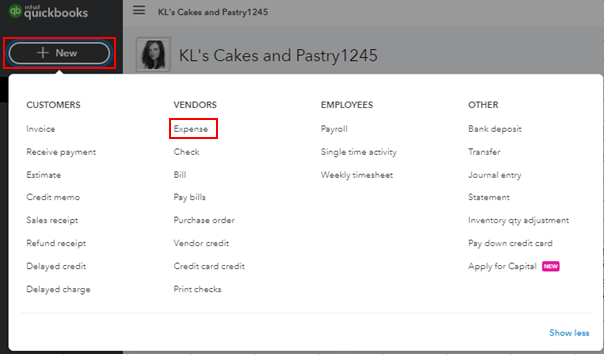

- Click the + New button, then select Expense.

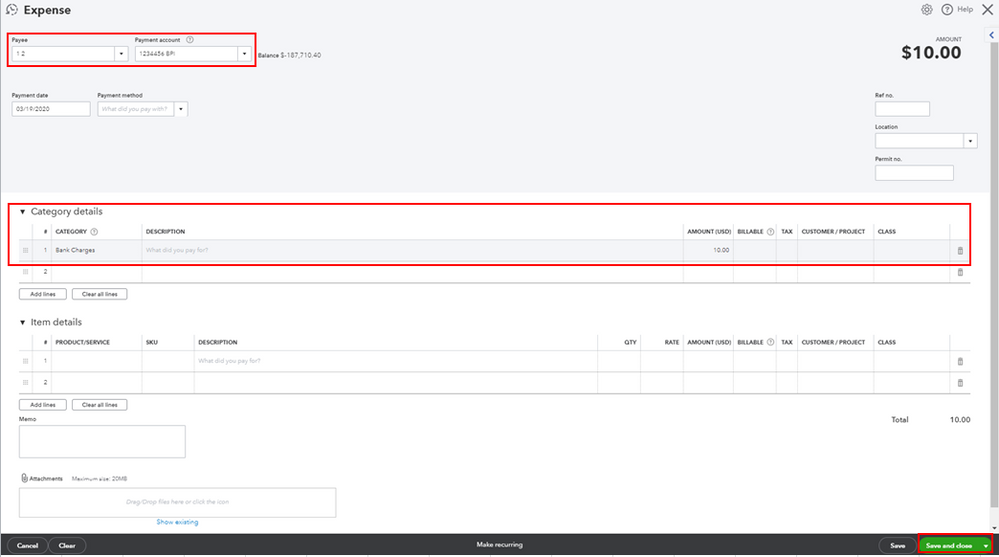

- Select the Payee from the drop-down. (Choose vendor if the bank charged it to them or bank if they charged it to your account.)

- Choose the account you use to pay expenses from the Payment account drop-down.

- In the Category column, select Bank Charges.

- Enter the amount and the necessary information.

- Click Save and close.

However, if your check bounces but your bank doesn't cover it and the vendor returns the check without redepositing it, you can void it and record the bank fee.

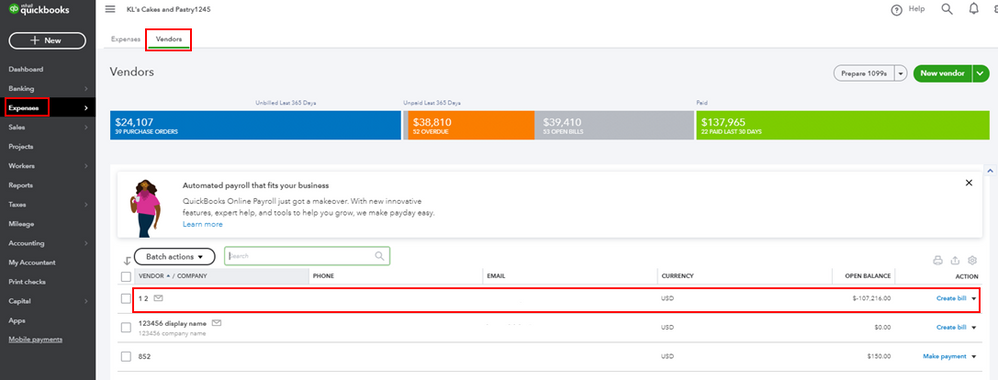

- Select Expenses from the left panel, then choose Vendor.

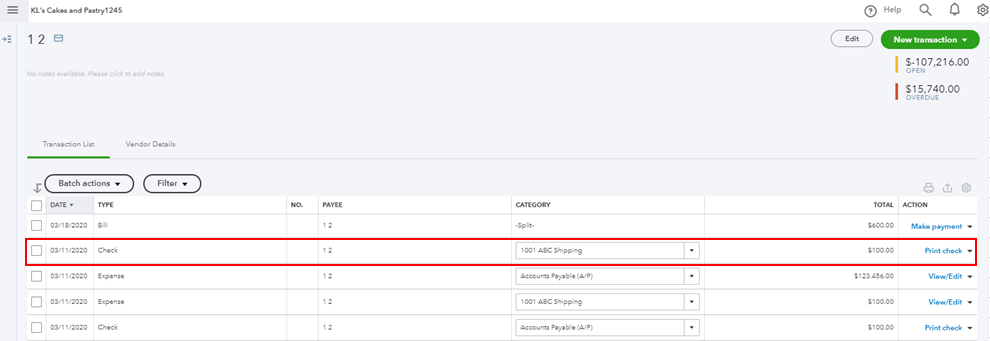

- Click the vendor you paid, then find and select the bounced check.

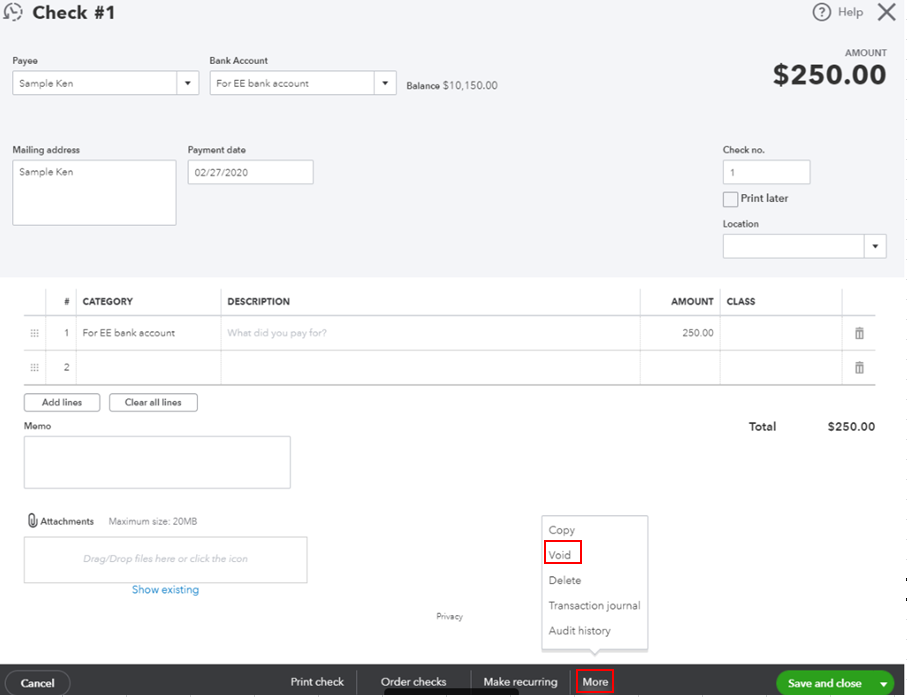

- From the transaction page, click More and choose Void.

- Select OK to confirm.

Once done, you can now record the bank fee. Please follow the steps above on how to record bank fees.

If your check bounces but your bank doesn't cover it and the vendor keeps redepositing the check, you can check out this article for the detailed steps and information: Record your bounced check.

You might also want to read these articles to learn how to record bounced check through different ways:

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Wishing you all the best.