Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThis is my problem, on the top it states ending balance different from what the balance on the bottom on the last day of the month when transaction occurred, I want the top to read the bottom of the last transaction that occurred, on the last day of the month.

Thanks for chiming in the thread, @Judy D1.

Can you tell me a little more about what you need help with? Thus, I want to offer support on whatever issues you may have in QuickBooks Online (QBO).

You can check out some of these articles to help you out:

I want to make sure that you're able to get your problem fixed as soon as possible. I'm always here to lend a helping hand. I'll be back around shortly.

I am having the same issue with a difference amount but it matches the bank statement.

I have searched for the 242.26 amount and it was not found.

I also went and all of the transactions are showing a blank status (so I can reconcile)

What is the next step to find the difference?

I appreciate you joining the thread, Shaundra2. Let me share some solutions to find or fix the discrepancy when reconciling your account.

Aside from checking for duplicate transactions and edited/deleted entries, I recommend examining your account's opening balance to determine the discrepancy. The opening balance plays a big role in your financial record. If it’s incorrect, it affects all following reconciliations.

To start, review the opening balance in QuickBooks:

If you forgot to enter an opening balance, enter it manually using a journal entry.

Now that you have the opening balance information, compare it to your bank records:

If the opening amount in QuickBooks does not match your bank data, make the following changes:

Once the balances match, you can go to your account's register and ensure that the Opening Balance Equity is reconciled (R).

This page will also guide you on what to inspect before you begin your reconciliation: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Leave a remark below if you have follow-up questions about your reconciliations or bank data. I'm only a few clicks away from assisting you once more. Keep yourself safe!

I'm hoping that you can help. I've reconciled my account several times and this month i went in and my beginning balance is all of sudden over by over $12,000. When I hit "help me fix it", there's only one check that shows that it was deleted after reconciling but that amount was only $560. There are no other items listed. What else can I do? I went back and checked that everything in my last statement was in fact still reconciled and I also looked into my bank register to see if anything had been changed to C from R and I don't see anything. Can you help?

Help has arrived, @acmlslong. I’ve got some fixes to get this beginning balance issue settled.

Before that, let me share the causes of why the beginning balance is incorrect. These are the following:

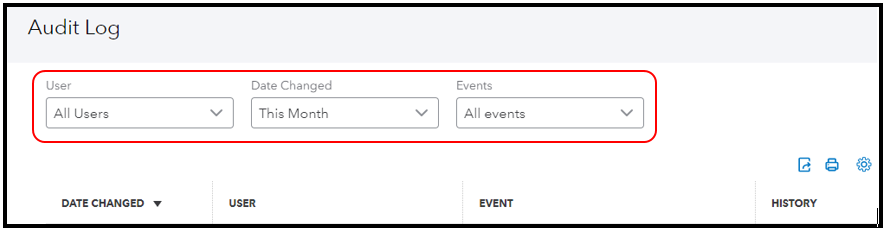

Aside from checking your statement and bank register, review the original opening balance and categorize all transactions to get your final and correct beginning balance. Then, use the Audit log feature to track any updates, especially the amounts that made this occurrence.

Here’s how:

See step 4 in this article for complete instructions on how to check and edit the events: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

If everything is accurate and intact, try to open your account in an incognito or other supported browser to sort this out. If the balance is correct, get back to your regular browser and clear its cache. Doing this helps your program run smoothly.

You can use these resources to get more insights on how to manage your accounts, reconciliation, and discrepancies properly:

You can always get back to this thread and add comments if you need further assistance with your reconciliation. I’m ready to lend a hand to ensure all concerns are covered.

I've tried several of your suggestions and here is what I've learned...

1. When I go in and run an Audit Log I see that deletions were made to entries beginning 6/16 - 7/14, including a Journal entry! I know that I didn't do this. However, I do remember that there was a glitch in the system and I kept having to hit refresh to manually add in my checks, etc. Could this have something to do with that?

2. When I hit "we can help you fix it" after getting the caution that my beginning balance isn't correct, the discrepancy report ONLY lists ONE check as being deleted and it does not match the amount that I'm off. When I look at my bank register it's still there and says "R". Additionally, when I go through steps to add it back in as per your directions, it tells me that there's already a check in the system with that number?

Could there be a bug in my system or have I done something incorrectly?

So something seems terribly wrong... Two things to note:

1. When I run the audit log, I see 74 transactions deleted over the past month -- include Journal Entry 1! I know that I did not go in and delete these. I do recall that I was having a problem with quickbooks and for awhile had to hit "refresh" every time I wanted to enter something. Could this be related in some way?

2. When I go to my bank account and hit reconcile, see the alert for the beginning balance discrepancy and hit "help me fix it", the report only generates one listing of a single check that was deleted -- yet it is showing up in my back register (as are the other transactions that were supposedly deleted) saying it has been reconciled. Despite this I attempted to add the check back in and I was alerted that, sure enough, another check already exists with this number.

Could I have a glitch in my system?

I appreciate you for coming back and providing further details, acmlslong.

Refreshing QuickBooks shouldn't normally delete existing transactions. The help me fix it link should also include all the affected transactions.

I suggest reviewing the username of the individual who performed the deletion. The Audit log functionality provides information about the user responsible for the action.

Still, I want to clarify if the deleted transactions from the Audit log correspond to the ones in your register that were marked as reconciled. If yes, we can perform an initial approach to isolate this behavior, as advised above.

To begin, use a private browser to avoid unusual behavior that may arise from frequently visited websites. Here are the shortcut keys:

Additionally, you can access your QBO account to a different web browser to see if the problem persists. It can help identify if the issue is specific to your current browser or device.

On the other hand, I recommend consulting your accountant to help you check your account and making sure it's accurate.

Please feel free to stay in touch, and we'll be here to offer further assistance if you require any help with balancing and reconciling your account in the system. Take care and goodbye for now.

I opened up my account in a private browser and got the same results. Just to clarify.... the audit log shows that it was ME who made the deletions, however I never intended to and don't know how that could have happened unless I did something wrong when "matching entries" or something? But again, these items are showing up in the register as reconciled so I can't even add them back in.

I appreciate all your time and efforts in trying to correct your beginning balance issue, acmlslong. Let me direct you to the appropriate support that help assist you in resolving your concern.

Since the register indicates that the transactions have been reconciled, I suggest speaking with your accountant for more guidance. They can advise you on how to resolve the discrepancy so the next time you can reconcile your account easily.

I've attached some resources that will guide you on how to troubleshoot opening and beginning balances issues:

You can utilize these articles to help you enter and manage an opening balance for a bank, credit card, and other types of accounts:

Fill me if you have any clarifications about the reconciliation process or questions about a specific QuickBooks task. I'll get back to assist you further.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here