Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello

I use three integrations: Quickbook Desktop, Quickbook Point of Sale and Intuit payments.

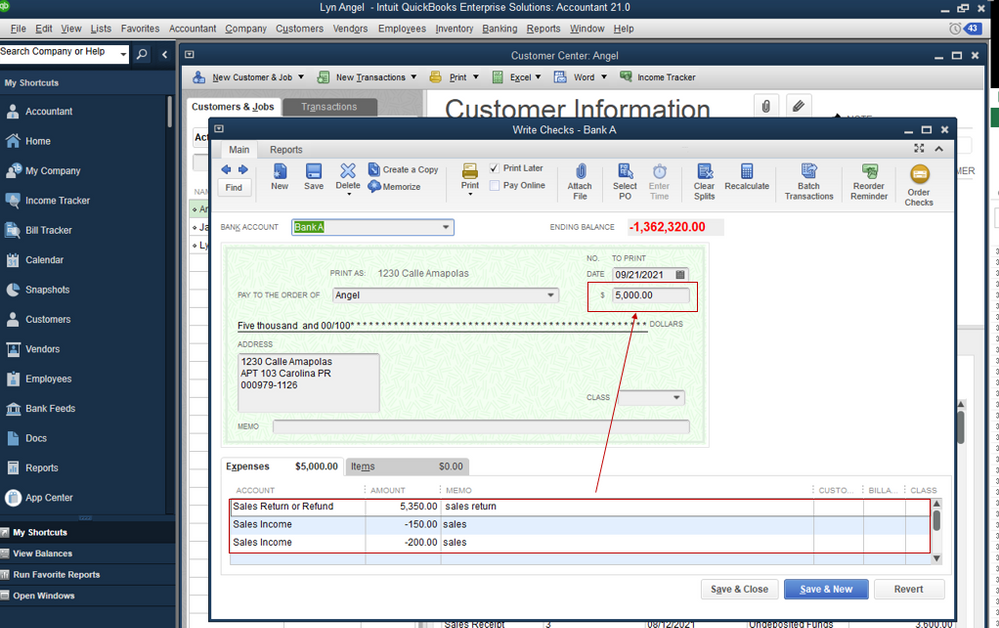

On one of the day there are certain receipts and a big sales return for example net amount is $5000. This amount is deducted from my bank by Intuit. I need to match this amount in my bank feeds to corresponding sales and sales returns. I am not sure how to do this. Lets say there are 3 transactions: sales of $200 and $150, and sales return of $5350.

Could someone please help me?

Thank you for adding a post, @dhavalkakadiya. I'm here to help you with matching your banking entry to the sales and sales returns.

First, please make sure to record the sales and the return in QuickBooks. Here's how:

You may also seek assistance from your accountant for other ways of recording the transactions. Once done, proceed with matching the entries through the Banking Feeds. I'm adding this article as your reference: Add and match Bank Feed transactions in QuickBooks Desktop.

After that, please make sure to reconcile your account to keep your books and balances correct.

Let me know how else I can help you with matching your transactions. I'm more than happy to provide additional assistance. Wishing you a good one!

Got this. I think this is just half done.

The transactions which is fetched from Quickbook POS into Quickbook Desktop would still remain unmatched.

How do I do if I want to match and close those as well?

Thanks for the prompt reply, @dhavalkakadiya.

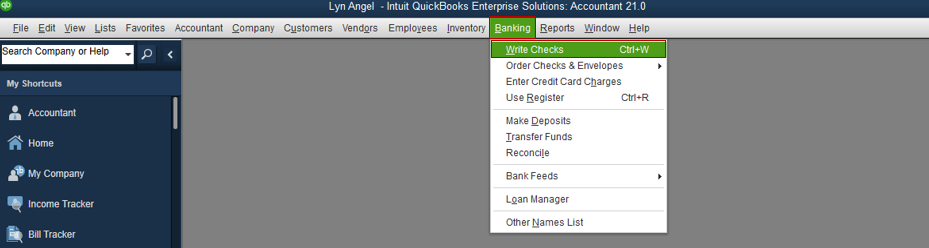

Allow me to chime in and share some insights on how you can match those transactions in your QuickBooks Desktop (QBDT). All you need to do is go to your Banking menu and match those transactions. I'll show you how:

To be guided through the process, check out this link: Add and match Bank Feed transactions in QuickBooks Desktop.

Once you're done, you can now reconcile your accounts whenever you're ready. I'd also recommend checking with your accountant for additional guidance. This way, we can guarantee your accounts are well accounted for. If you're not affiliated with one, you can visit our ProAdvisor page and we'll help you found one from there.

Keep me in the loop if you need more help matching your transactions. You can also add in your reply if you have any other QuickBooks concerns. I'll be more than happy to help you out!

Not sure if you got this correctly.

let me specify again, when I open deposits and click make deposits in merchant service deposits I see these transactions waiting to be matched. Will it create any potential issue?

I request you to read whole issue with this query.

I appreciate you for getting back, @dhavalkakadiya.

Once everything is settled and matched in QuickBooks, then there shouldn't be issues with your balances. If your transactions are still waiting for matched through the Merchant Service Center, I would recommend reaching out to our Merchant Team for further assistance. A live representative can look into your account securely and verify the status of the transactions.

For the support's contact information, open this link: Contact Payments or Point of Sale Support.

If you have any other follow-up questions, let me know by adding a comment below. I'm a post away to help. Keep safe!

It is not matched yet. I believe I am unable to make it clear somehow.

Let me try again from scratch. I would urge to understand the issue properly please.

I use Quickbook Point of Sale and Quickbook Desktop. Both are integrated. All sales are recorded in Quickbook POS and then pushed into Quickbook Desktop from Quickbook POS. Payments are received through Intuit. Intuit processes combines all receipts and pays in my bank account through a single transaction. My regular flow is I see sales receipts in bank feeds and I match it to corresponding bills pushed from Quickbook Point of Sale (hope all clear until here).

In one of the instance on one of the day, I had two small sales receipts of $150 (invoice) and $200 (invoice) but a sales return of $5000 (credit memo). Here, Intuit has combined all sums and deducted $4650 from my bank account.

As soon as I select 'match' in my bank feeds, I only see accounts payable entries waiting to be matched since this is a payment.

How do I reconcile here? in such a way that the amount gets recorded and three transactions are reconciled and not double counted in the financials.

Thank you for providing further details on your concern, @dhavalkakadiya.

I understand how important it is to have correct balances in business. I'm here to make sure your account balances in QuickBooks Desktop are corrected speedily.

With this, I'd recommend contacting our Customer Care Team. They can make a screen share on your account and provide additional help to resolve your balances. This way, you can reconcile your bank accounts in QuickBooks as soon as possible.

Here's how:

Make sure to contact them within business hours to ensure a swift response.

I've included articles on how to resolve reconciliation errors and some QuickBooks Payments FAQs:

If you need anything else, please let me know in the comments below. I'd be glad to help you out again. Stay safe, @dhavalkakadiya.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here