Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowActually, the problem still occurs even if I enter the deposit manually.

My bank account is not increasing because the deposit that I am making is entering as a debit and credit.

Hey there, @George Cristaff.

I appreciate you coming back on this thread. Allow me to point you in the right direction to get this handled.

If sure still having trouble, I recommend contacting our Customer Support Team to receive more details about your issue. Here's how:

It's that easy!

Keep us updated on how the call goes. I'll be waiting for your response!

Did you solve this issue? I am having the same issue

Did you end up solving this issue? I am having the same issue.

I know this advice is 3 years old, but it just helped me correct the same exact problem as the original post. My deposit was also showing as a payment and I realized that I selected our Operating Account (an expense account) under "Account" when I should have selected "Unapplied Cash Payment". THANK YOU!

Hello there, @stacy999. It's great to hear that the provided advice before works well for your concern.

We're also so glad to hear that it resolved the issue you encountered without any further issues.

Know that the Community is always here to back you up. If you have more QuickBooks-related questions, don't hesitate to post them here in the forum. Have a great day!

I am having this same problem, and the solution that is offered makes no sense to me. I have my accounts automatically updated from my bank. when I transfer money from my trust account to my checking account, the payment shows up in my "for review" of Quickbooks. I confirm the payment. But then Quickbooks (NOT THE BANK) sets up both a payment and a deposit into my trust account, canceling each other out and thereby leaving an invalid balance on my Quickbooks trust account. When I delete the invalid "deposit", QB deletes the "payment" from the register as well. As I read your "solution", the solution involves my "excluding" all these transfers, and re-entering them manually, which kind of defeats the purpose of having my Quickbooks automatically updated by my bank.

Hi, @ejinayoshi.

Let me help you correct the records this way, we can ensure that only one transaction appears in the trust account.

let's start by undoing the transactions in both your checking and trust accounts. To begin, we'll address the trust account transaction and record it as a bank transfer to your checking account.

Here's what you need to do:

When you follow these steps, the system will automatically match the checking account transaction and trust account. As a result, you will only see one transaction in the checking account register.

We'll also add these articles for future use:

If you have any questions about managing your banking or any other concerns related to our product, please leave a message below. I'll be here to help you.

Hello,

The only way I can find to add deposits in QB On-line is through bank deposits, but these now show up as debits. There is no way to add a deposit that doesn't have a chart of accounts type of "bank", that I can find. I created two new chart of accounts, one "income" and one "accounts receivable", and neither of them are an option with bank deposit.

How do I add monthly sales receipts in QB on-line without them being "bank" deposits and showing up as debits???

There are many ways to record income and deposits, depending on the specific situation, @VTGCR. While the Bank Deposit feature is designed specifically for recording money deposited into bank accounts, there are other methods to record income that don't necessarily involve immediate bank deposits. Let's look at the different options and see how they work in QuickBooks Online.

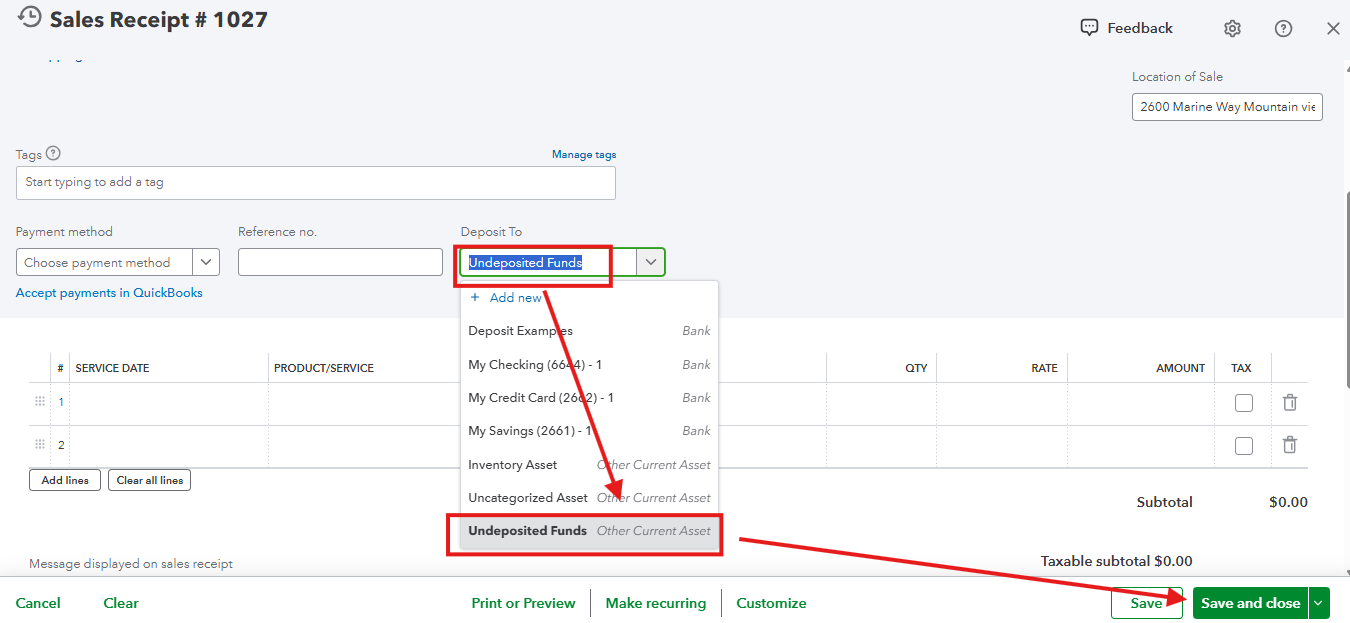

Firstly, the Bank Deposit feature is used when recording money entering your bank accounts. Since not all income goes directly to a bank account in your case, QuickBooks provides multiple ways to record income and deposits. Here's how you can do it.

To create a sales receipt:

You can find more details on recording income to Undeposited Funds in QuickBooks Online by referring to this guide: Deposit payments into the Undeposited Funds account in QuickBooks Online.

These methods allow you to record income to your income accounts without creating a bank deposit right away. Later, when you deposit the money in the bank, you can use the Bank Deposit feature to transfer the money from Undeposited Funds to your bank account.

However, it’s key to understand that Undeposited Funds is an asset account in QuickBooks. Whenever this account increases, it shows up as a debit entry, indicating an increase in your assets.

If you prefer not to see transactions as debits in Undeposited Funds, you can use a Journal Entry to record your income directly to allocate amounts to specific accounts. Make sure to consult with your accountant for accuracy and additional guidance.

Additionally, if you want to review your past bank deposits in QuickBooks Online, you can learn more through this article: Record and make bank deposits in QuickBooks Online.

If you have questions about bank deposits in QuickBooks, leave a reply to this thread below. I'm here to help you.

Hello,

My bank is NOT integrated with QB because my business is Cannabis and for what ever reason Intuit severed this function. I want to enter Sales Receipts for an entire month as a deposit or as INCOME. The only way I can see to enter a deposit is via "bank deposit", when I do this, it shows as a debit on the PL. I added new "chart of accounts" of "Sales Receipts as INCOME" and Sales Receipts as AR" and neither is an option to choose when entering a deposit. There isn't a single customer. it is for thousands of customers over a period of a month. How do you enter receipts in QB and show as a credit? When I entered a sales receipt for customer "Monthly Sales", it is canceled by the bank deposit. Why would a deposit ever show as a debit instead of credit?

VTGCR

I am having the same issue. In the review tab the transaction shows up as 1 item, in this case a withdrawal. When i go to reconcile, it is now 2 transactions a withdrawal and also a deposit. When I delete the incorrect deposit transaction from the reconcile account, both the withdrawal and deposit are deleted and the withdrawal shows up in review transactions again. These are transactions downloaded from the bank.

Hi, Karon2. Let's take a closer look at your withdrawal and deposit transactions to make sure everything is accurate during reconciliation.

These transactions might have been categorized under the same bank account, which is why they’re linked. This also explains why deleting the incorrect deposit will automatically remove the withdrawal tied to it.

To fix this, we need to make sure the deposit isn’t assigned to the same bank account as the withdrawal. For example, if the withdrawal was categorized under the Checking account, the deposit should be made to a different account other than the Checking account.

If you're unsure which account to select for categorization, it’s a good idea to reach out to an accountant or a QuickBooks Certified ProAdvisor. They can walk you through the proper process and help ensure your books are accurate. You can also check out this article for more details: Categorize online bank transactions in QuickBooks Online.

Once everything is fine, you can proceed with reconciling your account.

For even easier bookkeeping, consider trying QuickBooks Live Expert Assisted services. With their help, you can streamline processes like matching and categorizing transactions, as well as reconciling accounts, saving you time so you can focus on growing your business!

If you have any further questions or need assistance, simply click the Reply button. We're here to assist you always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here