Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

I'd like to add a few more details, BookkeeperMKE.

As mentioned above, if your bank register balance in QuickBooks Online doesn’t match your actual bank balance, several factors may cause the balances to vary:

This article will help you understand the cause and how to resolve these issues: How to Fix Differences Between QuickBooks Balance and Bank Balance.

If your financial institution is connected, you will unlikely see the bank balance and QuickBooks balance match. Our program is dependent on what your bank shares. Each financial institution has different time increments when they send the transactions. Having said that, the reason behind this is timing.

This is the same when you're manually importing transactions. It will not match since the bank balance will not be updated.

I'll add the reference on how to match and categorize bank transactions in QuickBooks Online. This will help you review these transactions after being downloaded or imported.

You can also get QuickBooks-certified bookkeepers to help you manage balances and other tasks:

Check out QuickBooks Live.

If any questions arise, please feel free to leave a comment below.

This question was for QB Online.

Hi @user21876,

If your bank register balance in QuickBooks Online doesn’t match your actual bank balance, several factors may cause the balances to vary. You would need to verify why they don’t match, and fix them accordingly.

Balances may not match for a number of reasons:

Please check this article to find out the recommended fix for the mentioned reasons: How to Fix Differences Between QuickBooks Balance and Bank Balance.

If you’re still having problems with mismatched problems, you may also read these articles for further help:

I’m always here to assist you if you have other concerns. I’m just a post away.

Hi @DarellA

Thank you for this response. My issue is slightly different. I use the global version of Quickbooks Online as such my bank is not listed in QBO when connecting my bank account. As such, I downloaded a CSV file from my bank and used CSVtoQBO software to convert it. Where i went wrong was I did not enter the opening balance in the software and uploaded the qbo file to my Quickbooks Online account. Now, My "In Quickbooks" balance is correct and spot on with my actual bank balance however my "Bank Balance" in Quickbooks online is incorrect with a difference of the opening balance.

How do I correct this? I have not done a reconcile yet as this is the first month of my subscription.

Thanks for joining this thread, deycomin.

I do have the steps to help you get back to business. To enter the opening balance, you can create a journal entry by following these steps:

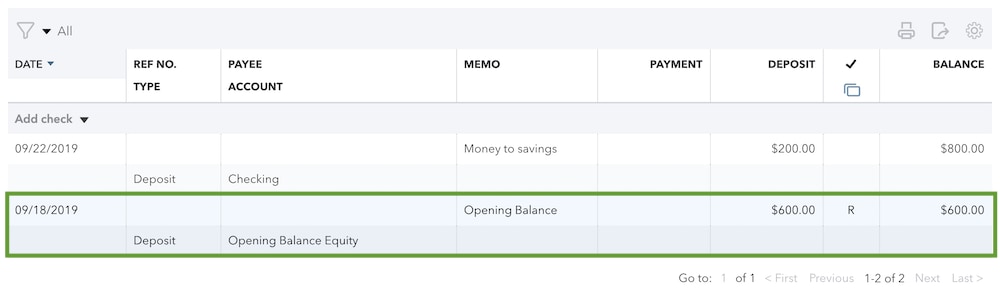

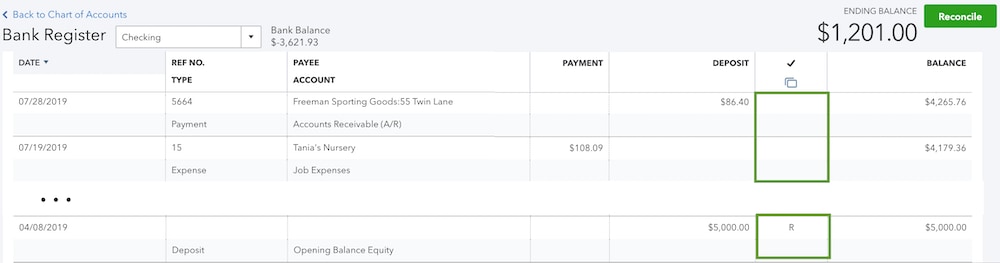

Once done, make sure to manually reconcile the transaction in the bank register. This way, the beginning balance shows up in the reconciliation page.

Here's how:

Please see sample screenshots below:

To view the detailed instructions, you can open this article: What to do if you didn't enter an opening balance in QuickBooks Online.

When you're ready to reconcile in the future, here an article link: Reconcile bank accounts in QuickBooks Online.

I'm just a few clicks away if you have any additional questions. Have a great day!

Hi @RenjolynC

Thank you so much for the response. I realize now that my explanation was not clear and I apologize for that. Where I said:

" As such, I downloaded a CSV file from my bank and used CSV2QBO software to convert it. Where i went wrong was I did not enter the opening balance in the software and uploaded the qbo file to my Quickbooks Online account. Now, My "In Quickbooks" balance is correct and spot on with my actual bank balance however my "Bank Balance" in Quickbooks online is incorrect with a difference of the opening balance."

I forgot to advise that I was a QB Desktop user. I subscribed to QB Online and imported my customers (and their balances), Products, Suppliers and Chart of Accounts manually. As such, the Bank account was imported with the chart of accounts with the Opening Balance Equity of $928.05 which is correct. i could not connect my bank at the time as my bank is not listed with Intuit QB Online. This is now where my quote above comes into play. When connecting the bank manually, the CSV I downloaded from my bank got an "Invalid File Format" error. I used software called CSV2QBO to convert the CSV to QBO format which was accepted however, in the conversion to QBO, I forgot to enter the starting Balance of 928.05. Therefore, balances were imported from the QBO file into QB Online without it. Now, my ACTUAL bank account, my "In Quickbooks" and Chart Of Account balance are identical at $1,369.76 which is correct but because there was no opening balance in the import, the Bank Balance in Quickbooks is showing $441.71 which is a difference of $928.05, the opening balance. How do I adjust the Bank Balance to correct the $441.71?

Whew, a bit long but I hope you can help.

I appreciate the detailed information, Deycomin. Let me ease your confusion.

The Bank balance and In QuickBooks balance will not be the same when transactions are imported manually. The Bank balance will only be changed or updated if the account is connected to online banking. The In QuickBooks balance will also depend on the added or matched transactions.

That being said, it's normal when you use WebConnect or CSV files.

If you have additional questions, please don't hesitate to drop a comment below.

Did you ever get the balances to equal?

I'd like to add a few more details, BookkeeperMKE.

As mentioned above, if your bank register balance in QuickBooks Online doesn’t match your actual bank balance, several factors may cause the balances to vary:

This article will help you understand the cause and how to resolve these issues: How to Fix Differences Between QuickBooks Balance and Bank Balance.

If your financial institution is connected, you will unlikely see the bank balance and QuickBooks balance match. Our program is dependent on what your bank shares. Each financial institution has different time increments when they send the transactions. Having said that, the reason behind this is timing.

This is the same when you're manually importing transactions. It will not match since the bank balance will not be updated.

I'll add the reference on how to match and categorize bank transactions in QuickBooks Online. This will help you review these transactions after being downloaded or imported.

You can also get QuickBooks-certified bookkeepers to help you manage balances and other tasks:

Check out QuickBooks Live.

If any questions arise, please feel free to leave a comment below.

"What do you do when your bank register balance does not equal your chart of accounts bank balance?"

Nothing. Ignore. And move on.

Already explained various reasons why that happens and there is no way to retroactively go back and fix them. Stuck. This is a known glitch in QBO bank feed balance since day-1.

What matters is the QuickBooks balance in the bank register. And you reconcile the account.

Seriously? You just ignore ignore it? We pay several hundred dollars a month for this software. If I am looking at my chart of Accounts I should be able to have an understanding of what is going on financially....particularly during this Pandemic. It is unacceptable that the balances don't match.

@vpcontroller wrote:"What do you do when your bank register balance does not equal your chart of accounts bank balance?"

Nothing. Ignore. And move on.

Already explained various reasons why that happens and there is no way to retroactively go back and fix them. Stuck. This is a known glitch in QBO bank feed balance since day-1.

What matters is the QuickBooks balance in the bank register. And you reconcile the account.

Hi y'all!

It seems there are different issues stemming from the original question.

Something to understand at the base is the "Bank Balance" & "In QuickBooks" may not always equal or "balance". Bank balance is what the bank is showing as the ins & outs of transactions. In QuickBooks is based on the check register.

If there is a beginning bank balance due to a conversion that is NOT entered in the check register, then whenever there is a bank reconciliation started, there will not be a reconciliation possible.

In order to correct the problem, verify the bank balance as of the date of conversion and make that entry into the check register. In other words, the balance before the bank reconciliation must be entered, in order for a reconciliation to be possible.

If there is a conversion on 3/15/19 with a bank balance of $39, but the bank balance on 3/16/19 is $40, there needs to be an entry for the $1 difference, in order to reconcile the bank account on 3/31/19.

However, using that same example, the Bank Balance feed may show $39, while the In QuickBooks may show $40, because until the $1 appears at the bank, the only place it exists is the check register.

It's OK for the Bank Balance and In QuickBooks to not balance on a daily basis, because outstanding checks are not present at a bank, until they're cashed. However, the bank account amount on the Chart of Accounts SHOULD match the In QuickBooks amount on the same date, because that amount is based on the bank register ONLY and not what appears at the bank.

Hope that helps!

Paula

Thanks for explanation, but my issue is that before I came I see that some items was not reconciled in 3 different years. I know I can clear them but it doesn't change the money value. My account says one amount and quick books says another because of the un-reconciled amounts. Is there a way to reconcile them or fix it? Thanks

Thank you for joining the thread, @Lady2bug.

The bank and QuickBooks balances don't match because of the manually created transaction. When reconciling, compare the list of transactions on your bank statement with what's in QuickBooks. Once done, we can manually reconcile the transaction in QuickBooks Online.

Here's how to manually reconcile:

You can also refer this article to check issues when reconciling: Fix issues when you're reconciling accounts.

Don't hesitate to leave a comment below if you're referring to something else or if you have any other questions. Have a good day!

I can not ignore it and move on, my accountant wants answers as to why the bank register balance and the bank account do not match. Unacceptable answer.

Hello, @April Union.

There are several possible reasons why your bank balance does not match. I can share some information to resolve this.

Let's start by reviewing the opening balance in your account to make sure it's correct. Here's how:

If there's an opening balance, let's make sure that it has the correct date and amount. While if there's no opening balance equity recorded, you can enter it by creating a journal entry. You can refer to this article for the detailed steps: What to do if you didn't enter an opening balance in QuickBooks Online.

On the other hand, you may have transactions that were not supposed to be reconciled. Let's run the previous reconciliation report to review it one-by-one. Here's how:

To correct the reconciled period, you can undo the reconciliation process. For more insights, you can use this article: Undo and remove transactions from reconciliations in QuickBooks Online.

Lastly, you'll want to review your list of uncleared and cleared transactions. You can look into the in-depth explanation that @PaulaS shared in this thread.

Always feel free to leave a comment below if you have other questions about managing your income and expense transactions in QuickBooks.

HI

I've picked up this thread as I have a problem with a client on QBO - they have made changes to items previously reconciled in the 31 March 2020 rec and the Trial Balance bank value is different from what is shown on the reconciliation for Register Balance. This applies to the TB for 31 March and also currently.

Is there any way to fix this without unreconciling back to 31 March?

Cheers

Phil

Thanks for joining this discussion, @PhilG,

If the adjustments made creates a discrepancy in the bank balance, you must undo the reconciliation. You need to go through this method to make sure the register's balance matches the bank statement and the trial balance.

The steps are simple. Add the adjusted amount in the register and manually reconcile it. Here's how to mark a transaction as reconciled:

This Community guide has all the information about manually undoing a reconciliation: Undo and remove transactions from reconciliations in QuickBooks Online

Please note that the ending balance of a reconciliation becomes the beginning balance of the following period. Every adjustment made to a previous reconciliation that changes the register's balance requires reconciling the following period again.

Check out our Resource Centers for tips on how to use QuickBooks at its optimum:

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Feel free to message me back. Have a great week ahead!

Hi,

I just got this trouble. I had to transfer some transactions to QB manually and couldn't wait until the set up automatic transfer. Now my bank balance is 0 in QB. This is a big bug!

Hi there, szarei.

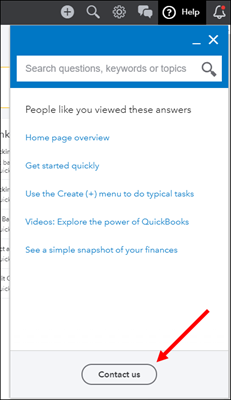

Thank you for stopping by the QuickBooks Community. I'm happy to help get you in the right place. My recommendation to you would be to reach out to our support team. This is because they will be able to dive into your personal account with you in a private setting, determine the location of your transactions and help you come up with a good strategy on how to make sure your books are in order, whether that be deleting the transactions you manually entered or reaching out to an accountant. To reach them, follow these steps:

If you'd like to skip reaching out to support, you can also reach out to a ProAdvisor. They're accountants that are also trained in how to use QuickBooks. Visit our Find a ProAdvisor website to see if there are any local Advisors in your area.

I'm also including a helpful link, should you decide to delete or void the transactions added.

If you have any other questions, feel free to reach out here. Thank you for your time and have a nice weekend.

Hi Jen_D,

You said, "Please note that the ending balance of a reconciliation becomes the beginning balance of the following period. Every adjustment made to a previous reconciliation that changes the register's balance requires reconciling the following period again."

I'm hoping you can help me with an issue that I'm having. The company I now work for had hired an outside bookkeeping company. This company had saved 5 copies of the same month's reconciliation, all with different end dates within the same month. I discussed this is our accountant, and it was agreed there should be only one copy of the month's reconciliation, so our accountant used the "batch undo" function to undo all of the month's reconciliations.

Now, when I try to do the reconciliation again, it says the beginning balance is out by roughly -$40,000. I've followed the steps in "We can help you fix it", but that hasn't changed anything. I've gone through the bank register to make sure all of the transactions are there and "cleared" and that hasn't made a difference either.

When I look at the last reconciled month, the ending balance is correct as to what the beginning balance should be. Do you have any thoughts why there is this error between the ending balance and why I'm being told my beginning balance is out by so much?

We are using QBO.

Thanks in advance!

Hello @MJW3,

You're on the right track, clicking the We can help you fix it hyperlink is the first step to take when you bump into an issue with reconciliation. Learn more about how you can fix it: Fix beginning balance issues if you've reconciled the account in the past QuickBooks Online.

Since you're unable to determine the cause of your beginning balance issue, let's pull up your reconciliation report to determine why you are off with such a great amount of transactions for your next reconciliation. Let me show you how.

Additionally, you can also browse for the content of this helpful article for a compilation of references you can use while working with your reconciliation: Use this guide anytime you need help doing or fixing a reconciliation.

If you have any other concerns, please let me know by leaving any comments below. I'll be here to lend a hand. Stay safe!

Hi @JonpriL,

Thanks for the reply. I've pulled up the reports, and everything looks to be in order. How would I be able to find a discrepancy within the reports, if there is one to be shown?

I've gone through the articles as well, but nothing seems to be of help to me.

Is this issue I'm having related to the fact that my accountant hit and confirmed "undo" on a few completed reconciliations?

Can an accountant also "Redo" reconciliation that has been undone?

What happens to a reconciliation when one confirms the "undo" function? Is "undo" different than "delete," or is it gone for good?

Finally, I've attached what I see when I follow the "We can help you fix it" hyperlink. Any further advice on what to do when there is no data?

Thanks again,

Melody

Hi @MJW3,

Yes, you can review the transaction changes base on the list shown on the report. You can compare each of them from what is listed on your bank statement to identify what if the discrepancy all about.

Also, when your accountant undoes a reconciliation, all transaction status within the period will go back to the initial entry when recorded in the register. I'd suggest reaching out to your accountant so you can work with your reconciliation.

Lastly, the We can help you fix it hyperlink will list the changes made within the reconciliation period. Since it doesn't show any, I'd say you'll have to start from the very first statement for your reconciliation.

Tag me again if you need some clarifications with your reconciliation. All of us here in the Community is ready to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here