Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHello there, wak0511.

If you're using QuickBooks Payments, it's possible that the account you selected where to deposit your payments is the Undeposited Funds. You'll want to select a bank account where payments are deposited.

You can check out these articles for more details:

Let me know if you need more help. Take care!

The payments are matched to invoices and but not removing themselves from undeposited funds appropriately. Usually it shows in and and out of UD so that account stays at zero. It keeps growing with this issue.

Thanks for posting here, @wak0511,

If you're using QuickBooks Payments, the system will auto-assign the customer payments into the Undeposited Funds account.

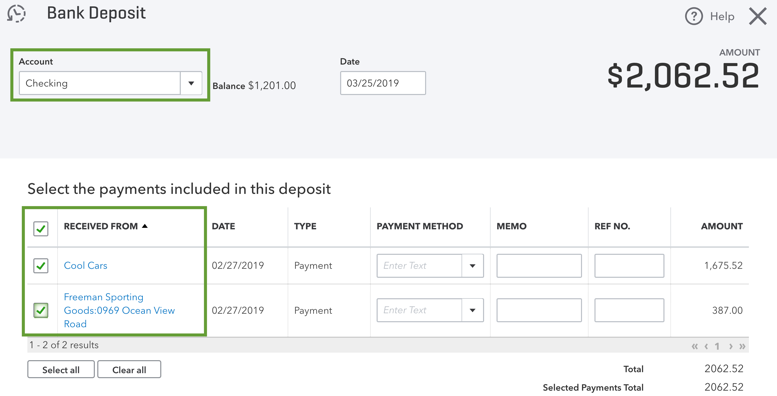

In order to match it to the online banking entries, you'll need to create a bank deposit. This process will move the funds to the register and zero out the UF balance.

Here's how:

However, if this isn't the case for you, I recommend contacting our Support Team to get further assistance. They can look into your account and help ensure you're able to match everything appropriately.

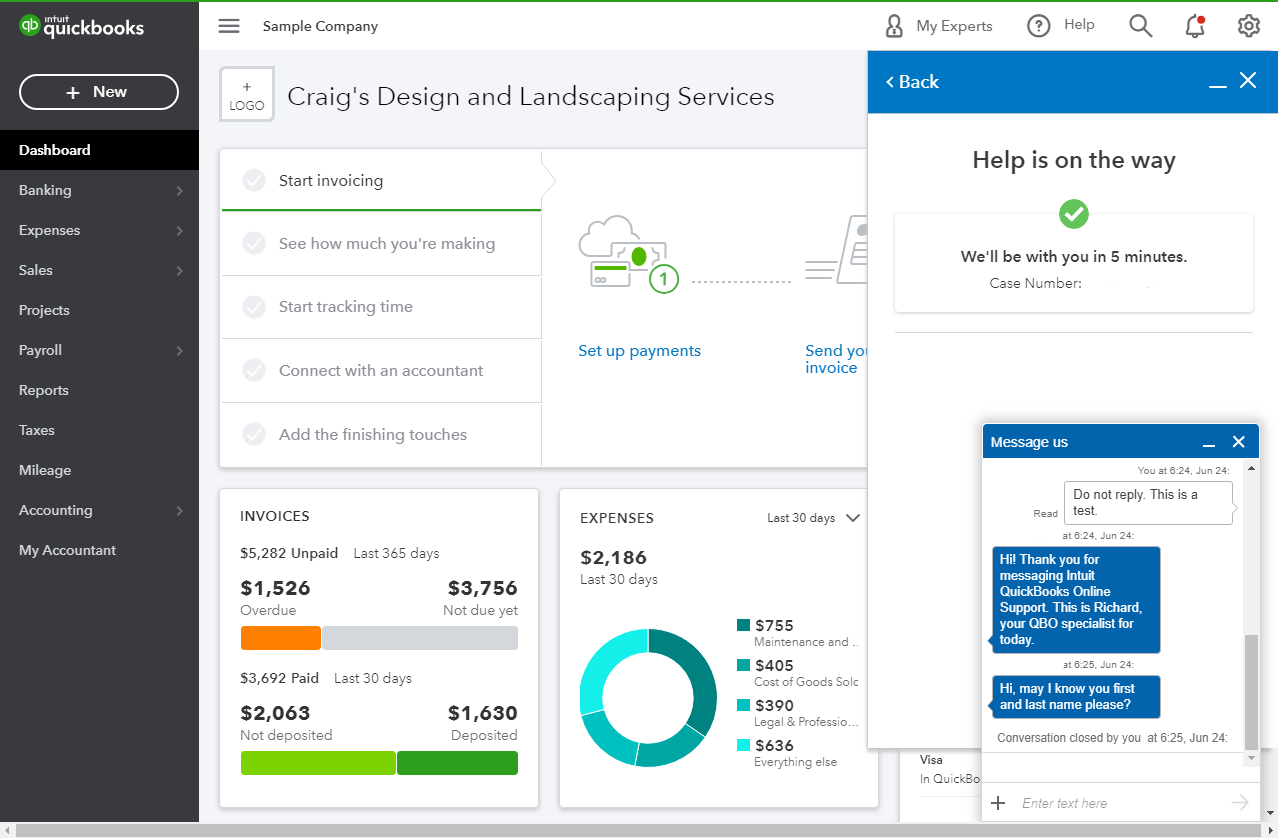

To reach us on time, our Live Help are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM til 3:00 PM on Saturdays. Follow these steps to get a live representative:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

I want to know how it goes, so I can make sure this is resolved. Just add another comment below and I'll be right here to help. Have a good one!

Hi, I have a client who's PayPal account is sync in QBO, we also do the matching but upon checking the transactions, it still shows "undefined online banking matches". Other bank accounts are matched and shows "online banking matches". Please help. Thank you

Thanks for joining this thread, @Jenny0212. Let me add some information about undefined online banking matches status in QuickBooks.

To begin, make sure to select a bank account where payments are deposited. If you're using QuickBooks Payment, customer payments will be assigned automatically to the Undeposited Funds account. What you have to do is to change it to a specific bank account.

Also, Unspecified Online banking matches are transactions that are not QuickBooks matches but are instead Banking matches. In other words, these are payments coming from the bank, so once you update your bank account on the Banking tab inside QuickBooks Online, these payments will be posted on the For review section that you'll need to match from the previous transaction you have inside the banking register.

To review transactions in QuickBooks, please follow the steps below:

For more details, please see this article: Categorize and match online bank transactions in QuickBooks Online. It also covers some ideas on how to split transactions between multiple accounts and exclude duplicate transactions.

Moreover, let me share this link to help you reconcile your accounts so they always match bank and credit card statements.

Keep me posted if you have other questions about managing banking transactions in QuickBooks. I'll be happy to assist you again. Have a great day.

Hello!

I have the same issue as mentioned by jenni on the paypal bank. I have noticed it will no longer show the green MATCH button like your picture for transactions that require a match to a sale receipt thats already in the register.

In order to match, I must:

- click the transaction to see details

- click "find match"

- search for match"

- make sure all the dates, names are correct

- click save

This will "match" the transaction to the sale receipt, but when the matched sale receipt is view, it will show "undefined online banking match", with no details about what it was matched too. Ever since the green MATCH button stopped appearing for sale receipts and a search was required (still shows MATCH for transfers/deposits/other transactions), that is also when all the paypal processing fees started appearing in the undeposited funds account instead of the paypal register like they used to.

- Thomas

I appreciate you for joining the thread, @WeaponzOnline. I'm here to share with you some information about matching transactions on the Banking page.

The Match button is available under the Action column when the system automatically finds a match for your banking entries. If not, the transactions may be affected by the date of record or different amounts due to processing fees. In this case, you can tap on the Find Match tab, then match the transactions manually.

If there are fees added, you can resolve the difference by clicking on the button in between Resolve and Difference. For additional resources, you can check out this link: Resolve the difference in a matched transaction.

I'm also adding this article for more hints about categorizing your downloaded banking transactions: Categorize and match online bank transactions in QuickBooks Online.

If you have any other follow-up questions about your banking or PayPal transactions, please let me know by adding a comment below. I'm more than happy to help. Wishing you a good one!

Hello!

The resolve and difference feature is not the fix, as the transactions match the sale receipts properly. However, once it is saved, the match is split into the sales receipt and the added paypal processing fee. The sales receipt stays in the paypal register because thats where it was already created/saved. The paypal processing fee is not added to quickbooks until the transaction is matched to a sale receipt. It is intended to be added to the paypal register to balance the account out properly, but instead goes to the undeposited funds account. This appears to have started around January/February of 2021.

This cause many issues, and the paypal account can not be reconciled, and the fees that are put into undeposited funds can not have the account changed without un-matching them (and if it cold I would have to do its 1000s of times due to the number of matches). Unmatching them should make the fee and match status go away, but for some reason it not, and it duplicates the sales receipt and processing fees if they are re-matched.

- Thomas

I appreciate you getting back to us, @WeaponzOnline.

Allow me to chime in and help make sure that you're able to match bank transactions in QuickBooks Online (QBO).

Since the issue persists after trying the steps shared by my colleague above, I highly suggest contacting our Support team. They have tools such as screen-sharing (remote access) that can pull up your account in a secure environment and check the cause of this odd behavior. They can also perform other troubleshooting steps if necessary.

Here's how to reach them:

In case you need, I'm also adding these articles that tackle matching and reconciling bank transactions in QBO for future reference:

Keep me posted on how the call goes. I'll be here should you have any follow-up questions or concerns. Have a good one.

I am not using Quickbooks Payments for these transactions.

Screen share and 4 phone calls have produced no helpful results. Not one person from QBO support can help me with this issue. 3 out of 4 phone calls ended with me being disconnected as if "oh well." from the agent.

It's best to find your own work around, QB wont be fixing it anytime soon. Most reps barely understand how quickbooks works, especially the screen share and phone rep (one told me to talk to the developer of the QB paypal app (hint, it's quickbooks!). Then there are the rest of who like you said "lose connection" when they realize it's complicated.

My workaround:

I no longer match sales transactions that come in through paypal into QB. I exclude them all, but this is only because my shipping software (ShipStation) can also sync sales receipts into QB. Not a perfect system, but its easiest method I have right now. This allows the sales tax to be properly recorded (paypal does not always send detailed transacitons over when it syncs sales transactions).

Then when I reconcile the account I compare it to the transaction statement report that I get off paypal. I used to think the green "matched" box mattered, but it really doesnt as long as your register matches your paypal statement and it closes out properly.

It's best to find your own work around, QB wont be fixing it anytime soon. Most reps barely understand how quickbooks works, especially the screen share and phone rep (one told me to talk to the developer of the QB paypal app (hint, it's quickbooks!). Then there are the rest of who like you said "lose connection" when they realize it's complicated.

My workaround:

I no longer match sales transactions that come in through paypal into QB. I exclude them all, but this is only because my shipping software (ShipStation) can also sync sales receipts into QB, avoiding the need for the transactions from paypal. Not a perfect system, but its easiest method I have right now. This allows the sales tax to be properly recorded (paypal does not always send detailed transacitons over when it syncs sales transactions).

Then when I reconcile the account I compare it to the transaction statement report that I get off paypal. I used to think the green "matched" box mattered, but it really doesnt as long as your register matches your paypal statement and it closes out properly.

Turns out this issue 1st occurred nearly a year ago and yet it's still an issue.

I first encountered it few months ago on matched transactions in under Paypal account but still showing as "undefined online banking matches" when the transaction is viewed.

Hello, Benj_Acuña.

We'll go ahead and sort things out by doing some basic troubleshooting steps. The stored cache can sometimes cause unusual browser behavior.

Let's log in to your QuickBooks Online company using a private window. Here are the keyboard shortcuts in opening a private/incognito window:

Once done, you can now start matching your transactions. Here's how:

If you can match the transactions completely, you'll have to clear your regular browser cache.

If the same thing happens, I recommend reaching out to a member of the QuickBooks Support Team. Agents have specialized tools, such as screen-sharing, that would be particularly helpful in this situation. Please refer to this article to contact our support team: QuickBooks Online Support.

You can always get back to us by leaving a comment on this thread. We're already ready to help with any QuickBooks and banking concerns you have. Stay safe.

Because the account the transaction was originally deposited to was deleted or has been disabled/made invisible.

I just noticed this issue yesterday. 30 minutes with phone support makes me think that QB knows this is an issue but doesn't know how to fix. Thanks for the workarounds.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here