Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi userjpcornes!

Thanks for the additional info. Let me join this discussion so I can further assist you with the bank deposit.

Ideally, the UF (Undeposited Funds) balance will reduce once you deposit the payments or match it to the downloaded transactions. You don't need to create a journal entry to clear it.

It could be that this is a browser error since you're able to match and reconcile them. You'll want to use an incognito window and check the UF from there. Incognito won't save your browsing history which can result in an error. These are some of the shortcut keys:

Also, you'll want to clear the cache and make sure you're using a supported and up-to-date browser. This can help in fixing any browser-related issues.

I've added this article in case you need help in adding a subaccount for a more organized and detailed report: Create subaccounts in your chart of accounts in QuickBooks Online.

Comment again here if you have other concerns. Take care!

I'd be happy to help you clear the payment, @userjpcornes.

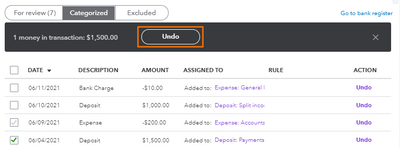

Since you deposited the payment to your Undeposited Funds, you'll have to match it with the downloaded transaction, instead of the invoice. To fix it, undo the categorized deposit and link it with the payment.

Here's how:

Make sure to reconcile your accounts regularly. This ensures the transactions agree with your real-life bank and credit card statements.

You can tap me should you need help with reconciling your accounts. I'd be happy to help.

I am sorry I was incorrect in the description of my issue. The transactions were matched to Intuit deposits at the bank. Each transaction has been paid and closed. I have also been able to reconcile with no problem for August 2021. So I guess my real question is why is there still a balance in the undeposited fund account? Does the undeposited funds register serve as a archive of any "accounts receivable" transactions? That is how these seven transactions were categorized automatically by QuickBooks Online when the payments were processed. Do I need to take another step by creating a journal entry to clear this up?

Hi userjpcornes!

Thanks for the additional info. Let me join this discussion so I can further assist you with the bank deposit.

Ideally, the UF (Undeposited Funds) balance will reduce once you deposit the payments or match it to the downloaded transactions. You don't need to create a journal entry to clear it.

It could be that this is a browser error since you're able to match and reconcile them. You'll want to use an incognito window and check the UF from there. Incognito won't save your browsing history which can result in an error. These are some of the shortcut keys:

Also, you'll want to clear the cache and make sure you're using a supported and up-to-date browser. This can help in fixing any browser-related issues.

I've added this article in case you need help in adding a subaccount for a more organized and detailed report: Create subaccounts in your chart of accounts in QuickBooks Online.

Comment again here if you have other concerns. Take care!

Bingo! Thanks you AlexV! This solved my issue.

How did that solve the problem? We opened an incognito window and checked; the undeposited funds account has every transaction since Jan 1st in it. How do we clear this

Thanks for becoming part of this thread, rshearer64. I appreciate you performing AlexV's troubleshooting steps.

Since you've opened an incognito window, but credit card deposits that have cleared the bank and been matched to invoices are still showing up in your Undeposited Funds account, I'd recommend checking the browser's compatibility with QuickBooks by utilizing our browser health checkup tool. QuickBooks supports current and two previous versions of browsers. If you find that you're using an unsupported version, make sure to update it to its latest release. Steps for doing so can be found on the particular company's website.

In the event you've found no problems that could be causing this with your browser, I'd recommend using a different device and/or internet connection. If it continues happening on other devices and/or internet connections, you'll want to get in touch with our Customer Care team. They'll be able to pull up the account in a secure environment, conduct further research, and create an investigation ticket if necessary.

They can be reached while you're signed in.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

Please feel welcome to send a reply if there's any questions. Have a lovely day!

I need help with this too!

Hello there, @DIETRYING.

I can see there is a duplicate posts for this exact query you posted. My colleague, ChristieAnn, has already answered a similar question you've posted. You can view his answer through this thread: Undeposited Funds that have already been deposited still showing up as undeposited.

Also, you can always read this article to guide you about reconciling your bank account: Reconcile an account in QuickBooks Online.

Don't hesitate to keep in touch if you need anything else. As always, the Community is always here to attend to your concerns.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here