Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

I am using Quickbooks Pro 2019

My system seems to be in the incorrect period

When I do any transaction the correct date is displayed but when I try to save the transaction it says that I am working in a closed period.

When I am is bank recons the date at the service charges and interest earned is on 2034

Would you be able to assist me with this matter

Thank you

I can definitely assist and help correct this period, @erika26.

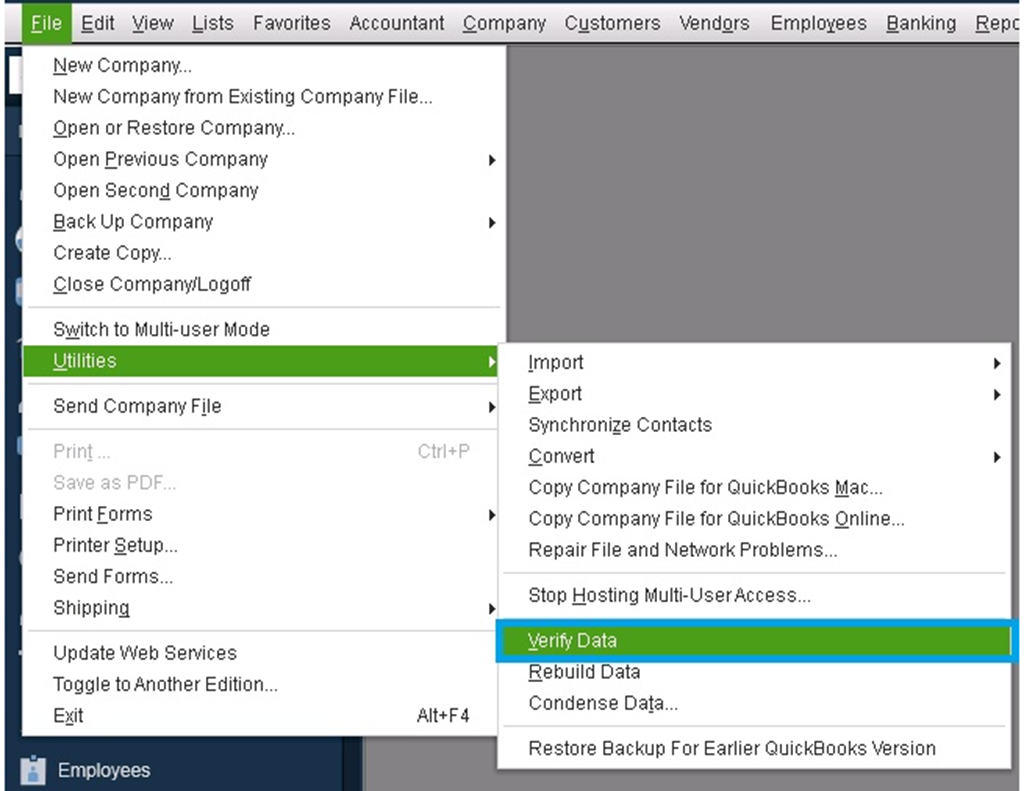

The most common reason why users encounter performance issues, such as incorrect date periods, is due to data damage and an outdated program. You can run the Verify and Rebuild Utility to troubleshoot potential data issues.

Here’s how:

Since you’re using QuickBooks Pro 2019, please know that last May 31 this year, access to add-on services and certain features are discontinued for all QuickBooks Desktop 2019 versions. The program will no longer receive any latest security patches and updates. Based on our service discontinuation policy, unsupported QuickBooks will continue to work only for basic accounting functions.

If you want to continue having an up-to-date system and product improvements, you can upgrade to a higher version.

Once everything is good, you can create any transaction and prepare for the reconciliation. See our complete reconciliation guide if you need fixes and steps to make changes after the process.

I’ll be here if you need further assistance with managing your books. Just add them to your reply below. Have a good one!

Thank you for the reply,

The bank recon is not really the problem, I can not do any transactions.

As you can see from attached file the automatic date on the system is correct, as is the calendar setting in the system

The only place I can find the difference date of 2034 is on the bank recon,

Hi there, @erika26.

Thank you for the following information you added, including the screenshots. It helps me figure out how I can assist you with your concern about reconciling an account in QuickBooks Desktop (QBDT).

Issues such as incorrect date periods in reconciliation usually happen if you have unused QuickBooks for quite some time. In this, I want to share a workaround to get you to proceed with the reconciliation and enable you to perform your other tasks in QBDT.

Based on your initial screenshot, you can copy the date from the Statement Date, 2022-11-30, to the dates beside Service Charge and Interest Earned. Then, press Continue to finish your reconciliation. QuickBooks will then follow the correct sequence of the dates on your subsequent reconciliation.

If you still experienced the same after following the workaround. It would be best to get in touch with our Technical Support Team. This way, they can thoroughly check your company file and determine why such behavior occurs.

Here's how to reach them:

You may also refer to this article to check our support hours: Contact QuickBooks Desktop support.

Furthermore, refer to this article to begin reconciling your account again: Reconcile an account in QuickBooks Desktop.

Let me know if you have more concerns about reconciliation. I'll be around the corner to lay a hand for help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here