Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThe reconciled balance for my bank account as of the end of the period shows a different amount than what is on my balance sheet for the same period end. What is the reason for the difference?

I thought maybe it could have to do with uncleared transactions, but I only had one outstanding transaction and the amount of the difference and the amount of the transaction do not match up.

Is there something wrong? The balance sheet shows the same balance as the what the register does, but that is not the same as what the reconciled balance shows for the same period end.

Hello anwava,

Aside from outstanding transactions, here are other reasons why your QuickBooks and bank balances don't match:

Though, there are different ways to fix this depending on the what's causing the issue.

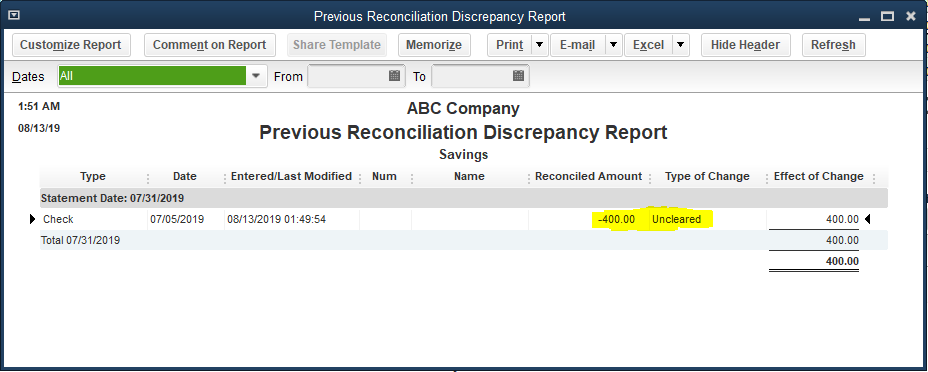

First, we can review the Audit Trail to see if there are reconciled transactions that were deleted or edited. Here's how:

If you need more about how reconciliation work in QuickBooks, you can use these articles for reference:

Feel free to let me know if you need anything else.

For more information on taxes, forms, filings, payroll and other Year End activities, make sure to check out our Year End Resources page.

RE: The reconciled balance for my bank account as of the end of the period shows a different amount than what is on my balance sheet for the same period end. What is the reason for the difference?

The most common and normal cause is that there are uncleared transactions before the date of the balance sheet. Nothing needs to be done about this. You'll see the same balance in the bank register for the balance sheet date.

@anwava wrote:The reconciled balance for my bank account as of the end of the period shows a different amount than what is on my balance sheet for the same period end. What is the reason for the difference?

I thought maybe it could have to do with uncleared transactions, but I only had one outstanding transaction and the amount of the difference and the amount of the transaction do not match up.

Is there something wrong? The balance sheet shows the same balance as the what the register does, but that is not the same as what the reconciled balance shows for the same period end.

The replies don't seem to be answering the question, and I may have a similar issue. The bank reconciliation has been completed. On the QBs reconciliation report the 12/31/2018 register balance is -4861.80. The register balance is, of course, after the uncleared transactions. The Balance Sheet balance for the same bank as of 12/31/2018 is -3,948.98. This is a difference of 912.82. There should be no difference between the register balance in the reconciliation report and the balance sheet, since the register balance takes the uncleared transactions into consideration. I've selected the bank reconciliation report that shows any changes since the original reconciliation, so it isn't a matter of the data having changed since it was reconciled. What causes this amounts to become out of sync and how do I fix it? I have run data integrity and a data rebuild, but the issue has not resolved. There were also no issues found.

Hello there, @KristinaG.

Thank you for joining the Community. Allow me to help share additional ways to determine why the balance sheet report doesn't match your register.

If your company's fiscal year is different than the calendar year, the amounts on both the report and the register may not match because the Balance Sheet is run on a calendar year.

To fix this, I recommend changing the date of the report to match your fiscal year or the calendar year. Let me show you how:

Otherwise, you'll need to check the dates on the individual checks and deposits to fix the discrepancy. For additional help, I recommend reaching out to our Customer Care Support. They can use the screen share tool to determine what's causing the issue and help you get back to business in no time.

You may also want to visit our QuickBooks Resource Center for future reference while working with QuickBooks.

That should point you in the right direction today. Please know that I'm just a post away if you have any other questions about QuickBooks. I'll be happy to help you out. Have a great day ahead.

There are 2 dates and 2 balances to keep separate in your mind:

Actual balance in Bank vs QB Register Balance

The reconciliation does not make these the same - it just explains the difference.

Also Reconciliation (bank statement) Date vs Report date - self explanitory.

QB financial reports always contain Register Balances as of Report Date.

Bank Balance (as of any past date) will not change.

But the register balances at any date can change after a reconciliation is done if new entries are made.

Hi Kristina,

Did you resolve this? I have the same issue, but cannot resolve it. I expect the "register balance" on the bank rec to agree to the register (as at the same date) but they do not agree and I can't work out the difference.

Would be great if you had the answer.

Let’s check out why the beginning balance of your reconciliation doesn’t agree with your register, Charley. I’ll also add information about the balance in the register and the Balance Sheet.

Before we start, we’ll have a little background to guide us through the process.

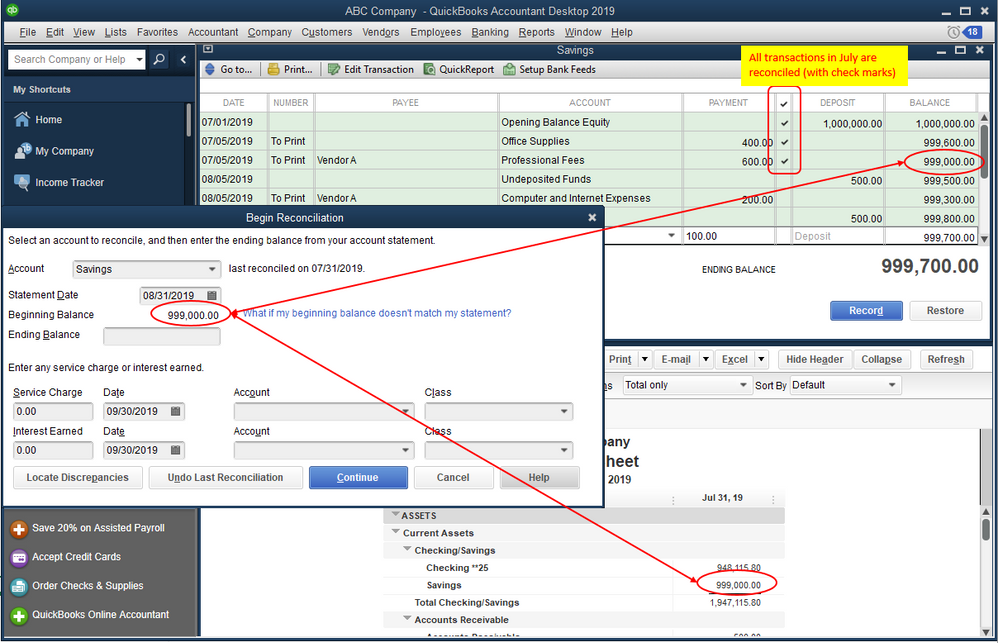

The reconciliation has two balances. The Ending Balance is from your bank statement, whereas Beginning Balance is from your register. The latter is from the last reconciled transaction in your register, as shown in the screenshot. It also reflects on the Balance Sheet.

To resolve this, you'll want to correct the Beginning Balance:

Please let me know if you're able to resolve the difference or if you still need more help.

I just ran into this same issue and realized it is actually something simple and not so complicated. If the register balance on your bank reconciliation does not match the value on your balance sheet it is likely the cleared transaction from the next month. An example in my situation was we mailed out checks for bills that were due October 1st, those checks cleared our bank account in September so they are included in the bank reconciliation but not included on the balance sheet. I hope this helps.

Thank you - that was incredibly helpful info -- that the balance of the account when the report was generated is included in the reconciliation report.

That's it! It happened to me, too - super helpful, thanks!

Can you advise if you are on cash accounting or accrual, though it shouldn't matter. If the cash was actually removed from you're account, it should be removed from your balance sheet on the date of the removal and not the due date of the bill.

Was this ever resolved? Each month, my beginning and ending balance matches the bank reconciliation and I have a completely cleared reconciliation that is in balance yet my register balance as of the end of the month (not the ending balance - the register balance) is never in sync with my balance sheet as of the end of the month. How can my reconciliation be in balance with the bank but not my balance sheet?

Nice to have you in the Community space, @sbasnett.

Incorrect dates affect the accuracy of your report, causing your bank balance not to match. To fix this, you’ll want to ensure you've entered the correct date so it matches the details of your reconciliation balance.

If the dates are accurate and the report is still not in sync with your bank balance, I recommend contacting our Support team. They have the tools to check your account and help you check why the report doesn't match your bank.

Here’s how to reach them in your QuickBooks Desktop (QBDT) software:

Ensure to view their Support hours in this link to know when agents are available: Contact QuickBooks Desktop support.

Let me also add these articles that you can utilize to seamlessly manage your reports and accounts in the future:

You can always get back to me if you have other follow-up questions about your balance sheet report or with your account. It’s always my pleasure to help you. Have a great day ahead and stay safe!

Wish me luck... I am calling support. I have the same issue. I really hope that they DO have the tools to solve it.

Dates are correct

Everything is cleared.

Register balance on the bank recon does not agree with the balance sheet.

In real world most of the time it will not match. Balance sheet cash balance come from Ledger and some trnx are in transit which hit one side only either bank or ledger like payment issued may not yet hit the bank and deposits(Ach or direct deposit) received is still not recorded in ledger. In reconciliation we only try to match with bank statement in actual Ledger it may vary because of the transactions which are not appear both side (or appeared only in one side) bank and Ledger.

Thanks - Kul

The balance sheet draws from the register and includes uncleared items. The reconciliations do NOT include uncleared items, that's the point of reconciliations, to find items that haven't cleared, for whatever reason. If your business is a dynamic environment, transactions of money in and out happening daily, it is highly unlikely all transactions will be cleared on any given day, so that balance sheets will not and should not match up with reconciliations.

To get the Balance Sheet Balance to match the Reconciled Balance, Clear Payments of the uncleared transactions seen at the top of the reconciliation account page.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here