Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAny deadline posted for when we can make amendments to 1099s? All I can find is some time in February

Hey Summitupllc,

Thank you for reaching out to the QuickBooks Community. I will be happy to help. This article lists all the deadlines, requirements, and penalties. I encourage you to go through the article.

Please let me know if you have further questions or concerns. We will be here to assist. Take care.

I would like to know when we will be able to make corrections in Quickbooks Online for 1099's. Corrections! Not the deadlines for filing.

I appreciate you coming back, summitupllc. You’re right, the corrections for 1099s will be available around February. Allow me to provide a more detailed overview to help clarify.

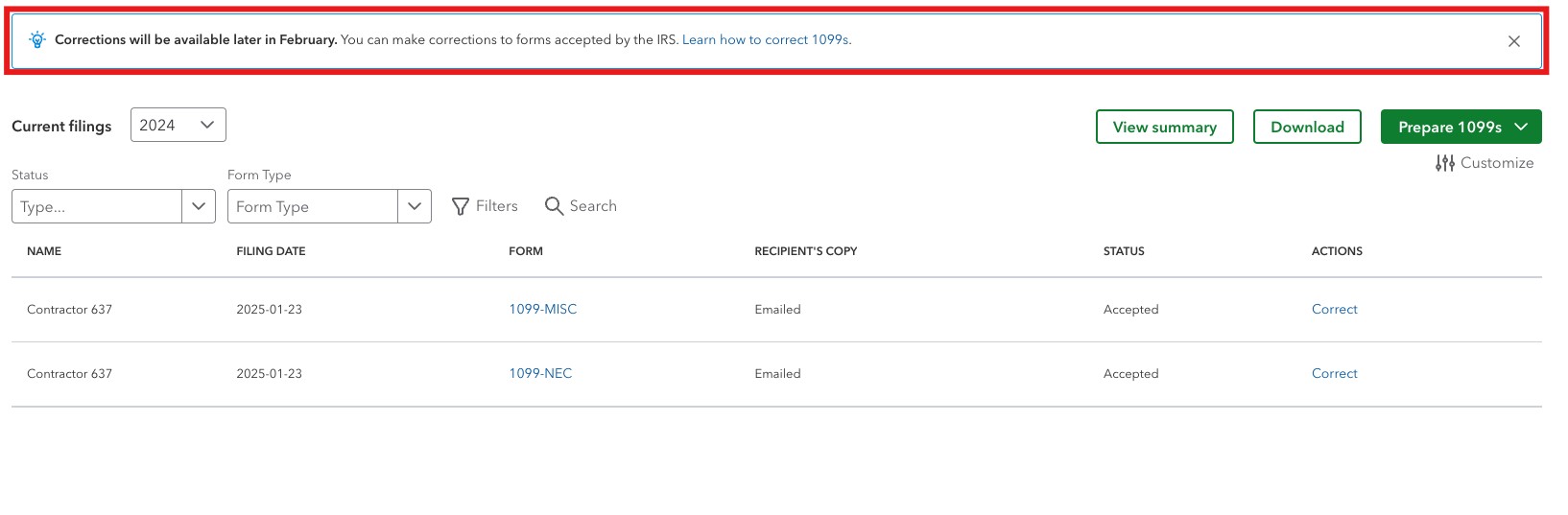

1099 Corrections for the 2024 filing year will be available by mid-February 2025. We will update you with the specific date as soon as it is confirmed. To stay up-to-date, keep an eye on the Corrections Banner at the top of your Tax Center page in QuickBooks Online. The banner will notify you precisely when you can start making corrections. Currently, the message on the banner, "Corrections will be available later in February," means the feature hasn’t launched yet. It will be updated or removed once the corrections are live. Additionally, make sure to check the Notifications area for any important updates.

Steps to Locate the Corrections Banner:

For further reading, you'll find this article helpful, as it contains Frequently Asked Questions about creating and filing: 1099s using QuickBooks Online.

For future reference, this guide will help you manage your returns: IRS Online Ordering for Information Returns and Employer Returns.

We’re here to ensure you have all the information you need. If you have more questions or need further assistance, feel free to continue the discussion right here on the thread. The community is always ready to help and support your tax journey.

Hi, thanks for the info. Why is it taking so long at this point to have that feature activated?

Hello there, Jay.

The strategic pause in activating 1099 corrections within QuickBooks Online was carefully executed to ensure full compliance with current IRS regulatory standards. Allow me to give you further details.

In line with this, any corrections to 1099 forms must be filed using the same procedures as the original forms. This process requires careful attention to detail to make sure that all information is accurately updated and complying with applicable tax laws.

QuickBooks Online had to implement additional checks and validation steps in its system, which caused an adjustment period in activating the 1099 corrections to ensure everything was handled correctly.

Moreover, for timely updates, I recommend contacting our live support team. They are always available to assist you and can provide up-to-date information and guidance tailored to your specific situation.

Furthermore, I'm adding this resource for future reference so that you'll know how to make corrections to 1099-NEC or 1099-MISC forms after you e-file them: Correct or change 1099s in QuickBooks.

We are fully prepared to assist you with your 1099 correction. For any questions or further assistance, do not hesitate to visit this forum. We appreciate your interest and are eager to make your QuickBooks experience even better.

QBO originally said corrections available 2/3 and now it just says "later in February". So users are supposed to just check daily? Why is this so vague?

I recognize your feelings about the recent shift in our schedule updates to later in February, JCO16. To ensure you receive the most accurate updates, please keep an eye on the Corrections Banner in your Tax Center on QuickBooks Online. This banner will notify you when changes can be implemented. You can find it at the top of the Tax Center page, and I'm here to help guide you through locating it.

Here's how:

The update to later in February for the availability of the corrections feature reflects the importance of ensuring that the feature is both compliant with all regulations and optimally functional before its release.

Additionally, we're planning to launch the 1099 Correction workflow in mid-February in QBO. It's important that corrections are handled in the same manner as the original entries. Please verify that all contractor information and payments are correctly updated in QuickBooks beforehand. It's crucial to note that only IRS "Accepted" forms can be corrected, and all corrections need to be completed within the three-year IRS deadline from the original e-filing date.

For detailed instructions on how to adjust 1099 forms in QuickBooks, consider referencing the article: Correct or change 1099s in QuickBooks.

To print your 1099 forms directly from QuickBooks Online, you can also follow the guidelines provided in this article: Print 1099 forms.

Our goal is to ensure you are well-informed about 1099 corrections and have all the essential details you need. If you have any more questions or require additional help, our support thread is available 24/7 to assist you. Please take care and don’t hesitate to reach out for further assistance.

It's starting to be late February. I'm dumbfounded as to the delay and vagueness. What's going on over there?

I agree. What is going on guys?? We need to get this done before half of the IRS is fired!! (kidding)

Please, would you be able to provide an update? A date would be appreciated.

Please provide an update, as we are now in the end of February.

The launch of 1099 corrections for the filing year 2024 is anticipated to occur in mid-February. Although a specific date has not yet been determined, we will promptly update you with an alert with the exact date as soon as it becomes available. Allow me to provide further details below, @sbucket.

Customers will see an in-product banner in QuickBooks Online that states "Corrections will be available later in February," indicating that the corrections feature has not yet been launched. To stay informed, please monitor the Corrections Banner at the top of your Tax Center page. This banner will be updated or removed once corrections are available, notifying you precisely when you can begin making adjustments.

If you need assistance locating the corrections banner, please follow the steps shared by my colleague, @Dandie_A, in the previous reply within this thread.

Furthermore, it is essential to ensure that corrections are processed in the same way as the original entries. Before making any changes, please confirm that all contractor information and payments in QuickBooks are accurate and up to date. It's important to remember that only IRS "Accepted" forms are eligible for corrections. Additionally, all corrections must be finalized within the three-year IRS deadline counting from the original e-filing date. This adherence is crucial for maintaining compliance and accuracy in your financial records.

Moreover, you can check this article to learn how to print 1099 forms in QuickBooks Online: Print your 1099 forms.

If you require additional assistance with managing your 1099 forms in QuickBooks, please don't hesitate to click the reply button below. Have a productive day!

I’m at a loss. A Quickbooks rep just responded with a statement that corrections will be available mid February and it’s FEBRUARY 20th- PAST mid February. I’m starting to lose confidence in you, QB! Where is the QC? Urgency?!

I called for a second time about this yesterday after waiting since February 5th. I was told to wait and check today. This is actually so awful, they just put a vague "later in February" and now it IS later in February and they're just telling us to log in every day? How am I spending $40 a month on this????

Truly unacceptable. And yet we have zero recourse. I wish we paid $40/mo - we have $99 for this!

The option to correct is now available, but not if you would like to correct the recipient's name, which is what I needed to do. Quickbooks, answer for yourselves.

Ensuring the accuracy of all forms is indeed essential for any filing process. Rest assured, the ability to update the recipient's name will be launched shortly, @masona.

There some essential changes ought to be executed to unlock the capability for recipient updates. This is a necessary step for enhancing our system's functionality and overall user experience.

You may consider keeping an eye on the said Corrections Banner at the top of your Tax Center page. Once this feature is enabled, you will be able to make adjustments and submit your corrections right away.

For more information about making amendments, check out this article: Correct or Change 1099s in QuickBooks.

Additionally, here's a helpful reference for printing 1099s forms, including solutions for any issues you may encounter while publishing in QuickBooks Online: Print Your 1099 and 1096 Forms.

We appreciate your patience as we implement these changes. If you have any further questions about the 1099 forms, feel free to click the Reply button below, and I'll respond to your inquiries promptly.

I'm going to have to correct you on this--a few days ago, for one day only, I had correction capabilities for my 1099-NEC employee, including his business name. I sent it to him to verify, but by the time he had approved the following day, the capabilities to correct anything at all were gone. So there did exist, in fact, the ability to correct these things in Quickbooks. I'm not sure why you're suddenly telling me I have to do this via the IRS. My accountant has told me that it is far more preferable to correct 1099s via the original submission method. I want to know when this feature will be back, if at all.

@Anonymous changed their answer to me after I called them out for saying that the feature wasn't available and did not acknowledge that I was given misinformation. So to anyone else who might be following this thread and dealing with this issue, this is what they originally said to me:

Ensuring the accuracy of any forms is indeed essential for any filing process, @masona. I've got information here to correct your recipient's name.

There are information that QuickBooks doesn't support yet and that includes the name of the payer. You may consider sending a letter to the Internal Revenue Service (IRS) to correct the details. Before that, be sure to include the following information:

Name and address of the payer. Type of error (including the incorrect payer name/TIN that was reported). Tax year. Payer TIN. Transmitter Control Code (TCC). Type of return. Number of payees. Filing method (paper or electronic). Was federal income tax withheld?

Once ready, send your letter to the Internal Revenue Service

Information Returns Branch 230 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430.

Check out this article for more information about making amendments: Correct or change 1099s in QuickBooks.

Moreover, here's a reference to learn how to print 1099s in QuickBooks Online: Print your 1099 and 1096 forms.

I'm still available if you have further questions about 1099s. Simply click on the Reply button, and I'll make sure to answer your queries promptly.

This is getting ridiculous and confusing. Just be straightforward with your customers who are paying a LOT of money to use your services.

As of today full correction mode is not working any update?

I appreciate your participation in this thread, Bookkeeper7689. Allow me to discuss more details about the 1099 corrections and how QuickBooks notifies users once this feature is available.

Please know that there's no specific date for when the Correction option will be accessible on the platform. It's essential to note that the temporary unavailability of this feature is a way to ensure that the IRS can process 1099 corrections seamlessly after the initial filings. Moreover, you can only initiate and submit a correction for Accepted forms.

As my colleague has mentioned, you'll have to review the Corrections Banner on the Tax Center page frequently. Once the Correction button is available, the notification in the banner will be updated automatically.

I'm also attaching these resources you might find handy once you need to print your 1099 forms or gather more insights about the IRS' guidelines for 1099 filings:

Should you have more questions about managing your 1099 filings or corrections, click the Reply button. Our team is always available to help you.

The option to correct a 1099-NEC is available now however I get an error message that I cannot correct a name or TIN, all I need to do is correct the dollar amount. You people are really dropping the ball over there.

Thanks for getting involved with this thread, businessessentialsinc.

Currently, QuickBooks Payroll only supports certain types of corrections. If you entered an invalid company name, EIN, SSN, or TIN, Intuit doesn't support corrected 1099 forms for company names or IDs.

To correct a 1099 in this scenario, you'll need to send a letter to the Internal Revenue Service (IRS) with the following information included:

Your letter will need to be sent to:

Internal Revenue Service

Information Returns Branch

230 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430

For more info, you can refer to their General Instructions for Certain Information Returns (2023) article.

I've also included a detailed resource about working with 1099s which may come in handy moving forward: Correct or change 1099s

Please feel welcome to send a reply if there's any questions. Have an awesome Monday!

I am not trying to change the name, address or TIN from the original 1099-NEC filed and accepted. I am only trying to change the amount that was reported incorrectly and only discovered after the Contractor received the 1099-NEC and notified us.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here