Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowWithholding is not being calculated even though I entered the dollar amount for the 2020 W4.

I have downloaded new payroll tax table and done the payroll update.

I have entered the dollar amount that the employee figured on his 2020 W4.

When I run payroll, it doesn't calculate.

Help!

@Paulaatgsconcrete Great question and I have an answer for you. The following article will give you information on possible reasons for not having federal taxes withheld on a paycheck.

No income tax withheld from paycheck

Let me know if you have additional questions and thank you for being the best part of Intuit.

Yes thank you. I've checked all these possibilities and they are all set up correctly. Still doesn't work.

@Paulaatgsconcrete are you able to send me a private message with your email to take a look at your payroll account?

Please send me a private message on this community by: 1. logging in to the community at the top right, 2. click on my username “YvetteVelarde” in this post above, 3. On the right hand side, click on the Send a message button.

If you don't see these options let me know so we can make different arrangements.

SAME HERE!! Makes no sense at all to tell QB to WH an addl amount and then only that amount is WH, NOT that amount PLUS the normal tax amount. My employee is not exempt and all the info remained the same except for updating to the 2020 W54 form and adding the addl tax to be WithHeld. I talked with support and they had no answer other than to increase the addl tax amount to the amount you really want WH. Crazy! This must be a glitch in the 2020 W4 form page.

"W4" form, not W54 - sorry about the typo.

@BNISSEN I understand your concerns with changes that occurred with the implementation of the new W-4 worksheet. As a payroll service provider we must stay compliant with all state and federal regulations.

The 2020 W-4 worksheet has updated the way employees setup withholdings and includes instructions on how to properly fill it out. Intuit payroll services will then withhold taxes according to their tax setup.

If your employees feel they should be contributing more than what is auto calculated, they can enter additional taxes to be withheld each pay period.

You can also visit the IRS website for more information on changes that took effect: FAQs on the 2020 Form W-4

The problem is not that I can't figure out the W4 form. The problem is, QB is not auto withholding the fed tax. I input the amounts as filled out on the W4, but once the check is generated, it says 0 on the withholding on the paycheck stub. I think there is a glitch in the system. I have watched tutorials and done it exactly that way. Still doesn't withhold taxes as it should. This is making payroll for our new employees extremely difficult. I have done the maintenance update. I have done the payroll update. Nothing works. Very frustrated!!

Yes! It's not auto withholding federal tax. I don't understand why?

@Paulaatgsconcrete I would like to dig deeper into your concern. Can you send me a private message with your email on file to look up the account?

My problem exactly. QB support response doesn't seem to acknowledge this glitch. Their reply to me says it will auto withhold plus the regular tax. It does not.

Hello there, BNISSEN.

I appreciate the details you've provided and for trying out some troubleshooting steps beforehand.

Let me provide additional option to resolve this. If you have created a paycheck that's not calculating the federal withholding, deleting and recreating it will do the fix.

Here's how:

If you haven't saved the paycheck, you can revert it. This will help refresh the paycheck for the taxes to calculate properly. I'll walk you through the steps below:

Here's a guide about reverting paychecks in QuickBooks Desktop.

If the same thing happens, I recommend contacting our QuickBooks Care Support. They'll be able to take a closer look at the issue and investigate further why the federal withholding is not taking taxes.

Here are some steps to contact support:

Be sure to get back to me if you have other questions. I want to make sure everything's taken care of.

I have tried the last step (QB help) and I received a call very quickly (Thank you). However, her solution was to "double the extra withholding" and that would fix it. HMMMM, sounds like this person really didn't' understand the problem. I shouldn't have to rig the system to have it work correctly. I did report " a bug" so we'll see if it reaches the programmers. Thank you for continuing to try to resolve this. We can't be the only ones who are experiencing this.

Hello, @BNISSEN.

I hope your week is going well. I'm so glad that our Customer Support Team was able to provide you with some helpful information to resolve your issue. We're always here to have your back.

Let us know if you have any other questions or concerns. Enjoy the rest of your week.

my gawds you are useless. QB support did NOT solve the problem and you are acting like it did! I've been a QB consultant for 20 years, and I am absolutely disgusted with how you are handling this. I came here for help as well and all I see you doing is passing the buck to canned articles. Shame on you.

Did you get this figured out? My office manager can’t figure it out and we need help! Is there a step she is missing.

Hey there, @Toothfairymom. Thanks for joining the thread.

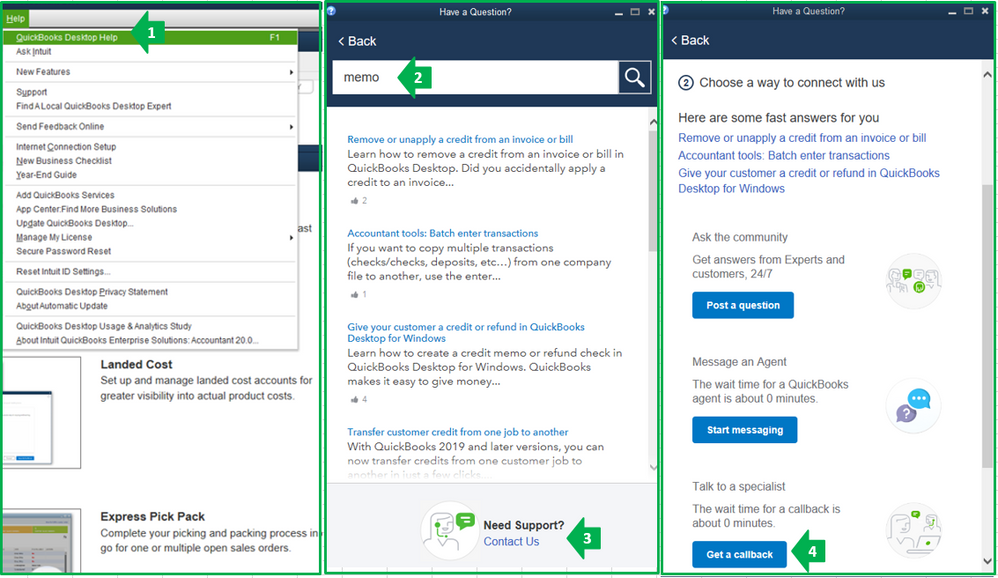

I recommend reaching out to our Support Team so that they can share your screen to see what might be causing it not to calculate. Here's how to get in touch:

Keep us updated here, your solution might be able to point others in the correct direction, as well! Hope you have a safe week.

I have one employee that wanted to have more taken out so we changed to the 2020 W-4. It was going to take out half and not more. We used the additional deduction field to get more out. Due to the Coronavirus, we have all had a pay cut and QuickBooks is now taking out $16 FWH plus the extra amount semi-monthly.

After a lot of back and forth and finding the a tax table for 2020 FWH, I found I could take out the amount from step 3 (Claim Dependents Amount) and the FWH was within $2 of the table. This of course doesn't take into account any dependents.

QuickBooks should realize their customers really do know what they are talking about. We have to pay to use this program every year. The reason we do is because QB doesn't want to be responsible for withholdings being in error when customers use old tax brackets because they haven't updated. So, it is QuickBooks fault now. Payroll doesn't work right. I think we would all appreciate it being fixed!!!

I am having the same issue. Has QB resolved this matter yet?

Thanks for following on this thread, @tamme00.

The steps provided by my colleagues should fix the issue about taxes aren’t calculating. To determine the root cause, I’ll have to access the company file and check the employees’ setup.

The process requires collecting personal information which I’m unable to perform in a public space like the Community. For security reasons, I recommend contacting our Payroll Support Team. They can perform a screen-sharing session with you, trace where the problem is coming from and provide a fix.

To reach them:

For future reference, you can bookmark these guides. They provide an overview of why payroll items/taxes are calculating incorrectly.

Let me know in the comment section if you have any other questions or concerns. I’ll get back to answer them for you. Have a good one.

I am having the same issue. Curious did you ever come up with a way to resolve this matter?

Hi there, Haggard3.

I'll provide information about federal tax calculations for W-4 2020.

If only one employee shows the wrong calculation, I suggest checking the setup. Then, make sure the filling and the claim dependents are correct.

You use this article to check if QuickBooks and IRS calculation is matched: https://www.irs.gov/individuals/tax-withholding-estimator

Here's how to check the setup:

For more details about Internal Revenue Services (IRS) rules for qualifying dependents, please check out this IRS article: https://www.irs.gov/publications/p501#en_US_2018_publink1000220868.

If there's a lot of employees affected, let's make sure that your QuickBooks software and payroll tax table is updated to the latest version. This is to ensure that the 2020 W4 updates are applied to your account. You can read through these articles for more detailed information:

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

I am having the same issue. It started a little over a month ago and I am having to manually change the withholding amount from each check. I upgraded to QB2020 hoping it would fix the issue and it has not. Some employees show $30 less taken out each pay period and I have some with $50 less each pay period. I think something is off in the system.

Hello, @MMotors.

This may need to be investigated further. It seems odd why the withholding is not calculating correctly after attempting several troubleshooting steps.

I'd recommend attempting to use the verify/rebuild tool first to check if there are any data issues within your company file. If the issue persists, please contact our Desktop Technical Support so they can dig deeper into this issue using their tools.

If you have additional questions, do let me know by commenting below. I'm here to help however I can.

I agree. Did you figure this out? I have employees using this new W-4 form, and trying to translate it over to QB is seeming very odd for me as the bookkeeper. I changed an employee from having 2 allowances on the 2019 W-4 system, and now they are on the 2020 W-4 system. I tried it two different ways from there, running a sample paycheck. I put in $4000 under the "Claim Dependents" section in QB (which is because its 2 dependents times $2000 = $4000). If I put $4000 into QB under "Claim Dependents", Quickbooks holds back ZERO income tax withholding both federal and state. If I put in 2 (instead of $4000) under the "Claim Dependents" section, it withholds something very similar to before. Does this seem correct to anyone else? It does not to me.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here