Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've got your back, @user19266.

You can print 1099's using your QuickBooks Online trial account by following the instructions below:

Doing this will allow you to print your 1099 forms right away. Check out our guide on printing 1099s in QuickBooks Online for more information.

I've also added here some articles about handling 1099 issues, reports, transactions, and other matters:

If there's anything else I can do for you, please let me know. I want to ensure your success. Have a wonderful day.

Hello LieraMarie_A,

Thank you so much for responding to my question!

I'm not sure if my entire question was posted though. I use QB & had 1099s sent to my contractors. One of the contractors contacted me & said he does not use QB & is unable to print his 1099 without signing up for a 30 day trial with QB. My question is how can he, as a non user of QB, print his 1099?

Thank you again very much!

Hi there, @user19266.

After you've submitted the 1099's forms electronically, you'll be able to view and generate a copy in your QuickBooks Online (QBO) account. You can follow the step so you can print a copy of your 1099's.

Let me walk you through reprinting the contractor's 1099 form in QBO. Here's how:

1. On your QBO account, go to the Expenses menu at the left panel, then Vendors.

2. Click Prepare 1099s, then select Continue your 1099s. You are prompted to review your form.

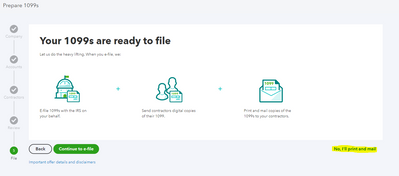

3. Choose Finish preparing 1099s, then pick I'll file myself or Print and mail.

4. Select Print sample on blank paper to see a preview of your form to be printed, then click Print at the bottom.

For your reference, you can also check out these articles for further guidance:

Please let me know how it goes by leaving a comment on this thread. I'm always here should you have any additional questions or concerns. Take care and have a great rest of the week.

Hi , I have a confusion . Does efiling 1099 with the trial version doesn't charge any money? Will the forms sent to the IRS directly? or Do I have to take 1099 E-FILE SERVICE.

Hey there, @tabassumr055.

Thanks for following the thread. I'm happy to provide additional insight into e-filing your 1099 when using a QuickBooks Online trial version.

To confirm your question, yes, if you're using a trial version of QuickBooks, you'll need to use our E-file service. QuickBooks is an approved IRS E-file provider, meaning we'll transmit the form securely and electronically for you. If you’re filing a 1099 with QuickBooks, the right 1099 form will be selected for you.

Additionally, our E-file services will create PDF copies for all your forms so you can provide a copy to your contractors.

You can check out further details in E-File 1099s your way. This article will include a guide for 1099-NEC, covers how to fill out a 1099, and Tips to avoid mistakes.

Please let me know if you have any questions or concerns. I'll be here every step of the way. As always, feel free to reach out to the Community anytime you need a helping hand. Take care!

Hi there,

Thank you for responding.

SO you mean the trial version does not support sending 1099 forms to the IRS electronically.I have to purchase the service?

Hi @tabassumr055,

Welcome back. To clarify for you, if you want to e-file 1009’s, you will need to buy a subscription to the service.

Let me know if you have any other questions. I’m happy to help.

So do we have to pay for 1099 forms?

Yes, you're correct. tabassumr055.

You'll need to subscribe to the 1099 E-File service so you can electronically your tax forms. The price starts at $14.99. This bundle includes creating and e-filing up to three 1099-MISC/NEC forms. For each additional form, you'll be charged $3.99. Feel free to check our website for more information.

On the other hand, you can also print the form for free and then manually file it to the IRS. Just follow the steps provided by my colleague, LieraMarie_A. Take note that the IRS requires you to send 1099s on pre-printed paper forms. You may purchase 2020 pre-printed 1099-NEC kits from our Intuit Market or outside.

Additionally, here are some articles that you can read to help prepare and file your 1099s in QuickBooks:

Do you have any other questions in mind? Feel free to leave them below and I'll take care of them. Have a pleasant day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here