Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Great day and welcome to the Community, @rach-g-c-96.

The tax notification will show if you have tasks that need your attention such as tax forms filings, payroll tax liabilities, etc.

If you're trying to clear notification for the W-2, Copies B, C & 2 (2019), yes, you can by archiving them in QuickBooks. Here's how:

This will clear the taxes (W-2) from showing up as File now in your notification. However, if you're referring to the W-2, Copies A & D (2019), it will only clear out if you're filing with QuickBooks. Otherwise, they will fall off from your notification after six months.

I've added an article for your future reference in case you'll need to access payroll tax forms and tax payments to print them in QuickBooks.

Get back any time if you have additional concerns. We're always around here to help you more.

Great day and welcome to the Community, @rach-g-c-96.

The tax notification will show if you have tasks that need your attention such as tax forms filings, payroll tax liabilities, etc.

If you're trying to clear notification for the W-2, Copies B, C & 2 (2019), yes, you can by archiving them in QuickBooks. Here's how:

This will clear the taxes (W-2) from showing up as File now in your notification. However, if you're referring to the W-2, Copies A & D (2019), it will only clear out if you're filing with QuickBooks. Otherwise, they will fall off from your notification after six months.

I've added an article for your future reference in case you'll need to access payroll tax forms and tax payments to print them in QuickBooks.

Get back any time if you have additional concerns. We're always around here to help you more.

Thank you this helps out a lot! Im okay with it on there as long as it will eventually go away

I would prefer to file our W2/W3 on paper, but cannot "unclick" the box that says "file electronically". Am I required to file electronically? We are a small entity with only 10 W2s.

Thanks for the help!

Ann

Hi @AnnF,

I'll take care of this concern about W-2 Forms in QuickBooks Online (QBO).

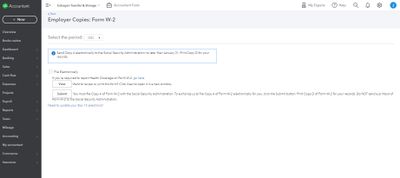

You have the option to print your W-2 Forms if you want to file manually. Given you already have the W-2 papers with you, follow these steps to set your print preferences:

To proceed, view this article: Print your W-2 forms. Scroll down, select the type of payroll service you have, then look for Step 3: Print your W-2s.

I suggest you take a look at this article: Invite your employees to QuickBooks Workforce to see pay stubs, W-2s and more. It has the steps on how you can invite your employees to Workforce. It allows them to view and print their W-2 copies.

Let me know in the comments below if you need further help with your W-2 Forms. I'll get back to you as soon as I can.

So where is this "Annual Forms" option you mention? I don't see it anywhere. Why does QuickBooks ONLINE have to make things so difficult. So happy our office uses the Desktop version. So much easier and user-friendly.

Hi there, @Jim7770.

Allow me to help you clear things out.

If you're using QuickBooks Online Payroll Core, Premium, or elite, you'll need to e-file your W-2s if automatic tax payments and filings are turned off.

To file, here's how:

We'll send you an email once the processing of your W-2 filing is complete. To check your filing status you can go to Taxes, then Payroll Taxes, select Payroll forms or filings, and then W-2.

However, once the automatic option is turned on we'll be the ones who'll file it for you.

You can read through this article if you want to learn how to manage automatic tax payments and form filings.

Additionally, I'll add these articles for future use:

If you need additional assistance with filing your annual forms, never hesitate to post or reply to this thread again. I'll be happy to help. Have a good one!

There is no way to remove the W-2 reminder unless you wait the 6 months for it to automatically go away.

Thanks for getting back with the Community, Jim7770. I appreciate your screenshot.

Since you're not seeing the Annual Forms option after clicking File on your W-2 Copies A & D (employer) screen, I'd recommend checking the browser you're using. It's possible this could have something to do with temporary internet files. Browsing applications store these types of records, but sometimes they can cause issues with certain webpages. You can open a private window and check to see if your Annual Forms option displays.

Here's how to access incognito mode in some of the most commonly used web browsers:

If you're able to see your Annual Forms option while browsing privately, it's safe to say this problem's being caused by the browser. It can be fixed by clearing cached data and Intuit-specific cookies.

In the event it continues not displaying while you're browsing in incognito mode, you'll initially want to try switching to another browsing application.

Here's a list of supported browsers

You can also check a browser's compatibility with QuickBooks by utilizing our browser health checkup tool. QuickBooks supports the current and two previous versions of browsers. If you find that you're using an unsupported version, make sure to update it to its latest release. Steps for doing so can be found on the particular company's website.

In the event you've found no problems that could be causing this with your browser, I'd recommend using a different device and/or internet connection. If it continues happening on other devices and/or internet connections, you'll want to get in touch with our Customer Care team. They'll be able to pull up the account in a secure environment, conduct further research, and create an investigation ticket if necessary.

They can be reached while you're signed in.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

I've also included a detailed resource about system requirements for QuickBooks which may come in handy moving forward: System requirements

Please feel welcome to send a reply if there's any additional questions. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.