Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am the new treasurer in our organization. We have Quickbooks desktop with enhanced payroll. When following these instructions step four in step one and two never become available. IMHO Qbb still sees her as the responsible party? There is absoltuely nowhere to change this. We filed form 8822-B. Changed everything we could within our QBB desktop license. I spent 3 hours online with QBB Payroll help. For them to tell me this ability was discontinued AND just file for a new EFTPS PIN. Which I told them was not the solution. Or call the IRS.

The Feds stipulate we can only apply for our 10 digit pin thorugh our payroll software.. Any ideas out there in the community. In both Step one Set up your federal filing method and Step two Enroll in the IRS e-file program option 4 never comes up for a new responsible person to be programmed in. It shows all steps but step four.

Thank you for any help. Quarterlies are coming up and I've spent countless hours on this. It is frustrating to pay for a service that is third party enlisted by the federal government to be the only avenue to your getting this pin and QBB has zero help or responsibliity to do so. I am not the only one going through this I'm sure. Google search sure is keeping the solution hidden.

Sandi

I'm delighted to see you here in the Community, @TreasSandi. I can share some information about pin enrollment in QuickBooks Desktop.

If you need to update your phone number under Payroll Tax Information, here's how:

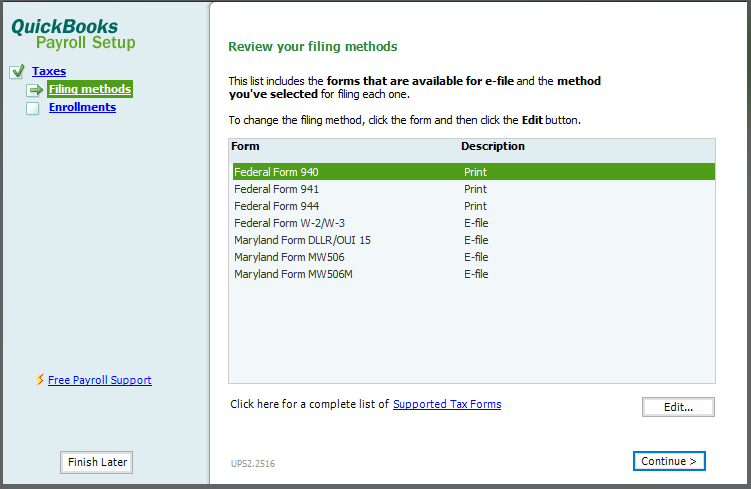

I added a screenshot below for your reference:

You can send E-file enroll directly to the IRS. Just continue with the instructions below if you haven't already enrolled in the IRS e-file program:

When the agency gets your QuickBooks Desktop enrolment, it will show as Accepted. A 10-digit e-file PIN will be mailed to you.

Additionally, I added this article for more information about e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

Hop in if you still have queries about your payroll taxes. I am happy to support you.

Hi Christine,

I had alread done the first section you posted. All of that was changed months ago.

The second part you posted is EXACTLY (not yelling but frustrated)and placing emphasis) what I linked to and spoke of. Step four does NOT become available. The ability to put in my personal information to apply for the 10 digit pin. It shows two pages of all of our business information, skips step four and wants you to submit.

I am fully updated also.

Thanks,

Sandi

Thanks for getting back, @TreasSandi.

Allow me to join in this conversation and provide you with the right solution.

When performing the second part of the steps, let's make sure to select

E-file as a filing method first before clicking Enrollments.

Let me show you how:

You should now be able complete the e-file setup.

For complete guidelines, check out this article: Set up Federal e-file and e-pay in QuickBooks Desktop Payroll Enhanced.

You can now start paying and filing your federal taxes electronically, see E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

If you have further questions or concerns, feel free to reach back out anytime. Just click Reply and I'll get back to you.

This is what I keep saying.... Step 4 does NOT come up. The ability to input my information.......I've done this 10,000 times exactly as stated. If you will notice my original post has a link to this procedure and what is NOT occuring. Why does no one read my question?

Did this ever get resolved.. mine comes up but doesn’t let me submit.. when I click submit nothing happens. I’ve updated everything as well as the rebuild tool etc

Thanks for keeping us updated with the results, Missypoo.

I appreciate you for trying out the steps shared above. I want to make you'll get the solution needed.

Since you've tried the possible solutions above to no avail, I suggest contacting our QuickBooks Care Team. They have the tools to conduct a thorough investigation to identify the reason why it won't allow you to submit the 10-digit pin.

Here's how to reach them:

To make sure you get prioritized on your concern. Please check out our support hours and contact us at a time convenient: Support hours and types.

Additionally, I've included these articles that'll guide you when you e-file your forms in QuickBooks Desktop:

In case you'll need assistance in e-filing your tax forms in QuickBooks, don't hesitate to get back on this thread. We're always here to help you.

I have my 10 digit pin from the IRS.

Where do i enter it in quickbooks so that the efile of 941 will be accepted.

Hello, @aboney.

You'll enter your 10-digit IRS pin while e-filing or submitting your 941 in QuickBooks Desktop (QBDT) Payroll. I'll gladly guide you through the process below.

When you get your 10-digit pin by mail after setting up the e-file feature in QBDT Payroll, you'll use it when filing your federal forms. To do this, here's how:

You'll receive an email confirmation within 24-48 hours. If you'd like to check the status of your submitted tax (941) form, please see this article for the complete guide: Check e-file or e-pay status.

To further guide you in e-filing federal tax forms and e-paying payroll taxes in QBDT Payroll, please see this article: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll.

Also, you'll want to run and customize payroll reports to get a closer look at your business' finances and employees. To help you go through the process, you can check out this article: Run payroll reports.

If there's anything else you need or you have other payroll concerns and questions about e-filing federal forms in QBDT Payroll, I'm always ready to help. Take care, @aboney.

These instructions and those online by QuickBooks are slightly incorrect.

After you confirm your company information is correct in Step 3, if you click Next it will NOT bring up the screen Enter the name, job title, email address, and phone number of the person the IRS can contact about your enrollment and your payroll tax forms. DON'T CLICK NEXT. after confirming your company information.

Instead, click "Send Information" and then it will bring up the screen Enter the name, job title, email address, and phone number of the person the IRS can contact about your enrollment and your payroll tax forms.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here