Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have two employees whose federal taxes are not being taken out. I have verified this and I have everything entered and set-up correctly for these employees. Can you tell me what I need to do to fix this? I was supposed to pay them last week and told them it would be today as I had something to fix. They both are making enough money to have federal taxes taken out. This is an URGENT matter.

I can see how important it is for the Federal taxes to be taken out. I'll guide you on how to fix this from happening again, ReneeE.

One of the main reasons why taxes aren't deducted it's because the employee doesn't have enough wages to meet the minimum threshold or the gross wages as per the last payroll are too low.

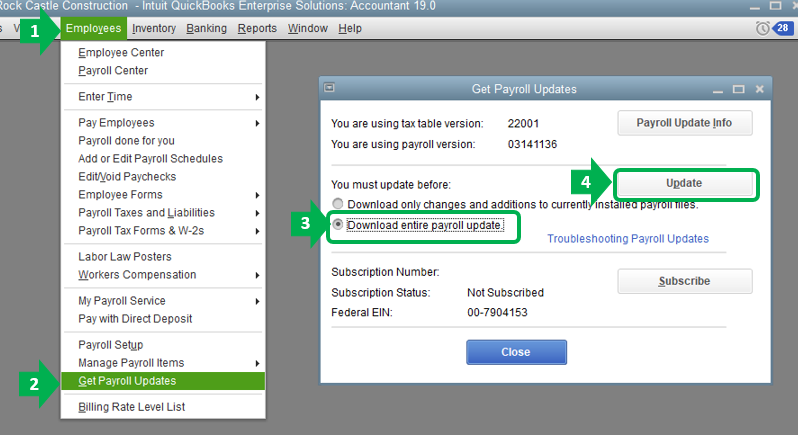

Secondly, if you haven't updated your payroll to the latest release, I'd suggest doing so. This will prevent payroll issues and download the most current tax rates and calculations in your account. To do so, follow the steps outlined below:

You can also end up with this issue if the total annual salary of the employee is more than the salary limit. A wage base limit is a per-employee cap on the earnings that are taxable. Once an employee reaches the cap, taxes may stop or increase.

While you're unable to personally modify wage base limits, you'll have to update them every year. Remember, wage base limits are updated by the tax table. So it's proper and a must that your payroll tax table is updated.

You may want to stay at the top of your payroll wage bases and limits for federal or state taxes, check out this article for more details: Understand payroll tax wage bases and limits.

To get a closer look at your business finances and payroll, I've added this resource for more information: Run Payroll Reports.

Please keep in touch if you have any questions about federal taxes. I'll be one post away If you need further assistance.

I appreciate you getting back to me. I was able to get it figured out after doing some research. I did have my payroll updated. This one employee I am going to have to keep track of because I will have to manually enter her Federal deduction because she is claiming 4. I did a dummy check with the correct amount to reflect her deduction and the paycheck detail still said 0. I did a chat with someone at QB's who said I would have to manually her Federal deductions per the IRS tax table since she is not taking the standard deduction. I would think that QB's desktop should be to differentiate between the two.

Thank you again for the help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here