Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello - How do I reflect a gift to an employee that is taxable but has already been given to the employee? In other words, I need to add the value of the gift to their W-2, but I don’t want a new check to be created for the employee. Thanks so much!

I've got your bank on recording gift to an employee that is taxable, @YKKim.

In QuickBooks Online (QBO), the best way to record gifts that are already given to your employees is to create a bonus paycheck. This way, the value of the gift will be taxable and will reflect in their W-2 form.

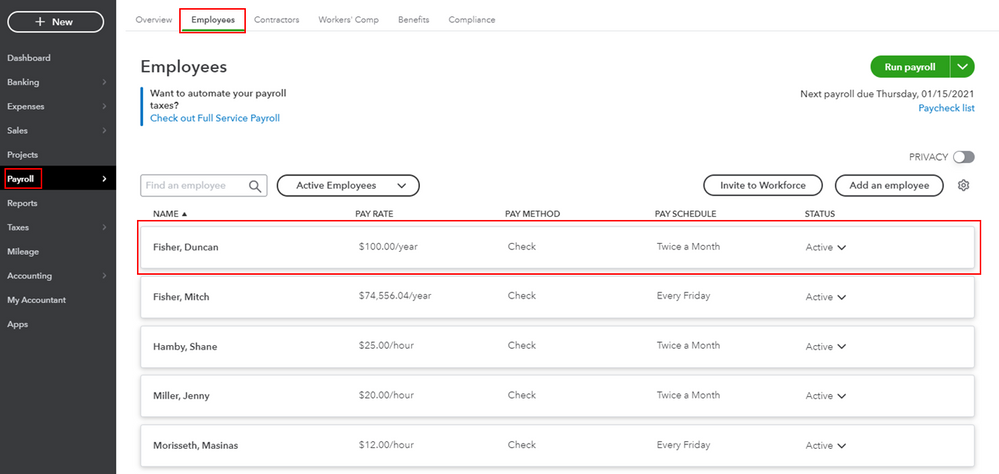

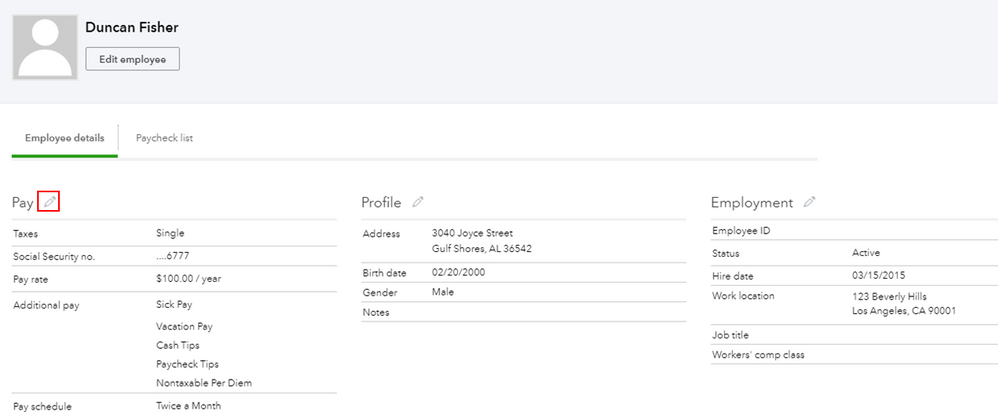

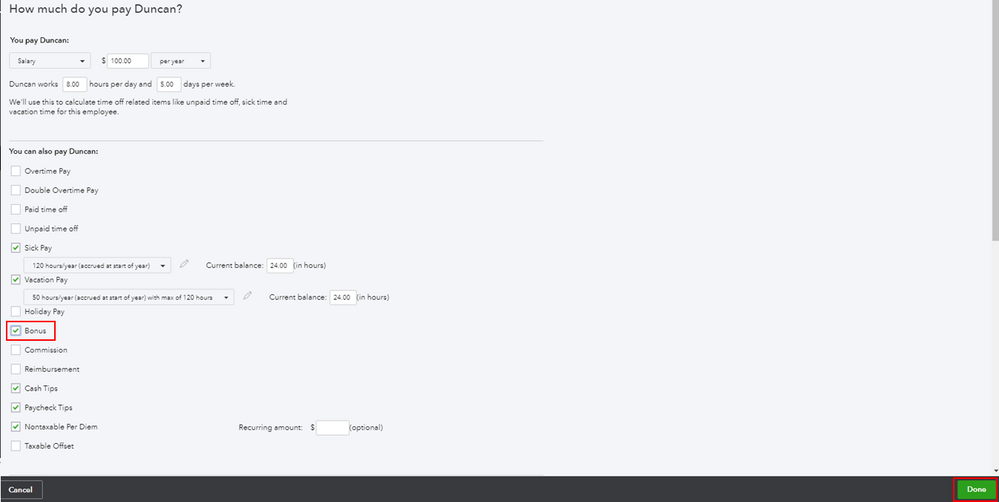

First off, let's add the Bonus pay type to your employee's profile. Here's how:

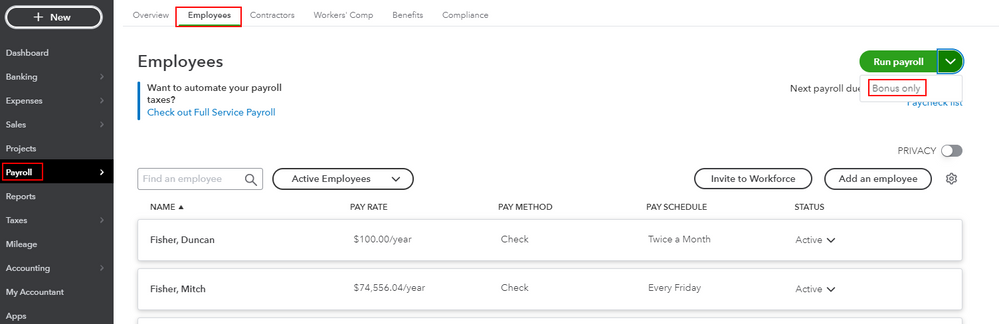

Once done, you can now create a bonus paycheck. Please follow the steps below:

I'm adding this article for more guidance: Pay an employee bonus.

Just in case you want to change your employees' information, feel free to read this article for the detailed steps: Edit or change employee info in payroll.

Please know that I'm just a reply away if you need any further assistance running the bonus paycheck. Wishing you and your business continued success.

Thanks for your response.

Doesn't this essentially create another paycheck? I'm trying to have items flow into payroll that the employee has already been paid. I found the article below after typing my question:

Let me join this thread, YKKim.

Aside from the bonus check, the zero net paycheck can also work. Though you still need to run payroll for this, the difference is that it'll offset the "gift" while making it taxable.

You'll need to set up an after-tax deduction which we'll use to decrease the net pay. You also need an Other Earning pay type which will be used to add the gift as regular wages.

You can follow the steps on the Record a gift made to an employee section from the article you've found. I've some links for your reference in filing the W-2.

Keep on posting here if you need anything else. I'll be right here!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.