Welcome to the Community forum, @pfspride.

I'll walk you through downloading the deposit form so you can give it to your employee. Through this, it's easier for them to receive their pay.

Employees or contractors who will be paid by direct deposit should complete the employee direct deposit authorization form. Let's go to the Payroll Tax Center to get a copy of the form. This way, your employees can start to fill out and sign. I'll show you how:

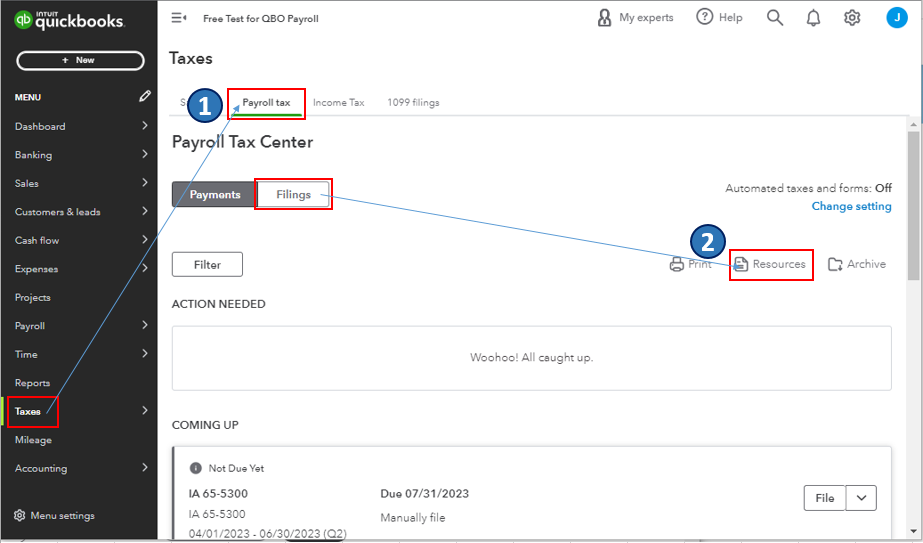

- Go to the Taxes menu and choose Payroll tax.

- Select the Filings tab and click Resources.

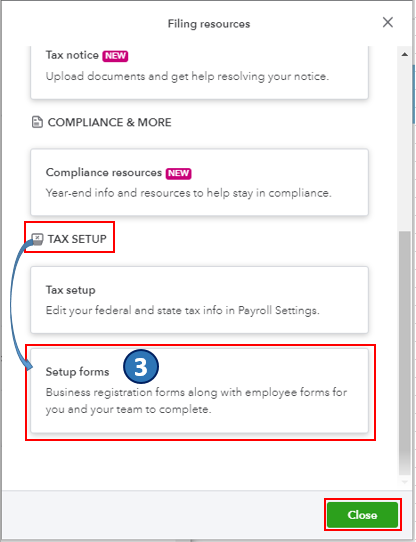

- In the Filing resources window, scroll down to the Tax Setup section and select Setup forms.

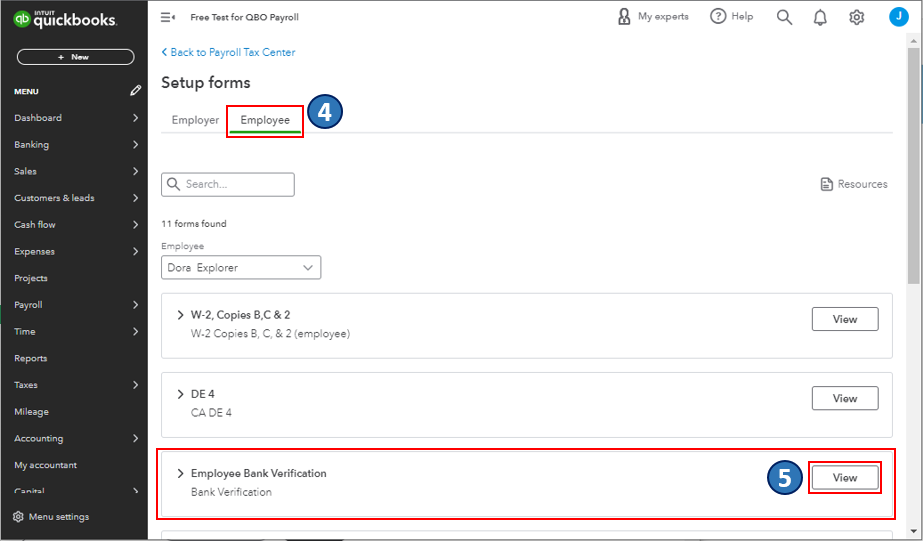

- Go to the Employee tab.

- Find the Employee Bank Verification section and click View.

- You'll be routed to the form's PDF file. From there, you can download and print the Employee Direct Deposit Authorization form.

Once done, refer to this guide to continue setting up and managing employees' direct deposit: Set up direct deposit for employees.

Several payroll reports are available to get a comprehensive overview of your business finances and employees. Know the available ones by scanning this article: Run payroll reports.

If you have other payroll concerns or questions about managing employees, don't hesitate to drop a comment below. I'm always ready to help. Take care, and I wish you continued success.